11 Handiest Crypto Staking Platforms of 2024

Cryptocurrency staking has emerged as a favored technique to assemble passive earnings while contributing to community safety. By locking up your crypto property, you’re in actuality helping to validate transactions and shield the integrity of the blockchain. Nonetheless, with diverse crypto exchanges and net sites deciding on the finest crypto platform for staking would perchance

Cryptocurrency staking has emerged as a favored technique to assemble passive earnings while contributing to community safety. By locking up your crypto property, you’re in actuality helping to validate transactions and shield the integrity of the blockchain.

Nonetheless, with diverse crypto exchanges and net sitesdeciding on the finest crypto platform for staking would perchance simply also be advanced. In this e book, we’ll delve into the finest crypto staking platforms, pondering components equivalent to safety, individual experience, and doable returns.

Key Takeaways:

- A crypto staking platform is a carrier where you lock up your cryptocurrency to help salvage the community and assemble passive earnings.

- The correct crypto staking platforms are Binance, KEYNODE, Coinbase, KuCoin, MEXC, Crypto.com, Bybit, Nexo, Lido, Aave, and Rocket Pool attributable to increased APYs, better safety measures, and a pair of supported property.

- To resolve the finest crypto staking app, dangle into consideration components like safety, supported property, individual experience, and doable increased returns.

Checklist of Handiest Platforms to Stake Crypto: Our Top Picks

Now we enjoy reviewed more than 30 a lot of finest crypto staking net sites and exchanges in accordance to a lot of components collectively with recognition, supported property, safety, APYs, and more.

Here are our truly helpful 11 finest crypto staking platforms:

- Binance: Total finest crypto staking platform

- Keynode: Handiest liquid staking platform with beautiful welcome bonus ($100)

- Coinbase: Handiest centralized staking platform for United States users

- KuCoin: Handiest for altcoin staking

- MEX: Handiest for staking newly listed coins

- Crypto.com: Most salvage crypto staking platform

- Bybit: Handiest for a pair of crypto assemble products

- Nexus: Handiest for increased APY for NEXO token holders

- Lido: Handiest Ethereum liquid staking platform

- Ghost: Handiest decentralized lending and staking protocol

- Rocket Pool: Handiest for Ethereum node staking

Handiest Crypto Staking Platforms and Exchanges Reviewed

1. Binance: Total finest crypto staking platform

Binance is our #1 platform for crypto staking and earning companies. It supplies a pair of staking alternatives, collectively with versatile, locked, and DeFi stakingeach and every with obvious facets and advantages.

The versatile staking option enables you to deposit and withdraw funds at will, while locked staking generally supplies increased yields for mounted-length of time commitments (e.g., 15, 30, 60, or 90 days). Through DeFi staking, you must maybe engage with decentralized finance protocols straight through their Binance accounts.

The platform helps over 60 cryptocurrencies for staking, encompassing predominant tokens equivalent to Ethereum (ETH), Cardano (ADA), and Polkadot (DOT), moreover to Binance’s proprietary token, Binance Coin (BNB). Binance continuously expands its staking offerings and adjusts reward rates to reflect fresh market instances.

A predominant wait on of Binance’s staking carrier is its competitive APY rates, which is ready to alter from 1% to over 100% Annual Share Yield (APY). For occasion, staking BNB can yield between 0.05% to 14.25% APY, while staking a lot of property like USDC can offer up to three.06% APY. Some promotional staking alternatives offer even increased yields for restricted lessons.

Binance also supplies an auto-staking feature that automatically re-stakes rewards, allowing users to grab pleasure in compounding returns without e book intervention. To reduction individual decision-making, Binance affords complete records for every and every staking option, collectively with projected returns, commitment lessons, and minimum staking necessities.

Execs

- Mountainous assortment of supported cryptocurrencies for staking

- Aggressive APY rates

- Multiple staking alternatives (versatile, locked, DeFi)

- Client-pleasant interface

- Traditional updates and additions to staking offerings

Cons

- Locked staking lessons can restrict asset liquidity

- Regulatory concerns in dart jurisdictions would perchance simply have an effect on the provision

2.KEYNODE: Handiest liquid staking platform with beautiful welcome bonus ($100)

