Meta Posts Stable Revenue Result in Q3

Meta has shared its most up-to-date efficiency exchange, showing a dinky lengthen in active users right through its apps, and a mountainous lengthen in earnings, in relative phrases.

Although its investments in subsequent-level projects remain essential. Right here’s a explore on the latest numbers from Ticket Zuckerberg’s tech behemoth.

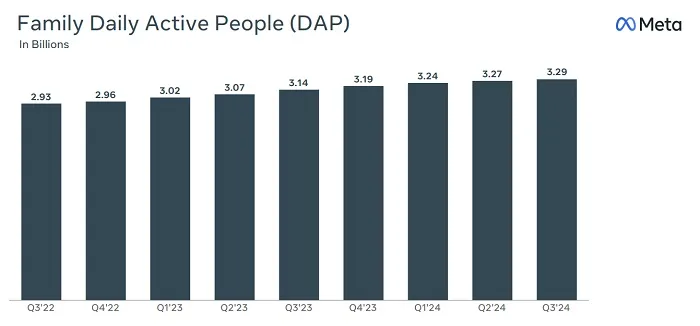

First off, on active users. Meta reports that it now has 3.29 billion other folks the spend of its apps (Fb, Messenger, WhatsApp, Instagram, and Threads) every day, which is a dinky lengthen on the three.27 billion it reported in Q2.

Although we’re talking about 3 billion plus other folks, the scale of which is difficult to if truth be told comprehend.

The population of the arena is estimated to be around 8.1 billion, so Meta’s apps are stale by nearly 40% of the total planet, every single day. Minus the 1.4 billion Chinese residents (the build aside Meta is banned), and that’s nearer to 50%, so the breadth of Meta’s operation in this sense is magnificent improbable.

And it’s soundless rising. Despite its apps presumably reaching saturation point in a total lot of markets, Meta’s soundless seeing more users sign in to its apps, which bodes neatly for its ongoing seemingly, and its core adverts enterprise.

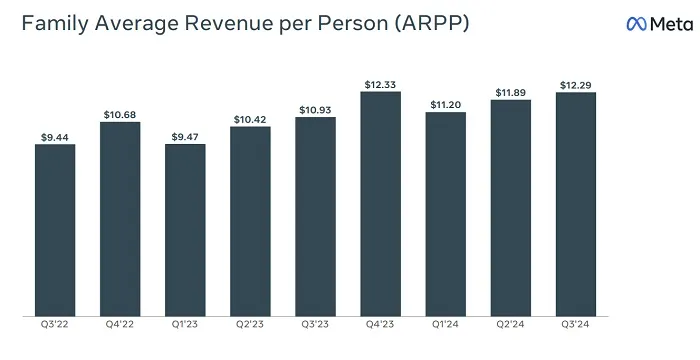

Indeed, Meta’s also utilizing more earnings, on average, from those users:

Meta doesn’t atomize down its ARPP results by market in discovering it irresistible stale to, however as that it is seemingly you’ll look here, Meta’s overall earnings per particular person is rising, and will lengthen again amid the holiday lope in Q4.

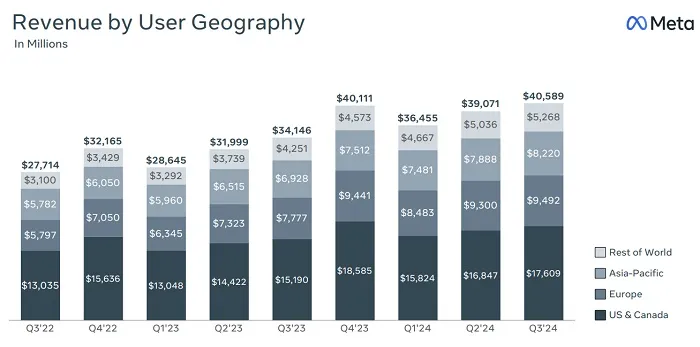

Which might perhaps assist Meta continue to strengthen its earnings consumption:

As that it is seemingly you’ll look in this chart, Meta remains reliant on North The usa and Europe for the bulk of its earnings consumption, despite the incontrovertible reality that it’s steadily rising its Asia Pacific market consumption as neatly.

That’s considered it put up a sturdy earnings consequence for the period of $40.59 billion.

