When Will Stocks Destroy to Original Highs?

The submit 11/1 Fed meeting bull rally has been very spectacular. The S&P 500 (SPY) is knocking on the door of the all-time highs. Then again, tiny caps are restful a very good method a ways from their past top. Ask why funding weak Steve Reitmeister is pounding the desk on tiny caps within the

The submit 11/1 Fed meeting bull rally has been very spectacular. The S&P 500 (SPY) is knocking on the door of the all-time highs. Then again, tiny caps are restful a very good method a ways from their past top. Ask why funding weak Steve Reitmeister is pounding the desk on tiny caps within the weeks and months forward. Plus he shares his hand picked selections. Read on beneath for extra.

We all know why the market is rallying. Dovish tilt by the Fed solidifies the probability for a mushy landing sooner than they lower charges and economic system picks up steam. That’s about as bullish of a recipe as you’re going to be ready to have.

With that shares are sprinting in direction of their all time highs to close out 2023. Thus, I believed it can also very effectively be attention-grabbing to search out out regarding the 3 key stock indices to peep how a ways a ways from their all time highs…and what that might possibly possibly maybe well expose us about tag action going into 2024.

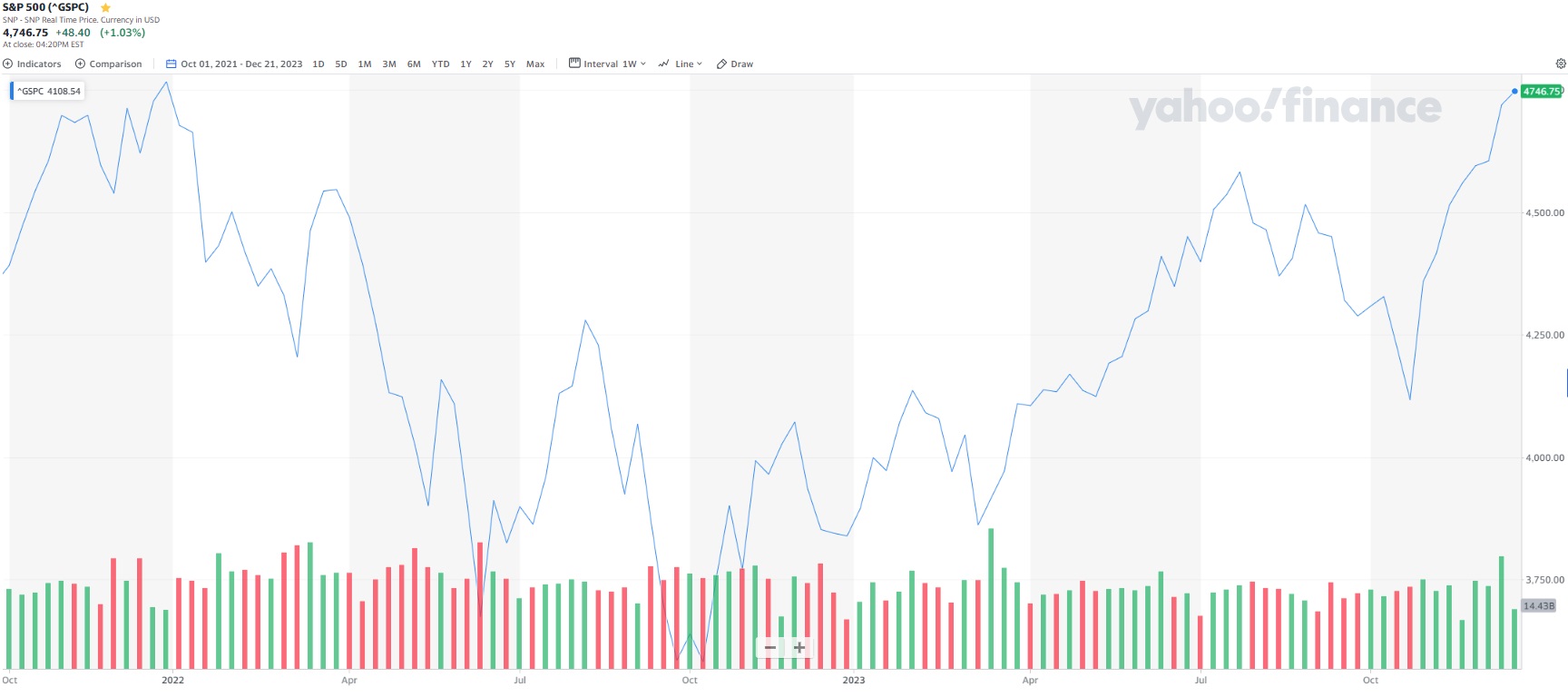

Let’s originate with the S&P 500 (SPY) centered on tall cap shares:

Here the index peaked on January 3, 2022 with a closing high of 4,796. Stocks had been flirted with that stage on Wednesday sooner than dramatic intraday promote off ensued. But on Thursday but again shoppers sold that dip main to closing the Thursday session at 4,746.