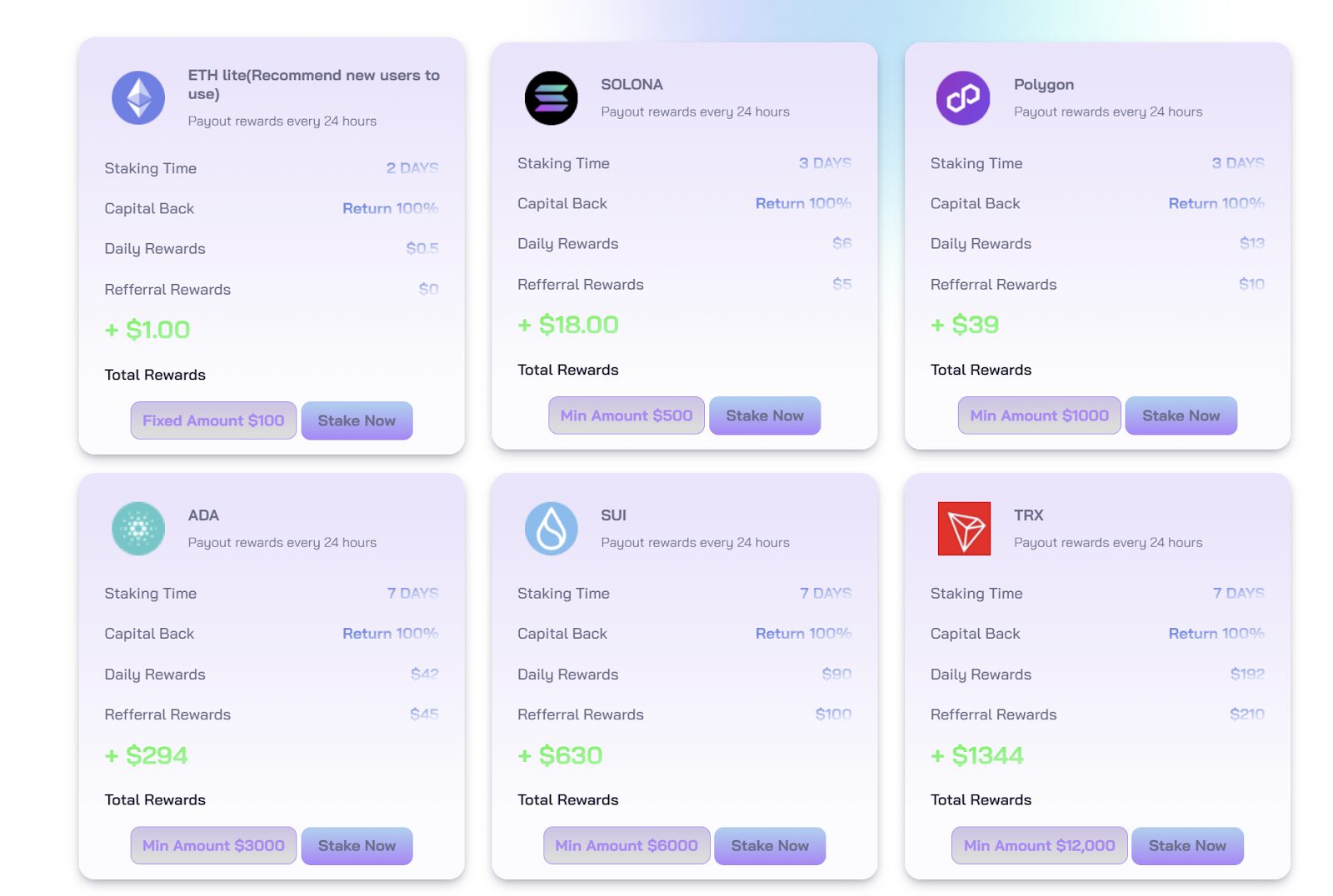

KEY NODE is one in all the finest crypto staking platforms in USA. The platform supplies staking companies for a various vary of proof-of-stake (PoS) cryptocurrencies. KEYNODE’s staking offerings enjoy expanded seriously, now encompassing 10+ property accessible for staking.

This gigantic option entails predominant cryptocurrencies equivalent to Ethereum (ETH), Cardano (ADA), Solana (SOL), Tezos (XTZ), Cosmos (ATOM), and Algorand (ALGO). The platform boasts impressive doable returns, with users ready to assemble up to 17% Annual Share Yield (APY) on their crypto holdings.

- Staking rewards vary considerably at some stage in a lot of cryptocurrencies. For occasion, Ethereum staking presently supplies an estimated APY of up to three.37%, while Cardano staking yields up to 1.84% APY.

- One in every of KEYNODE’s strengths lies in its individual-pleasant methodology to staking. You might originate up earning rewards with investments as modest as $100 in eligible cryptocurrencies. KEYNODE handles the technical aspects of staking, automatically distributing rewards to users’ accounts on a day-to-day, looking on the insist asset.

- KEYNODE supplies liquid staking for crypto and employs great safety measures to safeguard staked property, collectively with substantial insurance coverage coverage and the storage of most property in chilly wallets. The platform will be certified by McAfee Security.

- The enviornment reach of KEYNODE staking companies is great, with availability in over 100 nations.

Execs

- Client-pleasant interface wonderful for inexperienced persons

- Sturdy care for safety and asset protection(2FA+DDoS protection)

- Computerized distribution of staking rewards

- Support for traditional proof-of-stake cryptocurrencies

Cons

- Locked staking lessons can restrict asset liquidity

- Some excessive-yield alternatives enjoy prolonged lock-up lessons

3. Coinbase: Handiest centralized staking platform for United States users

Coinbase is one in all the finest crypto staking platforms for U.S. users. The platform supplies staking companies for a various vary of proof-of-stake (PoS) cryptocurrencies. Coinbase’s staking offerings enjoy expanded seriously, now encompassing 152 property accessible for staking.

This gigantic option entails predominant cryptocurrencies equivalent to Ethereum (ETH), Cardano (ADA), Solana (SOL), Tezos (XTZ), Cosmos (ATOM), and Algorand (ALGO). The platform boasts impressive doable returns, with users ready to assemble up to 12% Annual Share Yield (APY) on their crypto holdings.

Staking rewards vary considerably at some stage in a lot of cryptocurrencies. For occasion, Ethereum staking presently supplies an estimated APY of up to 2.07%, while Cardano staking yields up to 1.84% APY.

One in every of Coinbase’s strengths lies in its individual-pleasant methodology to staking. You might originate up earning rewards with investments as modest as $1 in eligible cryptocurrencies. Coinbase handles the technical aspects of staking, automatically distributing rewards to users’ accounts on a day-to-day or weekly basis, looking on the insist asset.

