Engineering Suggestions for Building Monetary Methods

Accounting hasn’t basically modified in the past couple of hundred years. Despite this, there would possibly perhaps be a quantity of misunderstanding around the factual manner of making instrument for monetary systems.

In this post, I’ll share lessons from my years working on monetary systems at huge tech firms. Our point of curiosity can be building an accounting draw, nonetheless the foundations be conscious to more fundamental monetary systems as neatly.

This post will lunge over the following

-

General monetary definitions linked to the post

-

High level targets of an accounting draw

-

Engineering concepts to total these targets

-

Easiest Practices

-

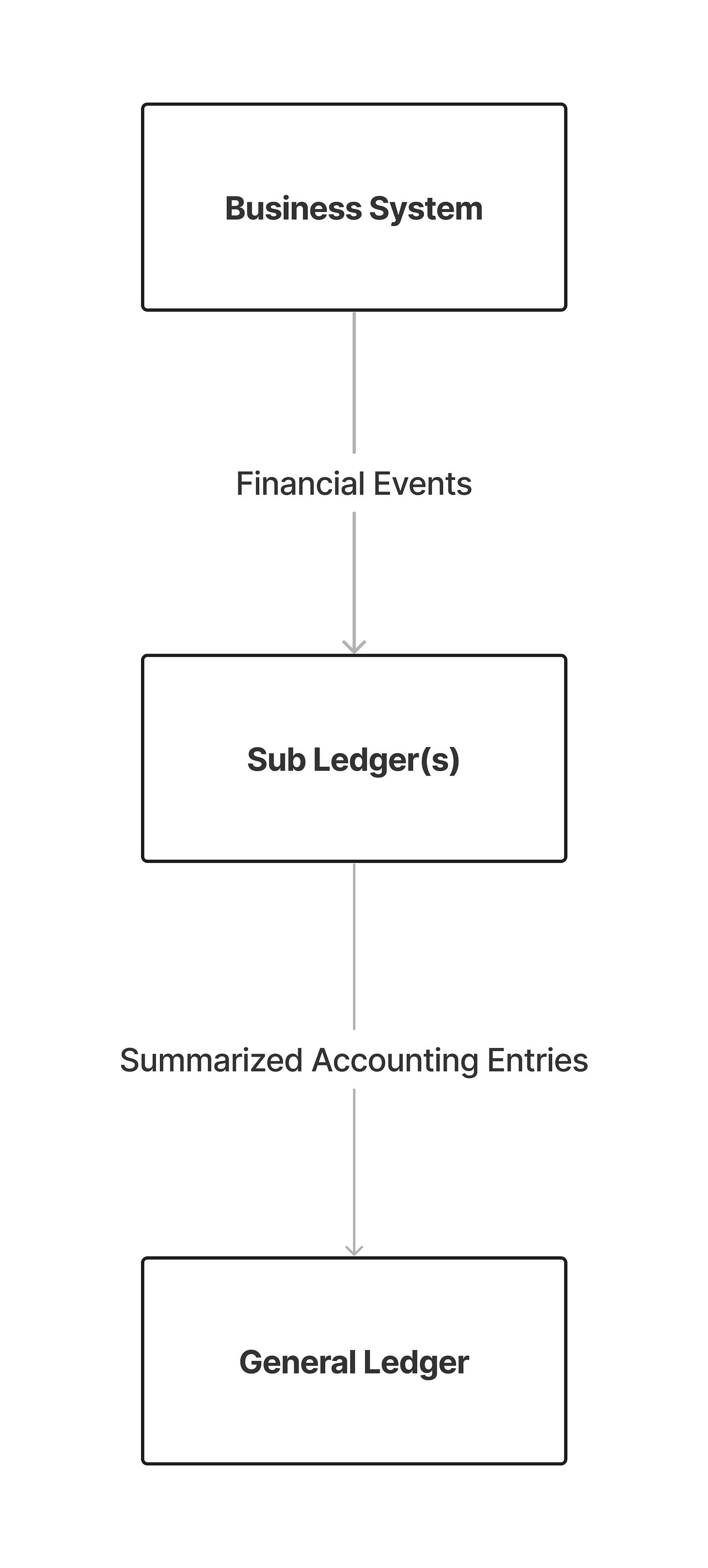

General Ledger (GL): The predominant accounting myth of the company, summarizing all monetary transactions over a command period of time. You would possibly perhaps well well perchance factor in this as an aggregation of or no longer it’s corresponding sub-ledgers.