The level is that that is the healthiest wanting index rising +23.63% this three hundred and sixty five days and handiest about 1% a ways from the all-time highs. Minute doubt we can eclipse that label reasonably soon. Correct a question of whether or no longer that occurs by the highest of 2023 or early within the Original three hundred and sixty five days.

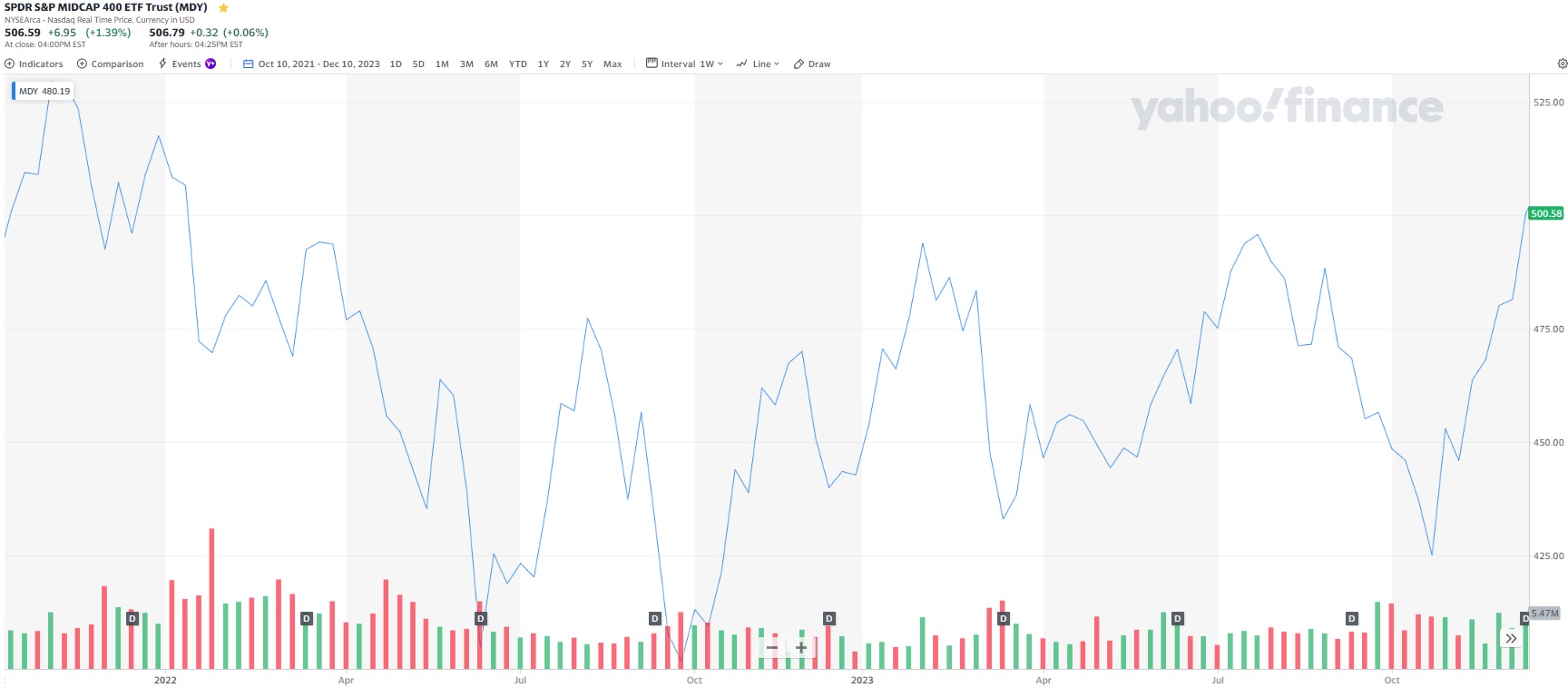

Subsequent let’s downshift to a stumble on of the midcap shares as represented by S&P 500 Midcap ETF (MDY).