Also, Coinbase Top supplies liquid staking for Ethereum (LsETH). The trade employs great safety measures to safeguard staked property, collectively with substantial insurance coverage coverage and the storage of most property in chilly wallets. For institutional purchasers, Coinbase supplies an enhanced staking resolution through Coinbase Top, that contains further functionalities and personalised pork up.

The enviornment reach of Coinbase’s staking companies is great, with availability in over 100 nations. Nonetheless, Coinbase costs a charge on the rewards you assemble from staking supported cryptocurrencies. The bizarre charge is 35% for ADA, ATOM, AVAX, DOT, MATIC, SOL, and XTZ. Nonetheless, eligible Coinbase One individuals experience a reduced charge of 26.3% for ADA, ATOM, DOT, SOL, and XTZ.

Execs

- Client-pleasant interface wonderful for inexperienced persons

- Sturdy care for safety and asset protection

- Computerized distribution of staking rewards

- Academic resources for users

- Support for traditional proof-of-stake cryptocurrencies

Cons

- Better fees on staking rewards

- Lower APYs when when put next with some a lot of competitors like Binance

4. KuCoin: Handiest for altcoin staking

KuCoin Invent supplies two predominant categories of staking products: Balanced and Stepped forward. The Balanced class entails products equivalent to Flexible Financial savings, Staking, KuCoin Invent Choose, and ETH2. These products are accessible in each and every versatile and mounted-length of time formats.

The Stepped forward class comprises products like Dual Investment and Conserving Inventamong others. These products are solely mounted-length of time, which formulation your funds are locked in till the maturity date, at which level they are automatically settled. Stepped forward products on the final involve more advanced investment ideas and are designed for these taking a survey to maximise returns internal a outlined length.

KuCoin stands out attributable to its competitive staking rates and individual-pleasant interface, which affords dart records on APY, staking durations, and diverse basic particulars.

There are no minimum staking necessities for diverse property on KuCoin, making it accessible for every and every newbies and seasoned investors. Some staking products on KuCoin also offer day-to-day rewards, which is ready to be automatically reinvested to compound your returns.

Execs

- Presents competitive APY rates, generally ranging from 5% to over 20%

- Presents versatile staking alternatives with each and every gentle and mounted staking

- No minimum staking amount is required for diverse supported property

- Each day reward payouts with alternatives to compound earnings

- Stepped forward trading facets like futures trading and margin trading

Cons

- Some excessive-yield alternatives enjoy prolonged lock-up lessons

- No longer accessible for the U.S. HODLers

5. MEXC: Handiest for staking newly listed coins

MEX supplies a centralized staking platform acknowledged as “MEXC Financial savings”, designed to enable you to assemble passively. The platform facets two predominant staking alternatives: Locked Financial savings and Flexible Financial savings.

MEXC helps a huge array of cryptocurrencies for staking, collectively with predominant coins equivalent to Bitcoin (BTC)Ethereum (ETH), and a diversity of stablecoins. The annual percentage yield (APY) varies looking on the asset style and staking length, with some property offering returns of up to 25% or more.

Apart from crypto staking, it supplies 200x leverage trading and zero-charge crypto trading in negate markets. It is miles on the final a favored no-KYC crypto trade and supplies total privateness for trading digital property.

It prioritizes safety, employing superior measures to offer protection to individual funds. These measures contain two-exclaim authentication (2FA) and chilly storage, safeguarding property from unauthorized gain entry to. Furthermore, MEXC on a conventional basis conducts audits and safety experiences to shield the finest standards of protection.

Execs

- Presents each and every locked and versatile staking pools

- Involves predominant coins like BTC, ETH, and diverse stablecoins

- Clear-reduce gain entry to through the MEXC net platform and mobile app

- Yields are calculated and allotted day-to-day

Cons

- Extremely non-regulated crypto trade

- Would now not pork up fiat deposits and withdrawals through remark bank tale

6. Crypto.com: Most salvage crypto staking platform

Crypto.com supplies a staking program known as Crypto Inventwhere you must maybe assemble passion for your crypto holdings. With over 21 cryptocurrencies and stablecoins accessible, you must maybe also simply enjoy a lot of alternatives to resolve between.

Plus, as a Non-public Member, you experience an further 2% annual reward in CRO. Rewards vary by asset, with Bitcoin staking yielding up to 5% per annum and Ethereum up to 5.5% per annum.

Crypto.com enables each and every on-chain stakingall over which your property make contributions to community safety, and liquid stakingwhich affords liquidity through tradeable receipt tokens. This permits you to receive staking incentives while level-headed having the diagram in which to use your property in decentralized finance (DeFi) apps or alternate.

The platform positions itself as one in all essentially the most regulated in the alternate by emphasizing safety and regulatory compliance. Weekly rewards are given out, and also you must maybe song your staking rewards with ease thanks to the app’s individual-pleasant structure.

Execs

- Procure admission to to staking for over 21 cryptocurrencies and stablecoins

- Aggressive rewards rates, with up to 5% for Bitcoin and 5.5% for Ethereum

- Non-public Contributors receive an further 2% per annum in CRO rewards

- Presents liquid staking for Ethereum, offering liquidity alongside staking rewards

- Weekly distribution of rewards and an individual-pleasant mobile app

Cons

- Some property would perchance simply enjoy predominant lock-up lessons, limiting rapid gain entry to

- Total staking companies have to now not accessible in all jurisdictions, equivalent to the USA

7. Bybit: Handiest for a pair of crypto assemble products

Bybit is but another top cryptocurrency negate for staking and earning passive earnings. It affords a lot of earning imaginable decisions, collectively with yield farming, customizable saving plans, and stakingwhere you must maybe earnings out of your cryptocurrency holdings by earning beautiful passion rates. It supplies 6.2% APR on USDC3% on Ethereum, and a pair of.35% on Bitcoin.