-

Sub-ledger: Contains detailed knowledge about all individual transactions linked to a command GL. Files in the sub ledger can have arrangement more granular knowledge then the fundamental ledger, love who the categorical customer is, command line objects in an suppose, etc. The adaptation in knowledge between the sub-ledger and GL will depend upon the form of industry and quantity of recordsdata it’s doubtless you’ll well well perchance be working with. Some runt firms can accept away without a longer having any sub-ledgers in any appreciate, nonetheless it’s miles doubtful that they’d ever need custom instrument to address something that is so low in scale.

-

Monetary Fable: This refers to the fundamental ledger and sub-ledgers.

-

Arena materials: A monetary match is regarded as field topic whether it’s miles well-known sufficient to affect the selections of stakeholders based completely on monetary statements. Demonstrate that this definition is a bit ambiguous by invent, as varied firms have varied materiality thresholds. Shall we embrace what would possibly perhaps well well be field topic for a industry making $250,000 of earnings per 365 days, would possibly perhaps well no longer be field topic for a industry making $1 billion in earnings.

The three major targets of your accounting draw are to be (1) Correct, (2) Auditable and (3) Timely.

The monetary myth wants to mediate the acknowledged tell of the industry. This statement is a shrimp bit of mighty and as much as a pair interpretation so I will give some true examples.

If we promote a 10 objects of a product that prices $9.99, the corresponding monetary records need to add as much as $99.90. This seems evident nonetheless whilst it’s doubtless you’ll well well perchance be aggregating thousands (in a quantity of cases hundreds of thousands) of transactions, simple summation or rounding errors between systems can trigger field topic inaccuracies.

Wasteman’s Demonstrate: Of us affirm naming is the toughest field in computer science, I would affirm a end 2nd is addition. After working on tidy scale monetary systems for the past few years, I will’t take into accout how frequently the smallest bugs caused tidy discrepancies in our knowledge. Additionally don’t accept me started on summations over floats. I learned the laborious manner why you ought to peaceable constantly exercise integers.

The monetary myth also wants to be total. Extra namely, each and every the sub-ledger and the fundamental ledger are a total illustration of all industry actions that passed off. If there would possibly perhaps be an match that passed off nonetheless is never any longer in the monetary myth, than the draw is never any longer total.

Wasteman’s Demonstrate: One other surprisingly basically laborious field is guaranteeing completeness. As your draw scales, knowledge hops between many systems and at each and every hop knowledge can with out thunder be mutated or dropped unintentionally.

Very linked to accuracy, your monetary myth ought to peaceable be with out thunder auditable so as that stakeholders can detect errors and precisely measure efficiency of your industry. And even whilst you don’t care, the IRS positively does.

This one depends upon fully to your industry and or no longer it’s command wants. Microscopic firms can accept away with factual dumping all numbers end to the tip of the month, factual in time to end the books. Bigger firms in overall settle on to lead clear of this, and have a end to true time draw. This permits them to video display financials one day of the month, form selections based completely on monetary knowledge sooner, and prick the push to end the month/quarter in the principle few days of the month.

However whatever that need is, our accounting draw ought to peaceable meet the wants of your industry, and whatever neatly timed technique to them.

Wasteman’s existing: Of us tend to accept lost in conversations about batch vs streaming systems with appreciate to timeliness loads. My grab is that this isn’t a really fundamental distinction to form. Batch is factual a varied case of streaming. Ought to you’re knowledge is modeled precisely, its gorgeous easy to change between them especially with unified frameworks love Apache Beam.

The three major engineering concepts your accounting draw ought to peaceable abide by are

-

Immutability and Sturdiness of recordsdata

-

Files wants to be represented on the smallest grain

-

Code wants to be Idempotent

This permits for auditability, which helps debugging and in flip accuracy. When knowledge is immutable, you will seemingly be able to have a myth of what the tell of the draw became once at any given time. This makes it basically easy to recompute the world from previous states, on narrative of no tell is each and every lost.

