Snapchat Shares Mixed Performance Outcomes for Q3

Snapchat has published its most up-to-date efficiency replace, which reveals that it’s advert industry is gradually enhancing, even though its particular person development is showing extra precise signs of stagnation, and a possible cap on its usage.

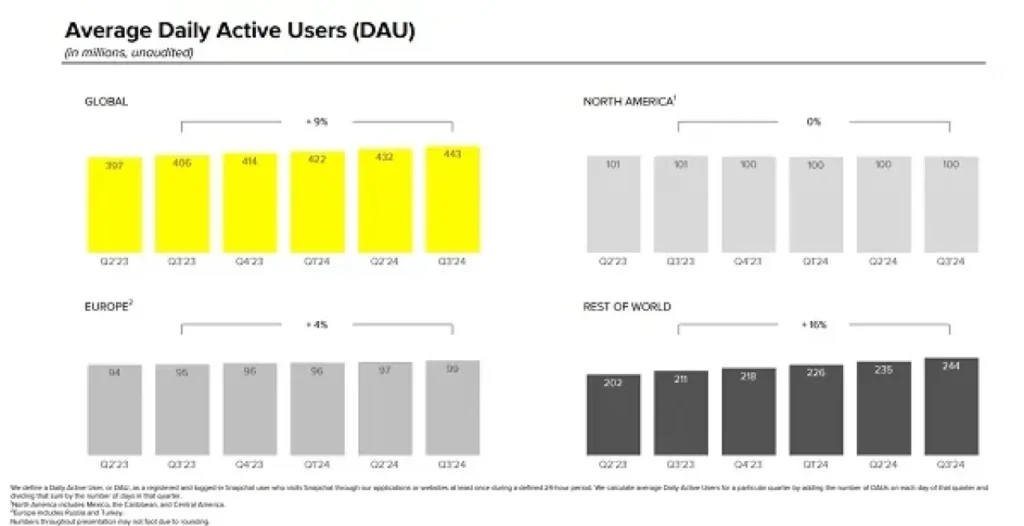

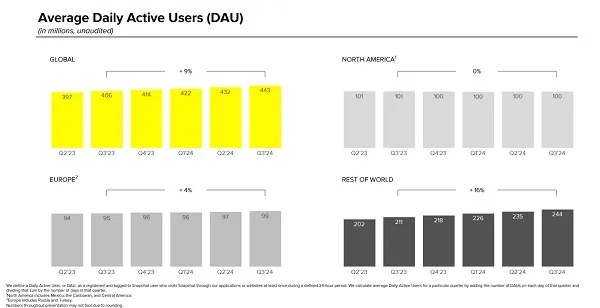

We’ll open with that component first. Snapchat added 11 million users in Q3, taking it as much as 443 million day-to-day actives.

Which is a precise amplify, even though as you’re going to be ready to search out in these charts, there are some relating to elements inside Snap’s development.

The largest wretchedness for investors will be that North American DAU’s remained flat at 100 million, where they’ve been sitting now for bigger than two years. That’s nonetheless a most well-known particular person atrocious, in a most most well-known market, and the reality that Snap has maintained it’s a selected. Nevertheless the stagnation right here highlights Snap’s ongoing development challenges, significantly in relation to other folks “aging out” of Snap’s market. As that occurs, the app has seemingly been ready to replace these users. Nevertheless the base line is that it’s no longer increasing its market fragment in its most established market.