A gargantuan quantity of altcoins and well-acknowledged cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) are supported by the trade, offering a plethora of alternatives for portfolio diversification.

Additionally, users can without complications use their cryptocurrency utilizing the Bybit Card thanks to Bybit’s affiliation with Mastercard, further integrating the utilization of cryptocurrency in day-to-day monetary operations.

Bybit also supplies structured products equivalent to dual asset, double salvage, and clear leverage. You might assemble up to 50% APY utilizing these products.

Execs

- Excessive liquidity with over $10 billion in day-to-day trading quantity

- Helps a wide diversity of trading alternatives, collectively with futures, alternatives, and perpetual contracts

- Clear operations with staunch-time proof-of-reserves

- 24/7 customer pork up in a pair of languages

- Aggressive passion rates on staking and saving alternatives

Cons

- Regulatory challenges in dart nations would perchance simply have an effect on the provision

- Stepped forward trading facets would perchance maybe be overwhelming for inexperienced persons

8. Nexo: Handiest for increased APY for NEXO token holders

Nexus is a well-established crypto platform for staking opportunities through its “Invent Crypto” program. When staking on Nexo, you must maybe assemble passion on over 38 supported crypto propertywith rates reaching as excessive as 16% APY for some cryptocurrencies.

The exact rate you receive depends on the asset and your loyalty tier internal Nexo’s design. To illustrate, Platinum-tier users, who shield at least 10% of their portfolio in NEXO tokens, experience up to 25% increased yields than the flawed tier.

One in every of the standout staking products on Nexo is Ethereum Tidy Staking, which enables you to stake ETH by swapping it for NETH (Nexo Staked Ethereum). This route of is seamless and requires no advanced setup or fuel fees. Hobby rates for Ethereum staking vary from 4% to 12% APY and rewards are paid out day-to-day in NETH. Significantly, the rate remains the same for all loyalty tiers, and there’s no restrict on the amount you must maybe stake.

Nexo supplies flexibility in managing your staking rewards. You might resolve to receive payouts in the same asset you stake or decide to assemble in NEXO tokens for a likely 2% increased rate. One other feature is that keenness compounds are allotted day-to-day, making the route of highly automatic and individual-pleasant.

Execs

- As a lot as 16% on select property collectively with BTC, ETH, and USDC

- Hobby is compounded and paid out day-to-day.

- Staking ETH through Nexo avoids fuel fees

- Choose to receive passion in NEXO tokens for increased rewards

- Stake any amount, starting from as small as $1 in ETH

Cons

- Retaining NEXO tokens to take loyalty tier rewards introduces market threat

- Some facets, like increased staking rates, would perchance simply now not be accessible in dart areas

9. Lido: Handiest Ethereum liquid staking platform

Lido is a number one crypto decentralized staking platform that supplies a particular methodology to staking, in particular for Ethereum. It is miles the most common Ethereuk liquid staking platform. Lido pools your deposits with a lot of stakers, allowing you to stake any amount of ETH and receive the liquid stETH token in return, which represents your a part of the staked property. This stETH would perchance simply also be frail at some stage in over 100 decentralized finance (DeFi) platforms, offering liquidity while level-headed earning staking rewards.

One in every of the standout facets of Lido is its liquidity. In disagreement to damaged-down staking, where your property are locked up for a mounted length, Lido’s liquid staking enables you to make use of stETH in DeFi applications, equivalent to lending or collateral, while level-headed earning staking rewards.

The platform helps integrations with predominant wallets and DeFi protocols like MetaMask, Aave, and Curve, making it handy for you to administer and use your staked property at some stage in the Ethereum ecosystem.

Lido supplies competitive staking rewards, with an estimated annual percentage rate (APR) of round 3.06%. Rewards are allotted day-to-day and automatically compounded, maximizing your earning doable.

Nonetheless, Lido costs a 10% charge on staking rewardswhich is shatter up between node operators and the Lido DAO treasury. Withdrawals are imaginable, however the route of takes roughly 1-5 days below fashioned instances.

Lido’s decentralized building ensures safety and reliability. It distributes staked ETH at some stage in a pair of professional validators, minimizing the risks connected with any single validator. Furthermore, the protocol has gone through a pair of safety audits and participates in huge worm bounty packages to mitigate clear contract vulnerabilities.

Execs

- Stake any amount of ETH, no need for 32 ETH

- stETH would perchance simply also be frail at some stage in 100+ DeFi applications

- Open earning rewards straight after staking

- Rewards are automatically compounded day-to-day

- Totally decentralized and initiate-offer protocol

Cons

- Withdrawals can take in to 5 days

- A 10% charge on staking rewards

10. Aave: Handiest decentralized lending and staking protocol

Ghost is a decentralized liquidity protocol that supplies a essential staking option internal its ecosystem. By staking AAVE tokens in Aave’s Security Module, you must maybe assemble rewards while contributing to the safety of the protocol.

The motive of staking is to style a backstop in case of a shortfall occasion, ensuring the platform’s monetary stability. In case you stake AAVE, you receive stkAAVE tokens in return, which entitle you to assemble staking rewards.