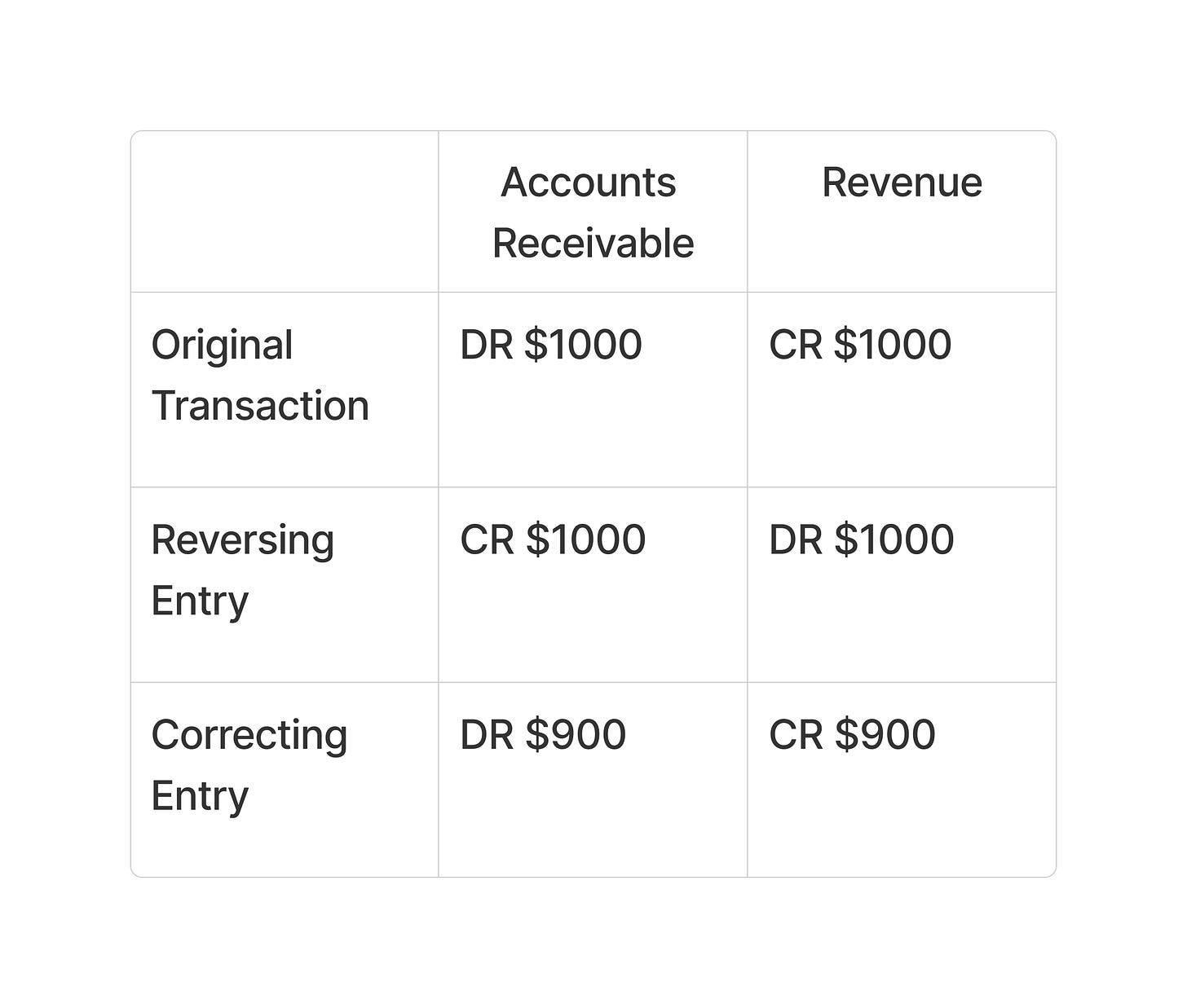

Building on, once knowledge is acknowledged in the monetary myth it will no longer be deleted. Any corrections to the draw ought to peaceable be represented as a brand contemporary monetary transaction. Shall we embrace let’s affirm your draw had a bug and unintentionally reported that a service became once sold for $1000, when it will peaceable had been $900. To appropriate this mistake, you ought to peaceable first reverse the accounting entries such as the error, and restate the accounting entry for the compatible quantity.

This would possibly perhaps well mediate about something love this:

So that it’s doubtless you’ll well well perchance witness that in the monetary myth, there would possibly perhaps be proof that the balance of Accounts Receivable (AR) and Revenue became once $1000 one day, nonetheless became once corrected later. Even supposing that balance became once inaccurate, we need an audit skedaddle of what the balance became once at any given moment.

