US chip shares tumble after strongest year since 2009

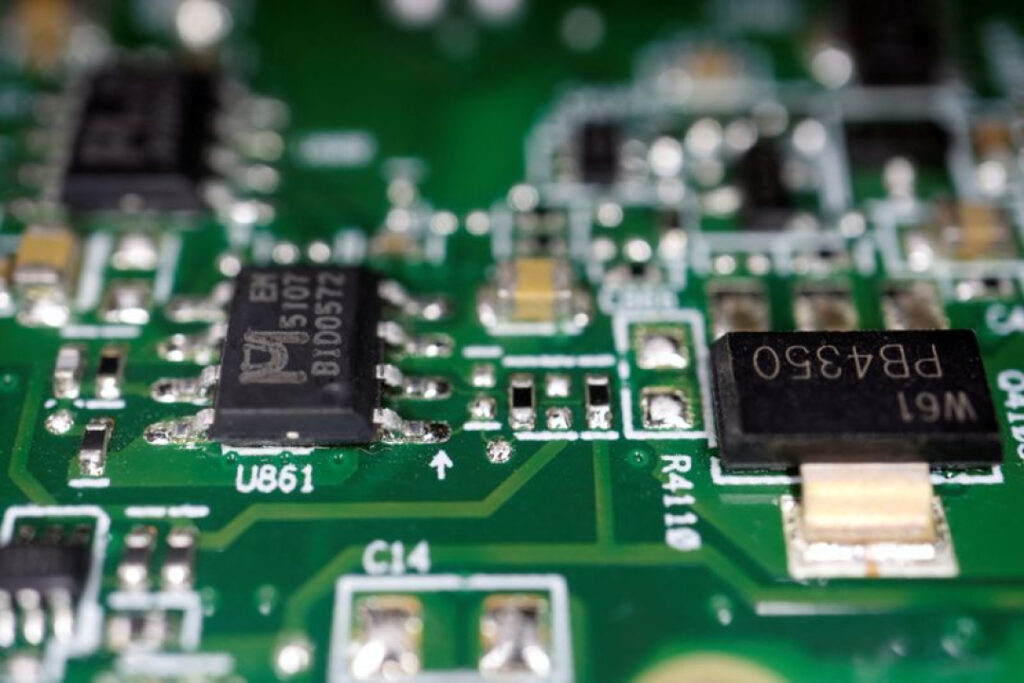

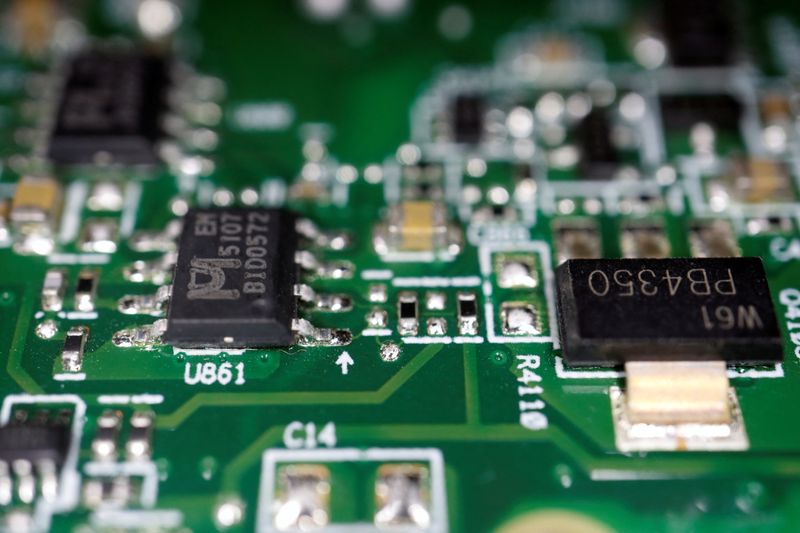

© Reuters. Semiconductor chips are considered on a published circuit board in this illustration describe taken February 17, 2023. REUTERS/Florence Lo/Illustration/File Characterize By Noel Randewich (Reuters) – U.S. chip shares added to a string of losses on Wednesday, with Wall Avenue’s predominant semiconductor benchmark tumbling from file highs following its strongest year since 2009, when

© Reuters. Semiconductor chips are considered on a published circuit board in this illustration describe taken February 17, 2023. REUTERS/Florence Lo/Illustration/File Characterize

© Reuters. Semiconductor chips are considered on a published circuit board in this illustration describe taken February 17, 2023. REUTERS/Florence Lo/Illustration/File Characterize

By Noel Randewich

(Reuters) – U.S. chip shares added to a string of losses on Wednesday, with Wall Avenue’s predominant semiconductor benchmark tumbling from file highs following its strongest year since 2009, when the field bounced reduction after the financial crisis.

Drops of over 2% in Developed Micro Gadgets (NASDAQ:), Qualcomm (NASDAQ:) and Broadcom (NASDAQ:) weighed most on the PHLX semiconductor index, which became down 2.1%.

The chip index has now declined nearly 7% since reaching a file high shut on Dec. 27.

This week’s tumble in semiconductor shares has tracked a astronomical Wall Avenue decline as traders anticipate the Federal Reserve’s December meeting minutes due later on Wednesday for clues on its rate of interest direction.

Fueled by optimism about man made intelligence and extra recently by expectations the Fed will slice interest charges this year, the PHLX surged 65% in 2023, its strongest performance since 2009. That compares to annual gains of 43% and 24%, respectively, for the Nasdaq and .

Chip shares appreciate also benefited from bets that a downturn in global demand final year that saw memory chip makers slice production has largely bottomed out.

Nvidia (NASDAQ:), considered as the pinnacle provider of AI-associated chips, saw its inventory market worth bigger than triple in 2023 to $1.2 trillion, making it Wall Avenue’s fifth most costly company. It dipped nearly 1% on Wednesday.

In a shopper show, BofA World Evaluation analyst Vivek Arya urged publicity to cloud computing and automobiles through shares including Nvidia, Marvell (NASDAQ:) Know-how, NXP Semiconductors (NASDAQ:) and ON Semiconductor (NASDAQ:). Arya also urged shares including KLA Corp and Arm Holdings (NASDAQ:) for publicity to the rising complexity of chip designs.

In one other show, Wells Fargo analyst Joe Quatrochi said he expects a muted restoration for chip instruments sellers in 2024, and pointed to KLA and Utilized Materials (NASDAQ:) as high picks in that industry.