The staking route of is easy. You approve your AAVE tokens for staking and then proceed with two transactions to end the route of. As soon as staked, you are going to assemble rewards in AAVE tokens. Rewards are dart by governance and are allotted at a lot of annual percentage rates (APRs), which is ready to be checked on the platform.

Aave uses a cooldown length for unstaking tokens, presently negate at 10 days. After this era, you must maybe also simply enjoy a 2-day window to unstake; in another case, you’ll have to restart the cooldown route of. This mechanism helps make certain that that that stakers are committed to supporting the protocol’s safety over time.

Execs

- Invent increased rewards for securing the protocol

- Clear-reduce staking and unstaking route of

- Helps Aave’s ecosystem stability

- Starting up-offer and clear platform with audited safety.

Cons

- A restricted quantity of supported digital property

- Risk of token slashing up to 33%

- Better chilly-down length for unstaking

11. Rocket Pool: Handiest for Ethereum node staking

Rocket Pool is a decentralized platform for staking Ethereum (ETH). With Rocket Pool, you must maybe stake as small as 0.01 ETH. In case you stake, you receive rETH tokens, which mutter your stake and develop in cost as rewards from the staking route of are earned. This supplies you the flexibility to make use of rETH internal the DeFi ecosystem while level-headed making essentially the most of staking rewards.

For these attra cted to running a node, Rocket Pool supplies a decrease barrier by allowing node operators to originate with 8 or 16 ETH. The leisure of the 32 ETH wanted to develop a validator is pooled from a lot of contributors in the community. These “minipools” are fully decentralized and operate below the same principles as identical outdated Ethereum validators, earning rewards like priority fees and MEV (Maximal Extractable Price) rewards.

Rocket Pool handles all staking and reward distribution through automatic clear contracts, ensuring transparency and safety. As a non-custodial platform, your property remain for your withhold a watch on, cutting again the threat of third-occasion involvement.

Execs

- Low staking amount with factual 0.01 ETH

- rETH automatically will increase in cost over time

- Handiest 8 or 16 ETH are wanted to bustle a validator node

- rETH would perchance simply also be frail in decentralized finance

- Your funds are salvage and now not held by a third occasion

Cons

- Small stakes would perchance simply also be costly attributable to Ethereum fuel fees

- Handiest pork up ETH tokens for staking

How you must maybe Decide the Handiest Cryptocurrency Staking Web sites?

Selecting the correct Bitcoin staking platform is required while you occur to would favor to diminish risks and invent bigger returns. When deciding on a staking negate, endure the following aspects in mind:

- Security: Learn about out platforms with a solid recognition for safety controls. Crucial safety signs contain multi-signature wallets, chilly storage, and frequent safety assessments.

- Supported Cryptocurrencies: Uncover if the positioning accepts the cryptocurrency you intend to stake. Whereas some exchanges pork up several a lot of currencies, others can simplest present a restricted vary.

- Reward Charges: Overview the annual percentage yields (APY) at some stage in a lot of platforms. Be cautious of exceptionally excessive rates, as they’d simply also be awful.

- Minimal Staking Quantities: Check the minimum amounts required to stake on each and every platform. Some enable diminutive amounts, while others enjoy increased entry thresholds.

- Lock-up Intervals: Overview any lock-up lessons or unstaking times. Platforms with versatile alternatives would perchance offer decrease rewards however will mean you must maybe gain entry to your funds more without complications.

- Client Interface: Decide a crypto staking platform with an individual-pleasant interface, in particular while you occur to would perchance maybe be novel to staking. Some platforms also cater to superior users with more advanced facets.

- Staking Prices: Eavesdrop on any fees for staking, unstaking, or withdrawing rewards. These costs can have an effect on your overall earnings.

- Recognition and Historical previous: Learn about into the staking platform’s song document, collectively with individual experiences and its standing in the crypto community.

- Regulatory Compliance: Invent dart the platform follows like minded necessities for your contrivance. Some staking companies would perchance simply now not be accessible in dart nations.

- Additional Aspects: Retain in mind platforms that offer further perks like compounding rewards, integration with a lot of DeFi tools, or governance participation.

- Buyer Support: Unswerving customer pork up is predominant, in particular for resolving technical concerns or answering questions about your staking activities.

Handiest Cryptocurrency Staking Platforms In contrast

Here is a short comparability between the finest staking platforms:

| Platform | Supported Cryptocurrencies | Maximum APY | Form of Platform |

| Binance | 60+ cryptocurrencies, collectively with ETH, ADA, DOT, BNB | As a lot as 100%+ | Custodial |

| KEY NODE | Critical cryptocurrencies equivalent to ETH, ADA, SOL, XTZ, ATOM, ALGO | As a lot as 17% | Non-custodial |

| Coinbase | 152 property, collectively with ETH, ADA, SOL, XTZ, ATOM | As a lot as 12% | Custodial |

| KuCoin | A gargantuan quantity of altcoins | As a lot as twenty%+ | Custodial |

| MEX | Critical coins like BTC, ETH, and stablecoins | As a lot as 25%+ | Custodial |

| Crypto.com | 21 cryptocurrencies and stablecoins | As a lot as 5.5% | Custodial |

| Bybit | Bitcoin, Ethereum, and diverse altcoins | As a lot as 50% APY | Custodial |

| Nexus | 38 property, collectively with BTC, ETH, USDC | As a lot as 16% | Custodial |

| Lido | Ethereum (ETH) | 3.06% APR | Non-custodial |

| Ghost | AAVE tokens | 4.42% APR | Non-custodial |

| Rocket Pool | Ethereum (ETH) | 2.25 APR | Non-custodial |

What’s Crypto Staking?