Akin to the above theory, this would possibly perhaps seemingly well be fundamental for enabling a clear audit skedaddle. Even supposing monetary reports and the fundamental ledger are aggregated, they are computed from more granular events. When the records would not form sense, you want basically the most granular knowledge to debug what would possibly perhaps well well need been the topic.

Saving knowledge on the lowest granularity also makes it basically easy to appropriate knowledge that is derived from that dataset. If a single immutable dataset is the core source of truth for all views of that knowledge, to appropriate the behold all or no longer it’s miles a need to-have to total is rerun the pipeline that creates that behold after fixing your knowledge.

In a similar vogue when accountants are making ready to end the books, they reconcile narrative balances with the total transactions that passed off to validate that the books are factual. When a discrepancy is found, it’s doubtless you’ll well well perchance dig into the categorical transaction that would possibly perhaps well well be inflicting the topic.

Every monetary match can most realistic doubtless be processed once, duplicates in the monetary myth will trigger evident inaccuracies. For that reason, all code that produces monetary records wants to be idempotent.

Over the years, I basically have escape into a quantity of gotchas which have caused me a quantity of peril. Beneath are most realistic doubtless practices I point out, to lead clear of the many pitfalls I basically have for my half faced.

Exhaust integers to indicate monetary amounts. Makes arithmetic far more uncomplicated. Withhold away from floats in any appreciate prices.

Granularity of your monetary amounts ought to peaceable give a boost to forex conversions with minimal loss of precision. Ought to it’s doubtless you’ll well well perchance be most realistic doubtless working with greenbacks, representing values in cents would possibly perhaps well well be sufficient. Ought to it’s doubtless you’ll well well perchance be a global industry, prefer micros or a DECIMAL(19, 4). The decimal change is rather current among monetary systems, nonetheless micros has been the celebrated for classified ads monetary systems. This limits loss of precision when changing between currencies

Wasteman’s existing: Micros of a forex=smallest unit * 1,000,000. E.g $1.23=1,230,000 micros. I first chanced on this when working with Google’s metrics API.

Exhaust consistent rounding methodologies. At scale the vogue you spherical can accept field topic differences between anticipated amounts. Shall we embrace one rounding methodology is to spherical all values 5 and as much as the next fundamental digit, and 4 and beneath rounds down. One other staunch manner is to constantly spherical up. All that issues is it’s doubtless you’ll well well perchance be consistent at some stage in the board. Whenever it’s doubtless you’ll well well perchance be coping with hundreds of thousands of transactions, being off by 1 cent per transaction can lead to field topic differences. (10 million transactions off by 1 cent, results in a distinction of $100k). This would possibly perhaps well no longer be field topic to your industry at this scale, nonetheless it’s field topic sufficient for the authorities to return after you for underpaying taxes.

Wasteman’s existing: Ought to it’s doubtless you’ll well well perchance be a global industry there would possibly perhaps well well be a quantity of gotchas with rounding and forex conversions. I would lunge up to now as asserting you ought to peaceable form a centralized library/service to address each and every rounding and forex conversions. Assorted governments appreciate varied rounding principles when calculating taxes, so having all these nuances abstracted into a single service will prick complexity.

Extend forex conversion so long because it’s doubtless you’ll well well perchance. Preemptively changing currencies can trigger loss of precision. Extend forex conversions except after aggregations happen in their native forex.

Exhaust integer representations of time. This one is a shrimp bit of controversial nonetheless I stand by it. There are so many libraries in varied technologies that parse timestamps into objects, and so they all smash them in a different arrangement. Withhold away from this headache and factual exercise integers. Unix timestamp, and even integer based completely UTC datetimes work perfectly heavenly. The much less knowledge conversions that happen between systems, the better. (Be taught about Etsy’s beget complications with timestamp kinds right here)

Wasteman’s existing: I haven’t even talked about daylight financial savings linked bugs. The exercise of an incrementing integer provide encourage to lead clear of this altogether. Ought to you basically instruct on the utilization of datetimestamps, please on the least exercise UTC. You would possibly perhaps well well perchance be shocked at how many very tidy firms exercise non UTC timestamps.

Thanks for reading this post, I am particular I made a controversial statement someplace nonetheless please basically feel free to statement and originate a discussion. I am very origin ate to discovering out and listening to varied individuals’s concepts. And whilst you liked this post, encourage in concepts supporting me by subscribing beneath!

And for additonal reading, listed below are some basically factual weblog posts on accounting tailored in direction of instrument engineers.