Here we have a closing high made about 2 months sooner than the tall caps on November 16, 2021 at 515.Fifty three. MDY changed into as soon as effectively beneath that label plenty of the three hundred and sixty five days, however has played plenty of compile up since the November 1st Fed meeting that sparked this discontinue of the three hundred and sixty five days rally that broadened out beyond the tall caps.

This index is merely no longer up to 2% beneath its all time highs. Stunning odds to eclipse within the times remaining in 2023. Nonetheless if no longer then easy hurdle to develop early in 2024.

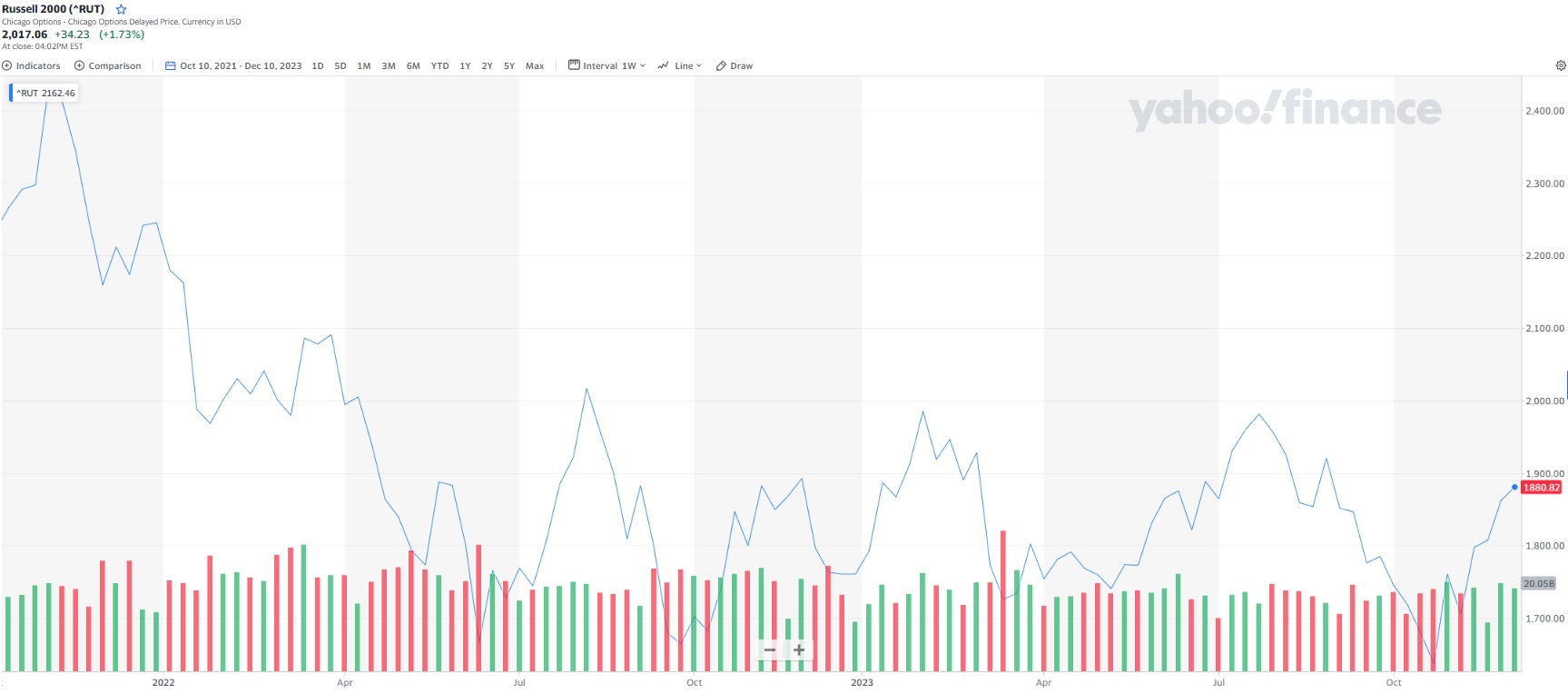

Lastly, we can steal a gander on the tiny cap shares greatest represented by the Russell 2000 index:

This index topped out at 2,442 the total method help on November 8, 2021. Even with the rotation to tiny caps of gradual, the index handiest closed at 2,017 on Thursday. That means we’re restful 17% beneath the all-time highs.

This underperformance by tiny caps is no longer any longer a most up-to-date phenomenon. Rather you might possibly possibly maybe after all return 4 years with reasonably consistent outperformance of tall cap shares.

But the extra we return in time…the extra we realize that tiny caps typically outperform tall caps by a nice margin. In particular correct all the method in which through bull markets as shoppers level of curiosity on suppose and upside doable.

