Nigeria Lifts Anti-Crypto Laws to Originate Contemporary Stablecoin

Nigeria’s Central Bank (CBN) no longer too long ago revoked its stringent anti-crypto measures that barred banks from handling crypto-linked transactions for practically two years. This glide coincides with collaborative efforts amongst Nigerian banks to introduce a fresh stablecoin named cNGN. CBN great that world hobby and adoption of cryptocurrencies prompted a rethink of the

Nigeria’s Central Bank (CBN) no longer too long ago revoked its stringent anti-crypto measures that barred banks from handling crypto-linked transactions for practically two years. This glide coincides with collaborative efforts amongst Nigerian banks to introduce a fresh stablecoin named cNGN.

CBN great that world hobby and adoption of cryptocurrencies prompted a rethink of the severe restrictions imposed in 2021.

CBN Finds Strict Necessities

The Nigerian regulator revealed revised pointers organising standards and must haves for banking relationships and yarn openings for digital asset service companies (VASPs).

Amongst these, banks are mandated to accumulate the Bank Verification Amount (BVN) of the management members of crypto companies sooner than initiating yarn setups. The CBN additional stipulated that crypto companies must create licensing from the Nigerian Securities and Alternate Commission. Additionally, these companies must register with the nation’s Company Affairs Commission sooner than gaining yarn procure admission to.

These pointers encourage risk management protocols within the banking sector, namely pertaining to licensed VASPs’ operations. The regulator wired that financial institutions can’t withhold cryptocurrency, trade, or habits transactions the usage of their gather accounts.

In February 2021, the CBN banned merchants from the usage of frequent banks for crypto-linked transactions and suggested banks to promptly title and shut accounts linked with cryptocurrency trading.

Nigerian Banks Unite for cNGN

Meanwhile, fundamental native banks — Get admission to Bank, Sterling Bank, Providus, Korapay, First Bank, Interstellar, Interswitch, Budpay, and Convexity — are collaborating to make the cNGN stablecoin.

cNGN will in all probability be backed by and pegged to the Nigerian naira, the nation’s fiat forex. This stablecoin complements the eNaira, Nigeria’s central bank digital forex (CBDC). The Nigeria eNaira has encountered challenges in gaining frequent adoption since its start.

“The fundamental motive why the CBN allowed banks is due to they desire the financial procedure to toughen/facilitate blockchain skills and they also know the cumbersome processes [the Nigerian] SEC designed to characteristic a digital service,” Olumide Adesina, a journalist, defined.

Read more: A E-book to the Most attention-grabbing Stablecoins in 2024

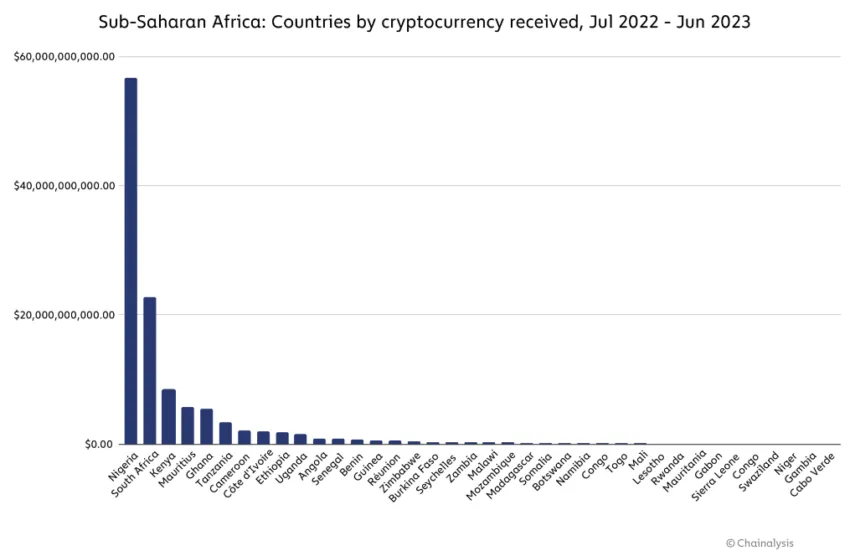

Nigeria stands out as truly appropriate one of per chance the most crypto-friendly jurisdictions globally. In response to Chainalysis, the nation ranks 2nd on its World Crypto Adoption Index. Additionally, Nigeria leads the African role in raw transaction quantity.

“Given Nigeria’s financial uncertainties, many voters are exploring financial choices, enhancing the cryptocurrency’s rate proposition,” Chainalysis great.

Disclaimer

In adherence to the Have confidence Challenge pointers, BeInCrypto is dedicated to self sustaining, transparent reporting. This news article objectives to present appropriate, timely records. On the alternative hand, readers are urged to confirm facts independently and seek the advice of with a authentic sooner than making any choices essentially essentially essentially based on this converse. Please dispute that ourTerms and Stipulations,Privateness PolicyandDisclaimershad been up so a long way.

Enhance your privacy on Ethereum with TornadoCash. Enjoy secure and confidential transactions without compromising on decentralization.

Enhance your privacy on Ethereum with TornadoCash. Enjoy secure and confidential transactions without compromising on decentralization.