Whales Wager Astronomical on Ripple, Fetch 360 Million XRP

Whales seem to leverage the stagnant mark action of XRP to catch discounted purchases. The most most modern acquisition of over 360 million tokens coincides with amplified censure geared toward the US Securities and Alternate Commission (SEC) by Ripple executives. Over the last week, crypto whales had been seen shopping XRP aggressively, signaling that a spike

Whales seem to leverage the stagnant mark action of XRP to catch discounted purchases. The most most modern acquisition of over 360 million tokens coincides with amplified censure geared toward the US Securities and Alternate Commission (SEC) by Ripple executives.

Over the last week, crypto whales had been seen shopping XRP aggressively, signaling that a spike in mark volatility is underway.

Whales Fetch 360 Million XRP

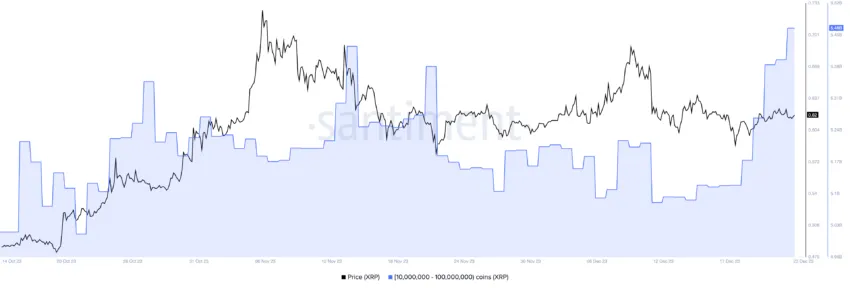

Ali Martinez, BeInCrypto’s World Head of Recordsdata, identified that whales rep gathered a well-known resolution of XRP worth thousands and thousands. This acquisition coincides with a shrimp downturn in the worth of XRP.

“Ripple whales rep bought spherical 360 million XRP over the last week, worth roughly $223 million,” said Martinez.

No topic the spike in shopping stress, BeInCrypto’s pricing files reveals XRP trades at roughly $0.61694, marking a 1.05% decline prior to now 24 hours, and over the last month, it has skilled a marginal decrease of 0.36%.

Even supposing prices remain stagnant, XRP is up 82% One year-to-date, demonstrating an even trajectory for many of the One year, up 82% on the One year-to-date metric.

Market observers counsel the latest shopping spree from whales would possibly per chance perchance bolster the XRP mark. It would possibly per chance perchance in point of fact perchance fleet reduce market present and trigger a mark upswing toward $0.75 in the upcoming days.

Ripple Finds SEC Settlement Offer

While whales appear to be accumulating XRP carefully, Stuart Alderoty, Ripple’s Chief Perfect Officer, disclosed that the SEC had proposed a settlement sooner than initiating the lawsuit in 2020.

The SEC’s proposal eager publicly categorizing XRP as security and allowing a quick window for market compliance. Then yet again, Ripple rejected the offer in step with two key parts. First, the firm asserted that XRP does no longer qualify as a security. 2d, the SEC lacked a complete framework for crypto compliance.

Alderoty emphasized that all around the case, their well-known purpose remained consistent. Ripple desired to illustrate that XRP does no longer fit the definition of security.

“We set aside all the things on the street. Few opinion we would discover. But we did. Within the approach we exposed the SEC for the hypocritical tyrant it is and the industry in the U.S. lived to battle any other day,” Alderoty added.

Earlier this One year, Ripple secured a pivotal victory in opposition to the SEC over the XRP classification. Make a resolution Analisa Torres dominated that the programmatic sales of the asset cease no longer constitute an offer or sale of an funding contract.

Disclaimer

In adherence to the Have confidence Challenge guidelines, BeInCrypto is committed to fair, transparent reporting. This files article objectives to give radiant, wisely timed files. Then yet again, readers are suggested to examine facts independently and seek the advice of with an knowledgeable sooner than making any choices in step with this assert material. Please repeat that ourPhrases and Prerequisites,Privacy PolicyandDisclaimersrep been up to this level.