The level being that this most up-to-date rotation to tiny shares has legs and no longer too gradual to affix the occasion. The secret’s WHICH tiny caps have the correct opportunity to outperform?

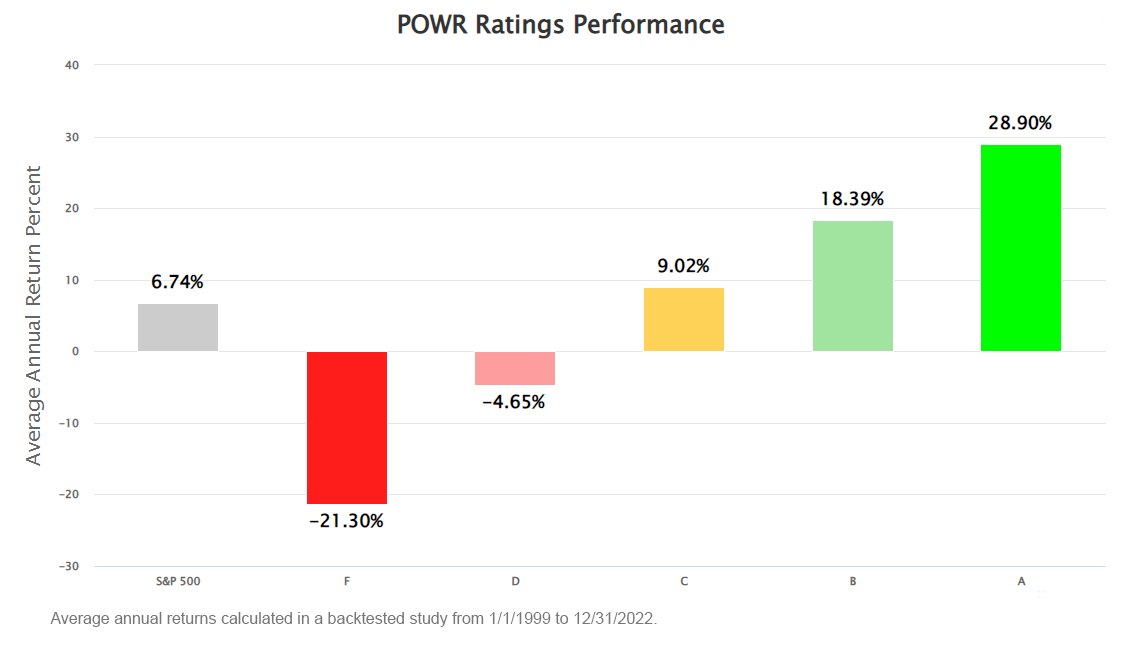

That might possibly possibly maybe also very effectively be a dapper advantage we have with the POWR Rankings system that analyzes 118 components for every stock. That means it does as deep of a dive on a mega cap adore Apple as it does on a hidden gem beneath $1 billion market cap.

Having these 118 components of the corporate in our decide is what results in dapper outperformance. Adore 4X higher than the S&P 500 for our A rated POWR Stocks going the total method help to 1999.

Lengthy narrative speedy, you should want to lever up on tiny caps with the correct POWR Rankings. And that is precisely what you will compile within the following piece…

What To Create Subsequent?

Ask my contemporary portfolio of 11 shares packed to the brim with the outperforming advantages learned in our queer POWR Rankings model.

This entails 4 tiny caps currently added with dapper upside doable.

Plus I after all have added 2 particular ETFs that are all in sectors effectively positioned to outpace the market within the weeks and months forward.

Here’s all in step with my 43 years of investing skills seeing bull markets…undergo markets…and every little thing between.

Whereas you happen to are peculiar to be taught extra, and want to peep these 13 hand chosen trades, then please click on the hyperlink beneath to originate now.

Steve Reitmeister’s Trading Idea & Top Picks>

Wishing you a world of funding success!

Steve Reitmeister…however all individuals calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares rose $0.15 (+0.03%) in after-hours trading Thursday. three hundred and sixty five days-to-date, SPY has obtained 25.forty eight%, versus a % upward thrust within the benchmark S&P 500 index all the method in which throughout the same duration.

Referring to the Creator: Steve Reitmeister

Steve is extra healthy identified to the StockNews audience as “Reity”. No longer handiest is he the CEO of the agency, however he additionally shares his 40 years of funding skills within the Reitmeister Total Return portfolio. Learn extra about Reity’s background, along with hyperlinks to his most most up-to-date articles and stock picks.

The submit When Will Stocks Destroy to Original Highs? looked first on StockNews.com