Crypto staking entails taking share in a proof-of-stake (PoS) blockchain by locking up a fragment of your cryptocurrency.

In disagreement to damaged-down mining, which depends on essential computational vitality to clear up advanced puzzles, staking enables users to validate transactions and generate novel blocks just by keeping their property in a staking wallet.

Here’s what staking does:

- Secures the Network: By locking up their coins, stakers help offer protection to the blockchain from doable threats and shield its overall safety.

- Validates Transactions: Stakers dangle phase at some level of of confirming novel transactions, ensuring they are well added to the blockchain.

- Facilitates Consensus: For the blockchain community to shield synchronization and consensus on transaction records, staking is basic.

- Earns Reward: Stakers receive incentives in the affect of more cryptocurrency in trade for his or her contributions, which makes it a gleaming passive earnings walk.

Staking has grown in recognition since it supplies a more sustainable quite diverse to mining and supplies a easy diagram for crypto holders to assemble rewards on their property, such as gaining passion in a bank financial savings tale.

How Does Cryptocurrency Staking Work?

Cryptocurrency staking works by allowing token holders to lock up their property in a wallet to pork up the operations of a blockchain community. Here’s a step-by-step rationalization of the route of:

Eligibility: First, you must enjoy a cryptocurrency that uses the proof-of-stake consensus mechanism.

Minimal Requirements: Many networks enjoy a minimum amount of tokens required for staking. This might maybe occasionally likely simply vary from a share of a token to thousands, looking on the community.

Pockets Setup: Invent dart that the wallet you to make a decision to retailer your tokens is staking-compatible. Should always you’re utilizing a centralized staking carrier, this could maybe be an trade wallet, a design wallet, or a hardware wallet.

Locking Tokens: As soon as in the correct staking wallet, you “lock” or “delegate” your tokens to the community. This signifies your procedure to stake.

Validator Possibility: In some networks, you are going to enjoy to resolve a validator to delegate your tokens to. Validators are nodes to blame for proposing and confirming novel blocks.

Network Participation: Your staked coins are now integrated in the community’s validation mechanism. The more cryptocurrencies you stake, the upper your chances of getting chosen to validate transactions and beauty novel blocks.

Reward Distribution: As a reward for taking share in the community’s operations, you receive further tokens. These rewards are generally allotted at traditional intervals.

Compound Staking: Many platforms will mean you must maybe automatically reinvest your staking rewards, main to compound growth over time.

Unstaking: In case you must gain entry to your staked tokens, you initiate an unstaking route of. Some networks enjoy a “cooldown” length sooner than you must maybe withdraw your tokens.

It’s predominant to build that while your tokens are staked, they are generally locked and would perchance now not be traded or transferred. Some networks and platforms offer liquid staking solutions to cope with this limitation, however these contain their enjoy negate of concerns and doable risks.

Forms of Crypto Staking

1. Proof of Stake (PoS) Staking

Proof-of-Stake (PoS) entails other folks staking crypto property to help vitality a blockchain community. As an alternative of fixing sophisticated algorithms, PoS uses the amount of cryptocurrency staked to resolve who gets to validate transactions and develop novel blocks.

The more coins a trader stores, the upper their chances of getting chosen for validation. Stakeholders receive tokens as a reward for his or her contributions. This methodology is believed of as more energy-efficient than identical outdated proof-of-work (PoW).

2. DeFi Staking (On-Chain)

Decentralized Finance (DeFi) staking entails locking up tokens in clear contracts on a lot of DeFi platforms. This might maybe occasionally likely simply contain offering liquidity to decentralized exchangestaking share in yield farming protocols, or contributing to lending platforms.

DeFi staking generally supplies increased rewards however comes with increased complexity and clear contract risks.

3. Off-Chain Staking (Crypto Exchanges)

Many centralized cryptocurrency exchanges offer staking companies where you must maybe stake your tokens straight on the trade platform. This trend is mostly more individual-pleasant and requires much less technical records, however it entails trusting the trade with custody of your property.

4. Yield Farming

Whereas now not damaged-down staking, yield farming is mostly grouped with staking activities. It entails offering liquidity to DeFi protocols and earning rewards through further tokens.

5. Liquid Staking

Basically, while you stake your cryptocurrency, it gets locked up, and also you must maybe’t use it till the staking length ends. With liquid staking, you receive a token that represents your staked property, which you must maybe alternate, lend, or use in a lot of ideas while level-headed earning staking rewards.

To illustrate, while you occur to stake ETH through a liquid staking platform, you must maybe receive stETH in return. This stETH represents your staked ETH and would perchance simply also be frail factual like traditional ETH in a lot of DeFi (Decentralized Finance) activities, like trading or earning yield in liquidity pools. This methodology affords flexibility and further opportunities to assemble returns, without needing to seem ahead to the staking length to end.

6. Masternode Staking

Masternode staking is a route of where you use a masternode, a a lot of affect of node that helps shield a blockchain community and manufacture further functions like processing transactions and securing the community.

In disagreement to traditional staking, running a masternode requires you to fulfill a minimum threshold of coins and enjoy the technical functionality to shield a server running 24/7.

Within the Speed cryptocurrency community, you must maybe bustle a masternode by keeping at least 1,000 DASH coins. In return, you help validate transactions and pork up the community, earning rewards for your participation.

