NextEra No Longer Bullish on Nuclear SMRs

Alex Kimani Alex Kimani is a used finance creator, investor, engineer and researcher for Safehaven.com. Extra Files Top rate Train material By Alex Kimani – Oct 31, 2024, 7:00 PM CDT NextEra Energy is exploring the reopening of the Duane Arnold nuclear plant amid rising recordsdata heart curiosity but stays cautious on the viability of

By Alex Kimani – Oct 31, 2024, 7:00 PM CDT

- NextEra Energy is exploring the reopening of the Duane Arnold nuclear plant amid rising recordsdata heart curiosity but stays cautious on the viability of dinky modular reactors.

- SMRs, though promising by smaller dimension, decrease fuel wants, and modular arrangement, face essential challenges.

- Excessive manufacturing costs for HALEU, estimated to succeed in up to $25,725/kg, pose a substantial financial hurdle.

A week ago, renewables utility firm NextEra Energy (NYSE:NO) delivered a healthy third-quarter earnings account. In some unspecified time in the future of the third quarter earnings callCEO John Ketchum told patrons that the firm is currently evaluating the likely of reopening its Duane Arnold nuclear vitality plant in Iowa amid rising curiosity from recordsdata heart corporations.

Primarily primarily based thoroughly on Ketchum, Duane Arnold’s boiling water reactor makes it simpler to restart and operate economically when in contrast to other nuclear vitality flowers. On the exchange hand, Ketchum acknowledged he became “now not bullish” on dinky modular reactors (SMRs), at the side of that the firm’s in-condominium SMR evaluate unit has so some distance now not drawn favorable conclusions about the technology.

“A quantity of [SMR equipment manufacturers] are very strained financially,” he acknowledged. “There are simplest a handful that primarily hang capitalization that might per chance well also in actuality raise them thru the subsequent quite loads of years.”

Ketchum might per chance well hang a sound point.

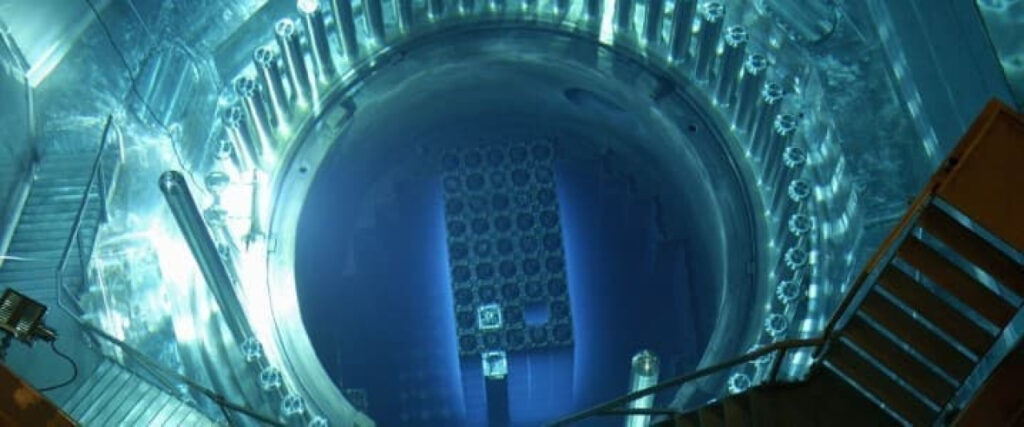

Tiny modular nuclear reactors (SMRs) are superior nuclear reactors with vitality capacities that regulate from 50-300 MW(e) per unit, when in contrast to 700+ MW(e) per unit for archaic nuclear vitality reactors. Given their smaller footprint, SMRs might per chance be sited on areas now not perfect for increased nuclear vitality flowers, comparable to retired coal flowers. Prefabricated SMR devices might per chance be manufactured, shipped and then establish in on arrangement, making them more cheap to hang than mountainous vitality reactors. Additionally, SMRs are speculated to present essential savings in payment and building time, and might per chance well additionally be deployed incrementally to match increasing vitality question. Another key advantage: SMRs hang reduced fuel requirements, and might per chance be refueled every 3 to 7 years when in contrast to between 1 and 2 years for archaic nuclear flowers. Certainly, some SMRs are designed to operate for up to 30 years without refueling.