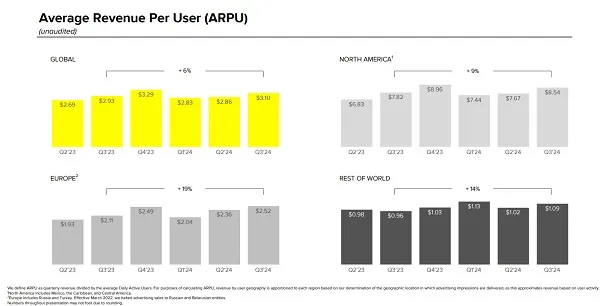

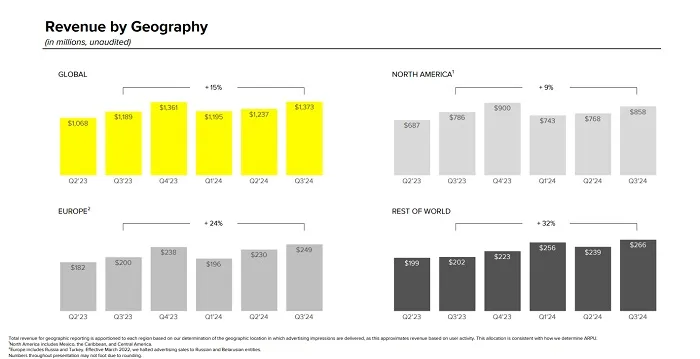

Which doesn’t bode neatly for expanded alternatives, and if you bear a examine its regional income per particular person stats, it furthermore points to an ongoing wretchedness.

Snap nonetheless generates the massive majority of its income from its U.S. users, so it genuinely desires to search out extra development there. Which hasn’t took field for some time, whereas its DAU development in Europe has furthermore been minimal over the previous three hundred and sixty five days.

From an investor standpoint, this might per chance even be considered as a possible plateau, that Snap, in the markets where it’s been round the longest, has now hit a transparent cap on its development skill. Older users switch off, youthful users near in, nonetheless Snap is outwardly at its limit, according to the final three hundred and sixty five days of records as a minimum.

That, clearly, is no longer definitive, and Snap must procure new programs to attract new users. Nevertheless it absolutely does seem delight in we’re starting up to search out the scope of Snapchat’s skill attain coming into watch, with development nonetheless coming in the “Leisure of World” class, nonetheless that too might per chance well also attain a identical limit.

That’ll no question spook the market, as it furthermore places a transparent limitation on Snap’s advert industry development.

Snap is making an try and address this, by reformatting the app with a extra simplified, streamlined UI, in expose to gather it extra welcoming to new users.

And to this level, Snap says that the revised UI is doing neatly amongst these which bear collect admission to:

“Broadly speaking, “Easy Snapchat” is driving the finest whisper engagement beneficial properties amongst extra informal users, which is a genuinely well-known input to neighborhood development and selling inventory. We’re seeing significantly certain impacts on Android devices, including elevated time spent with whisper, elevated story views, and extra replies to company’ tales. We’re furthermore seeing an amplify in whisper packed with life days on iOS, nonetheless the impacts to diverse high engagement metrics are no longer yet as broadly certain as on Android due in fragment to the diversifications in engagement all over these platforms.”

So the updated layout is outwardly helping to pressure extra adoption amongst new and informal users, which is a selected pattern. Moreover, Snap remains hesitant on a corpulent roll-out of the replace:

“Whereas we predict development in whisper engagement and quiz for the brand new advert placements might per chance well also execute over time, diverse the adjustments related to Easy Snapchat happen straight as Snapchatters transition to the brand new particular person skills, which gifts the risk of advance time length disruption. Whereas we attain no longer currently predict a giant roll-out of Easy Snapchat in our most highly monetized markets till Q1 at the earliest, we bear begun minute testing in these markets and might per chance well extra amplify this testing as we sail by Q4.”

In diverse phrases, whereas the longer-time length engagement results look certain, the instantaneous response from users might per chance well also detect extra of its U.S. and EU users switching off as a outcome, and Snap’s no longer ready to risk that on a broader scale as yet.

Nevertheless per chance, at final, that’ll brand yet every other manner for Snap to take away the cap on its usage development.

In relation to income, Snap introduced in $1.37 billion in Q3, a 15% amplify three hundred and sixty five days-over-three hundred and sixty five days.

Snap says that its pronounce response products are seeing certain advertiser response, whereas it furthermore continues to attract extra SMB advertisers to the app.