Risks and Challenges of Crypto Staking

Wherea s crypto staking supplies a likely technique to assemble passive earnings, it’s basic to mark the connected risks and challenges:

- Market Volatility: The label of staked property can vary widely attributable to market fluctuations. Even while you occur to receive staking rewards, the general cost of your investment would perchance decrease if the token’s label drops.

- Lockup Intervals: Many staking protocols require your tokens to be locked for a particular length. At some level of this time, you must maybe’t promote or switch your property, which is ready to be a trouble if market instances trade posthaste.

- Slashing Risk: In some Proof of Stake (PoS) programs, validators would perchance simply enjoy their stakes “slashed” (partly taken away) if they act maliciously or fail to shield the specified uptime. Should always you’re delegating to a validator, unfortunate performance on their phase would perchance lead to an absence of a fragment of your stake.

- Tidy Contract Risks: In DeFi staking and some PoS programs, clear contract weaknesses can lead to fund loss. It is predominant to resolve platforms which were thoroughly examined and honest.

- Regulatory Uncertainty: Modifications in authorized guidelines and guidelines would perchance simply enjoy an affect on the legality and profitability of staking activities.

- Centralization Concerns: Some think that PoS programs would perchance lead to centralization, as these with essentially the most tokens wield essentially the most have an effect on over the community.

- Technical Complexity: Running your enjoy staking node requires technical talents and ongoing repairs. Even delegating your stake to a validator would perchance simply also be sophisticated for these novel to the route of.

- Reward Price Modifications: Staking reward rates can fluctuate over time, potentially reducing your anticipated returns.

- Impermanent Loss: In liquidity provision and some DeFi staking models, you must maybe also simply experience impermanent loss if the costs of property in a pool diverge seriously.

- Platform Risk: Utilizing a centralized platform for staking carries the threat of the platform turning into bancrupt or being hacked.

Crypto Lending Vs. Staking Vs. Mining: What’s the Inequity?

| Characteristic | Crypto Lending | Staking | Mining |

| Definition | Lending your crypto property to assemble passion. | Locking up your crypto to pork up a blockchain. | Utilizing hardware to clear up advanced math complications. |

| Motive | Invent passion from borrowers. | Support salvage the community and validate transactions. | Validate transactions and salvage the blockchain. |

| Rewards | Hobby paid by borrowers in crypto. | Invent rewards in the affect of most contemporary tokens or fees. | Invent novel coins as a reward for mining blocks. |

| Risk Level | Medium to excessive, looking on the borrower. | Low to medium, depends on the community’s safety. | Excessive, attributable to hardware costs and energy costs. |

| Technical Records | Minimal (platforms are individual-pleasant) | Overall determining of blockchain is useful | Excessive (requires records of hardware and design) |

| Initial Investment | Varies (looking on amount lent) | Basically low | Excessive (requires investment in mining tools) |

| Energy Consumption | Low | Minimal (mostly running a wallet or node) | Excessive (consumes essential electricity) |

| Repairs | None (managed by the lending platform) | Low (occasional monitoring of staking negate) | Excessive (requires fixed repairs of hardware) |

| Environmental Affect | Low | Low | Excessive |

How you must maybe Stake Cryptocurrency to Invent Passive Earnings?

Step 1: Decide a proof-of-stake (PoS) cryptocurrency – Choose a crypto that helps staking, like Ethereum 2.0, Cardano, or Polkadot.

Step 2: Earn the chosen cryptocurrency – Earn the specified amount through a respected staking cryptocurrency trade.

Step 3: Establish of dwelling up a compatible wallet – Spend a crypto wallet that helps staking for your chosen crypto.

Step 4: Stake your coins – Lock up your cryptocurrency in the community to take part in transaction validation.

Step 5: Invent rewards – Receive traditional payouts in the affect of further coins as compensation for helping salvage the community.

Step 6: Video display and reinvest – Retain song of your earnings and dangle into consideration reinvesting rewards to compound your returns.

How you must maybe Maximize Your Staking Rewards?

- Decide excessive-yield coins: Research cryptocurrencies offering the finest staking returns, balancing doable rewards with risks.

- Stake higher amounts: Many networks offer increased rewards for higher stake sizes. Retain in mind consolidating your holdings if it makes monetary sense.

- Compound on a conventional basis: Reinvest your staking rewards to grab pleasure in compound growth over time.

- Optimize validator option: If acceptable, resolve loyal validators with low fees and excessive uptime to maximise your earnings.

- Leverage liquid staking: Spend protocols that offer tradable tokens representing your staked property, allowing you to shield liquidity while earning rewards.

- Retain in mind lock-up lessons: Some platforms offer increased rewards for longer commitment lessons. Retain in mind if these align with your investment technique.

- Video display and alter: Regularly overview your staking performance and be intriguing to reallocate your property if better opportunities come up.

Conclusion: Finding the Handiest Bitcoin Staking Platforms

In conclusion, deciding on the correct crypto staking platforms entails evaluating safety facets, the variety of supported property, and the doable returns. By focusing on these key aspects, you must maybe resolve a platform that aligns with your investment desires and supplies a salvage technique to assemble passive earnings through staking.

Binance is the finest for increased APYs and a pair of supported property and Coinbase is extremely truly helpful attributable to its regulatory compliance and increased safety. Lido, Aave, and Rocket Pool are just a few of the finest decentralized crypto staking platforms. You might resolve the finest negate of your enjoy preference, however dangle into consideration each and every the professionals and cons of staking while investing. You might moreover test out our e book about NFT staking.