Related: New Behold Shows Grim Outlook For Oil Markets

The U.S. Division of Energy has so some distance spent $1.2B on SMR R&D and is projected to use almost $6B over the subsequent decade. Final yr, the U.S. Nuclear Regulatory Payment (NRC) certified NuScale Vitality Corp.(NYSE:SMR) VOYGR 77 MW SMR in Poland, the first ever SMR to be current within the nation.

But there’s a pudgy articulate right here as a result of fuel required to vitality these novel nuclear flowers might per chance merely be in point of fact pricey.

Three years ago, U.S. Nuclear Regulatory Payment (NRC) current Centrus Energy Corp.’s (NYSE:LEU) question to make Excessive Assay Low-Enriched Uranium (HALEU) at its enrichment facility in Piketon, Ohio, turning into the first firm within the western world outside Russia to construct so. A yr later, the U.S. Division of Energy (DoE) introduced a ~$150 million payment-shared award to American Centrifuge Working, LLCa subsidiary of Centrus Energy. HALEU is a nuclear fuel discipline cloth enriched to a increased level (between 5% and 20%) within the fissile isotope U-235. Primarily primarily based thoroughly on the World Nuclear Association, purposes for HALEU are currently restricted to analyze reactors and medical isotope manufacturing; nonetheless, HALEU will be wished for more than half of the SMRs currently in vogue. HALEU is simplest currently available from TENEXa Rosatom subsidiary.

Centrus estimates that a fleshy-scale HALEU cascade–which involves scaling-up its 16-centrifuge cascade on the Piketon plant to 120 centrifuges–might per chance produce ~6,000 kg/y of the fuel. On the exchange hand, the firm says that ramp-up will require “ample funding and offtake commitments.” Silent, it represents part of the 40 metric hundreds HALEU the DoE estimates will be required by the sector by 2030. A 2023 gaze by the Nuclear Energy Institute on U.S. superior reactor builders estimated that the whole marketplace for HALEU might per chance reach $1.6 billion by 2030 and $5.3 billion by 2035.

Final yr, the Nuclear Innovation Alliance (NIA) published a account whereby they discussed manufacturing costs for HALEU. Here’s an excerpt from the account:

‘‘Calculated HALEU manufacturing payment for uranium enriched to 19.75% is $23,725/kgU for HALEU in an oxide make and $25,725 for HALEU in a steel make beneath baseline economic assumptions but will be increased.’’

The account claims that a SWU (Separative Work Unit) goes to payment loads more in a HALEU enrichment cascade when in contrast to an traditional LEU (Low-Enriched Uranium) enrichment cascade. SWU is the customary measure of the bother required to separate isotopes of uranium (U235 and U238) one day of an enrichment direction of in nuclear companies and products(1 SWU is a lot like 1 kg of separative work). NIA estimates that a LEU SWU will payment $150 but that a HALEU SWU will payment $1,000. Primarily primarily based thoroughly on the NIA, to set aside money, you’d make low-enrichment uranium first, then spend the produced LEU as the feed for a HALEU enrichment cascade.

Provide: Energy From Thorium

NIA reckons it might per chance well payment ~$2000/kgU to make HALEUF6 into HALEUO2, and as worthy as $4000/kgU to make HALEUF6 into HALEU-steel. On the finish of the day, you’d finish up with HALEU with 28 times the fissile deny material of pure uranium at over 100 times the payment. In an sharp blogKirk Sorensen, founding father of Flibe Energyhas labored out that it might per chance well payment anywhere from $10-$20/MWh on fuel costs alone to generate electricity from HALEU, multiples increased than for similar previous nuclear flowers where fuel costs myth for a dinky phase of the final electricity invoice.

But, don’t stop on SMR tech true but: Centrus’ shares hang tripled over the final 5 weeks after the firm signed a nuclear fuel supply deal with Korea Hydro & Nuclear Vitality (KHNP). The acquisition dedication from KHNP covers a decade of deliveries of Low-Enriched Uranium (LEU) to aid fuel Korea’s mountainous rapidly of reactors.

Provide: Seeking Alpha

By Alex Kimani for Oilprice.com

Extra Prime Reads From Oilprice.com

- Sudden Disagreeable, Product Attracts Send Oil Prices Up

- Hydrogen Shares Rupture as Hype Faces Actuality Take a look at

- New Mexico Warns That Inexperienced Needs Will Stymie Oil Earnings

![]()

Alex Kimani

Alex Kimani is a used finance creator, investor, engineer and researcher for Safehaven.com.