Snap’s furthermore experimenting with new advert formats, including “Subsidized Snaps”, which is able to search out ads inserted into particular person inboxes in the app for the principle time. Which I don’t think is going to be overly neatly-bought, nonetheless again, with its usage development seemingly minute, it has to achieve something to amplify its income alternatives.

That’s where the staunch squeeze comes in, with Snap being compelled to search out an increasing kind of advert alternatives, wherever it’ll, whereas furthermore no longer alienating the viewers that it has by pushing too many promotions.

Again, a cap on development in its key markets is a relating to component.

In relation to usage trends, Snap says that total time spent watching whisper in the app has elevated 25% three hundred and sixty five days-over-three hundred and sixty five days, whereas “Highlight”, its TikTok-delight in fast-collect video feed, had bigger than 500 million monthly packed with life users, on moderate, in Q3.

Snapchat+ furthermore continues to develop, with 12 million users now paying a monthly fee for various add-ons in the app. Snapchat reported that it had reached 11 million paying users relieve in Augustso it’s added an extra million subscribers in only two months.

When put next to diverse subscription offerings from social apps, Snapchat+ has been a sizable success, with X struggling to prevail in even 1.3 million X Top payment label-upsno matter every offerings being launched at round the identical time. As repeatedly, Snap has shown that it knows its viewers, and what they need from the app, which has enabled it to provide extra choices to entice Snapchat+ label-ups.

It remains a minor component in relation to income (Snapchat generated bigger than 90% of its income from ads in the length), nonetheless it’s yet every other indicator of Snap’s enduring recognition amongst its devoted users, and the stickiness of the app for teenagers, in explicit.

One more condo of wretchedness for Snap, nonetheless, might per chance well even be its skill to continue to make investments in greater-scale tasks delight in its AR glasses, if its development is indeed minute.

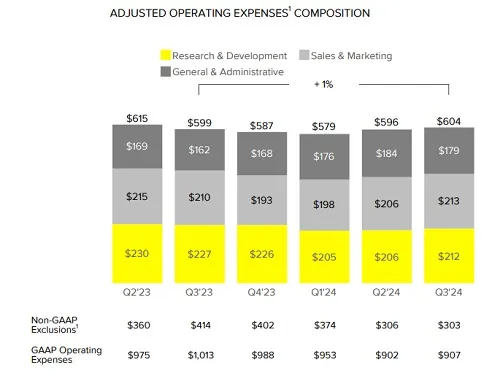

Attributable to taking a bear a examine Snap’s charges, its “Research and Pattern” prices are starting up to rise all over again.

Snap says that a ramp in ML and AI investments are inching this greater, after Snap had kept things pretty in take a look at on this front, and Snap will furthermore must make investments worthy extra sooner than its AR Spectacles attain patrons in a pair of years time.

With out that funding, the total challenge will drop flat, so Snap will need shareholder faith to take that soar. But, with Meta furthermore inserting its AR glasses on a identical timeline, it furthermore appears to be like possible that Snap is going to battle to prevail in adoption for its AR instrument either manner, because as per our overview of Snap’s AR instrument versus Meta’s Orion glassesMeta’s AR glasses, of their contemporary collect, are superior to Snap’s, in virtually every manner.

I’m no longer particular I detect a future in that challenge, significantly given these numbers, because Snap simply doesn’t bear the sources to compete, and is possible to be blown out of the water by Meta’s instrument upon starting up either manner.

Though it’s consuming to furthermore expose that Snap has initiated a $500 million fragment buyback program as fragment of its results announcement. That might per chance well also reduce the pool of skill objectors to its AR thought.

Snap nonetheless has alternatives in international markets, and its enhancing and lengthening advert choices are turning in results. Nevertheless as necessary, I’ll per chance well be afflicted about its stagnating development, and what which will mean in relation to a possible saturation level for the app.

Attributable to if you attain that wall, then your finest remaining development lever is, in actual fact, extra ads.

And with an ever-changing core atrocious of youthful users churning by, that’ll push Snap nearer to shedding its viewers.

You can well per chance also take a look at out Snap’s corpulent Q3 2024 results right here.