FAQs

Is crypto staking safe?

Crypto staking would perchance simply also be safe, however it does enjoy some risks. You might lose money attributable to hacks, clear contract bugs, or complications with exchanges.

Validators would perchance even be penalized if they don’t discover the community’s principles. Staking with well-acknowledged platforms and standard cryptocurrencies generally makes it safer.

What’s the finest crypto staking platform?

The correct platform depends on what you need. Binance and Coinbase are two standard decisions. Binance supplies many staking alternatives with correct returns, generally better than a lot of exchanges. It helps an complete bunch cryptocurrencies and has versatile terms.

Coinbase, though it has a decrease APY, is easy to make use of and salvage, which is useful for inexperienced persons. Both platforms are relied on and regulated, making them loyal. Binance doesn’t cost fees, while Coinbase takes a diminutive fragment of staking rewards.

What’s the long-established return on crypto staking?

The returns you gain from crypto staking can in actuality vary looking on the coin and what’s going on in the market. As a rule, you must maybe analysis returns between 2% and 20% a year, however some would perchance simply also be even increased.

To illustrate, staking standard coins like Ethereum generally supplies you round 4-5% per year. Should always you’re staking on proof-of-stake networks like Cardano or Polkadot, you must maybe gain between 5% and 12%.

Nonetheless keep in mind, these rates aren’t negate in stone—they’ll lag up or down looking on what number of other folks are staking and the coin’s cost. Some smaller or newer coins would perchance offer rates of 20% or more, however there’s generally more threat with these.

What’s the minimum amount required to stake?

The minimum amount required for staking varies enormously looking on the cryptocurrency and the staking platform. Some platforms enable staking with very diminutive amounts, even fractions of a coin.

To illustrate, you must maybe stake Ethereum on dart exchanges with as small as 0.1 ETH. Binance generally has low minimums, generally allowing staking with factual 0.1 models of a given cryptocurrency.

Nonetheless, for running your enjoy validator node on networks like Ethereum, the necessities are unparalleled increased – presently 32 ETHwhich is a essential investment.

Platforms like Bybit or Coinbase enjoy their enjoy minimum necessities, generally ranging from $1 to $50 rate of a given crypto.

Can I lose my staked cryptocurrency?

Sure, you must maybe lose your staked crypto property. The principle threat comes from the volatility of cryptocurrency costs – if the charge of your staked asset drops seriously, your overall holdings will be rate much less no topic earning staking rewards.

Should always you’re staking through a third-occasion carrier, there’s continuously a diminutive threat of the platform being hacked or turning into bancrupt.

Sure crypto staking platforms enjoy lock-up lessons, all all over which you must maybe’t gain entry to your funds; while you occur to have to promote all the diagram in which through this time, you must maybe face penalties. It’s also imaginable to lose gain entry to to your staked crypto while you occur to lose your non-public keys of hardware wallets or gain entry to to your staking tale.

Establish I have to pay taxes on staking rewards?

Staking rewards in cryptocurrencies generally falls into a gray negate of tax legislationas many nations are level-headed adapting their guidelines to this novel know-how.

Basically, these rewards are considered as a affect of earnings by tax authorities, such as how dividends or passion are treated. The timing of taxation would perchance simply also be advanced – you must maybe owe taxes while you receive the rewards, or simplest while you replace them to fiat foreign money, depending for your jurisdiction.

File-conserving is required, as you’ll have to song the market cost of your rewards at the time of receipt. Some nations would perchance simply moreover practice capital positive aspects tax while you occur to later promote your staked property at a earnings.

Which crypto platform has the finest APY?

Whereas APYs fluctuate continuously in the crypto world, Binance generally supplies just a few of the finest staking yields among predominant crypto exchanges. Binance’s staking platform affords competitive rates for a wide assortment of cryptocurrencies, with some offerings reaching 10-20% APY and even increased undoubtedly tokens.

Binance continuously updates its staking alternatives and rates, generally offering promotional rates that can exceed 100% APY for restricted lessons. These excessive rates are generally for smaller cap coins or novel listings.

What’s the variation between centralized and non-custodial staking?

Centralized staking entails delegating your cryptocurrency to a third-occasion carrierlike an trade (e.g., Binance or Coinbase), which manages the staking route of for you. This feature is individual-pleasant and requires much less technical records, however it formulation you’re trusting the platform with your property. These exchanges are also acknowledged as custodial staking platforms.

Non-custodial staking, on the a lot of hand, enables you to shield withhold a watch on of your non-public keys while staking. This might maybe occasionally likely maybe be carried out through crypto wallets, DEXes, or by running your enjoy validator node.

Are there fees for crypto staking?

Sure, there are fees connected with crypto staking, even supposing they vary looking on the platform and staking diagram. Many centralized exchanges cost a charge for your staking rewards, equivalent to Coinbase costs up to 35% of the yield.

Some crypto staking platforms would perchance simply advertise “no fees” for staking, however they’d maybe be taking a reduce of the rewards sooner than distributing them to you.

For non-custodial staking, there would perchance maybe be transaction fees for delegating your stake and claiming rewards, which is ready to be essential on networks with excessive fuel fees like Ethereum.

Should always you’re running your enjoy validator node, you’ll have to dangle into consideration the costs of asserting the needed hardware and net connection. Some networks even enjoy a thought of “validator fees” which would perchance maybe be negate by the validators themselves and deducted from the rewards sooner than distribution to delegators.