Constructing merchants extra bullish about year forward

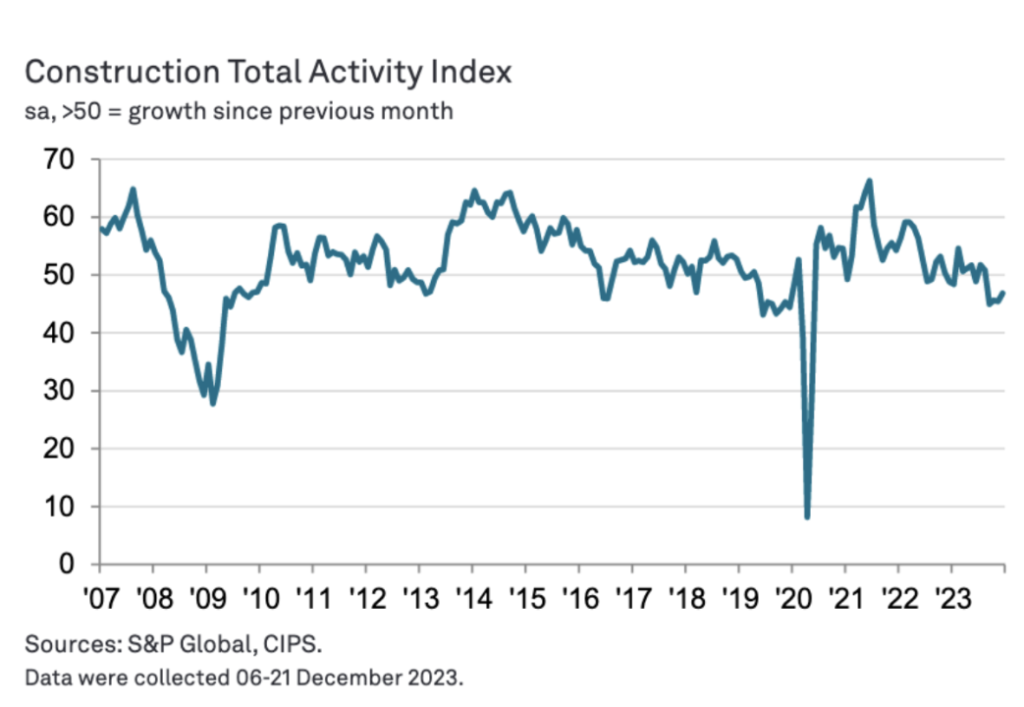

Essentially the most contemporary bellwether S&P World UK Constructing Purchasing Managers’ Index recorded 46.8 in December – beneath the fair 50 rate but up on November’s forty five.5 rate. However essentially the most contemporary watch confirmed better industry expectations at UK building firms for output ranges in some unspecified time in the future of the

Essentially the most contemporary bellwether S&P World UK Constructing Purchasing Managers’ Index recorded 46.8 in December – beneath the fair 50 rate but up on November’s forty five.5 rate.

However essentially the most contemporary watch confirmed better industry expectations at UK building firms for output ranges in some unspecified time in the future of the year forward.

Around 41% of the watch panel await an enhance in industry task over the course of 2024, while supreme 17% predict a decline.

Anecdotal proof on the spot that subdued forecasts for the UK economy had been a key mutter, while hopes of diminished passion charges and a turnaround in market self perception had been components cited as doubtless to take building task.

Tim Moore, Economics Director at S&P World Market Intelligence, which compiles the watch mentioned: “Expectations of falling passion charges in some unspecified time in the future of the months forward appear to be pleased supported self perception ranges amongst building firms.

“December data indicated that 41% of creating firms predict a upward thrust in industry task over the course of 2024, while supreme 17% forecast a decline. This contrasted with adversarial sentiment total on the the same time a year earlier.”

Apartment building remained the weakest-performing category of creating work in December (index at 41.1), despite the fee of decline easing to its slowest since July 2023.

Civil engineering task (index at 47.0) additionally posted a softer streak of contraction on the halt of ultimate year.

Industrial building in the intervening time declined supreme modestly (index at 47.6), however the fee of the downturn accelerated to its quickest since January 2021.

Some firms illustrious that concerns about the domestic economic outlook, alongside elevated borrowing costs, had led to bigger caution amongst purchasers.