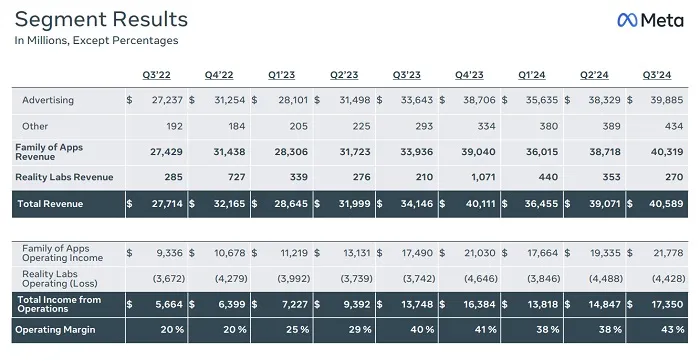

So while Meta is spending a uninteresting quantity on VR and now AI style, it continues to rake within the money from its main money cow, by showing other folks more adverts in its apps.

On that entrance, Meta also reported that advert impressions delivered right through its apps include elevated by 7% twelve months-over-twelve months. The average sign per advert will almost certainly be rising (+11% YoY), despite the incontrovertible reality that the mathematics there might perhaps even be no longer ideal for social media marketers.

Indisputably, that methodology that Meta is presenting more adverts to more users in additional places. Which methodology more opportunity for marketers to attain their aim viewers, however as an different of reducing the advert sign by including more placements, it’s if truth be told seeing them upward thrust. I will look why that’s a particular for Meta’s shareholders, and its bottom line. But for advertisers, no longer so worthy.

Perchance that’ll strengthen with more other folks taking on Meta’s Motivate+ computerized advert campaigns, which completely automate advert placement, inventive, even budgets and bidding while you choose. Meta says that these adverts are turning in better results through enhanced behavioral working out, and that, no longer lower than in conception, might perhaps assist marketers optimize their advert provide, and maybe lower overall charges.

Or stunning ship better results, making the more expensive adverts payment it.

So, more users, including to its already big presence, and more earnings from adverts, which, as renowned, are also position to upward thrust again in Q4. Every little thing appears to be like magnificent moral for Zuck and Co.

Oh, other than this:

Meta continues to lose money on VR and AI style, with its complete charges and charges rising by 14% twelve months-over-twelve months.

And that sinkhole handiest going to win deeper.

As per Meta:

“We quiz paunchy-twelve months 2024 complete charges to be within the variety of $96-98 billion, up up to now from our prior range of $96-ninety 9 billion. For Fact Labs, we continue to quiz 2024 working losses to lengthen meaningfully twelve months-over-twelve months attributable to our ongoing product style efforts and investments to further scale our ecosystem. We await our paunchy-twelve months 2024 capital expenditures will be within the variety of $38-40 billion, up up to now from our prior range of $37-40 billion.”

As neatly as to this, Meta’s looking ahead to “essential capital expenditures enhance in 2025” because it works to assemble new AI datacenters, and totally different infrastructure for its subsequent-level projects.

Meta’s arguably leading the manner on VR, AR and AI style, according to its big troves of files, its years of fashion on related projects, and the resources at its disposal. But that does come at a cost, and Meta’s soundless having to spend those charges, with none of those projects bringing in meaningful earnings for the company as but.

But they will. Neatly, confidently.

Meta’s AR glasses explore position to be a success, with the company showing off its new AR machine at its Connect convention final month.

At some stage, functional AR is going to change into a convey, and Meta, stunning now, appears to be like position to win out when it does win on and switch into a bigger pattern. And with gross sales of its present Ray Ban wise glasses on the upward thrustthe indicators attain counsel that shopper interrogate for AR glasses will be essential.

The metaverse will almost certainly be soundless lingering as a longer timeframe play, and Meta’s clearly paving the manner ahead on VR style, while its AI projects are also gaining traction, with Zuckerberg all but again lauding the take up of its AI chatbot, which he says it now the most stale AI chatbot instrument on the market.

Indeed, in his pre-ready assertion, Zuckerberg attributed the company’s sturdy efficiency to growth and momentum around “Meta AI, Llama adoption, and AI-powered glasses.”

Somewhat about a these remain speculative bets, however the indicators are there, they generally all point to those turning into the brand new norm for connection and interaction within the shut to future. It will doubtless be hard to deem other folks all interacting in VR headsets at some stage, however the event is wise, and AI can even additionally play a essential fraction in that abilities, in helping users generate their include custom VR worlds.

As such, while Meta’s present AI instruments seem rather generic, and don’t add loads to the experiences on Fb of IG (the rising spend of its AI chatbot is doubtless more indicative of Meta’s scale than the bot’s reputation), I also don’t mediate that here is worthy of an indicator as to the build aside Meta’s headed on this entrance.

So, a moral consequence for Meta, or no longer lower than, a largely anticipated one, with its advert enterprise closing solid, and its style charges closing high. I doubt there’ll be a mountainous market backlash in opposition to the company, even with those projections of further cost increases, as the future remains magnificent rosy for the enterprise.

But the compounding charges will spook some traders, which might perhaps instructed a short-timeframe kick support.