Tellor crypto recordsdata 20% hike – Will TRB detestable $125 subsequent?

Journalist TRB’s value has risen by 20% within the final 24 hours. Its key momentum indicators imply that the altcoin continues to experience a high interrogate. Tellor [TRB]a decentralized oracle protocol, has prolonged its 30-day positive aspects to rally by an further 20% within the past 24 hours, as shown by data from CoinMarketCap .

![]()

Journalist

- TRB’s value has risen by 20% within the final 24 hours.

- Its key momentum indicators imply that the altcoin continues to experience a high interrogate.

Tellor [TRB]a decentralized oracle protocol, has prolonged its 30-day positive aspects to rally by an further 20% within the past 24 hours, as shown by data from CoinMarketCap.

No matter major bearish sentiment, the altcoin has bucked the customary market model to document a rally within the final month.

According to CoinGecko’s data, global cryptocurrency market capitalization declined by 15% within that interval as a result of low buying and selling process.

Nonetheless, TRB’s value rose by 32% at some stage in that interval, causing it to alternate its hands at $114.60 at the time of writing.

TRB has locations to be

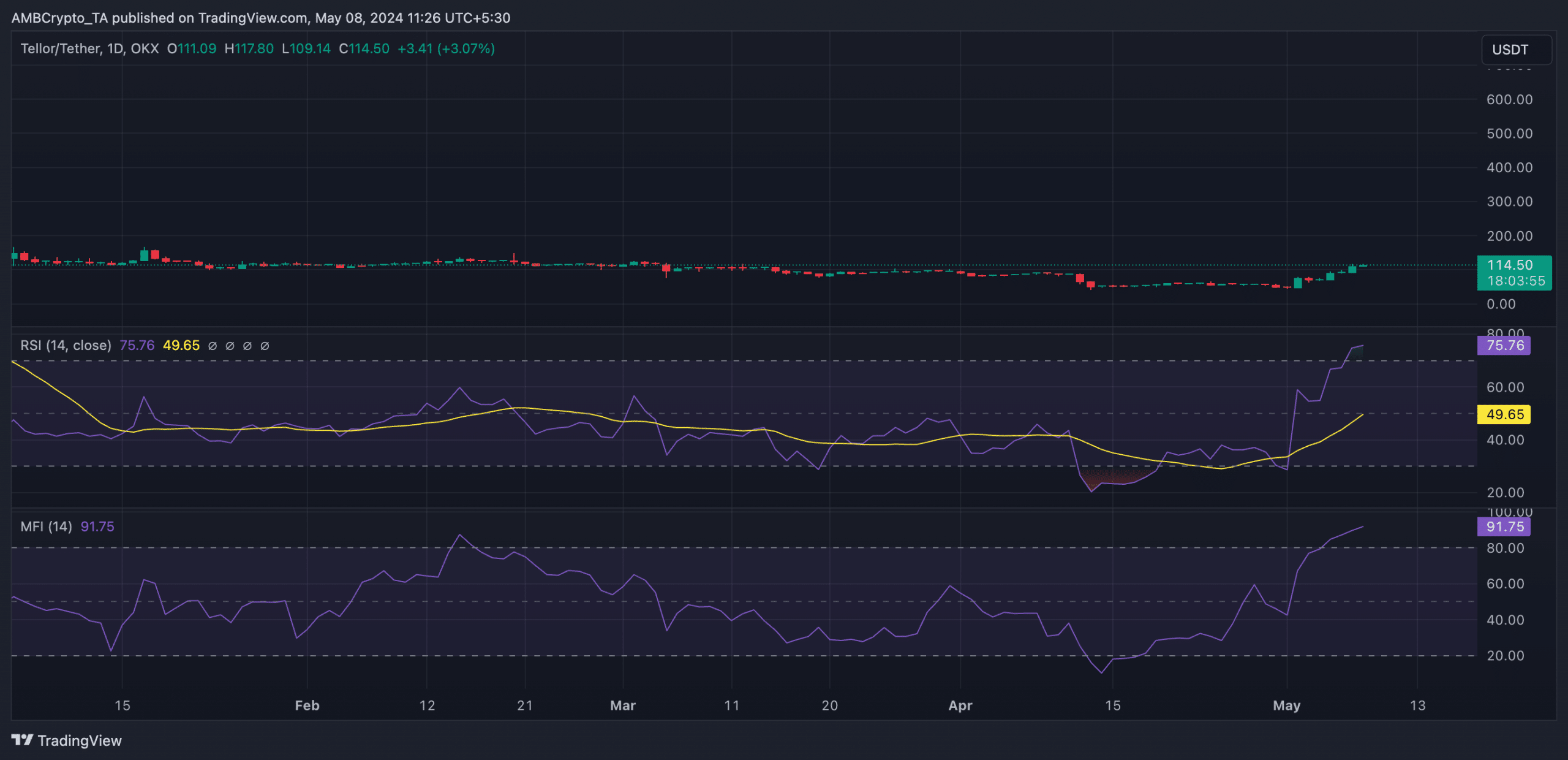

An evaluation of TRB’s label movements on a 1-day chart confirmed the high interrogate for the altcoin by market participants. Its key momentum returned high values at the time of press.

For instance, the token’s Relative Energy Index (RSI) used to be 75.96, while its Money Glide alongside with the circulation Index (MFI) used to be 91.75.

At these values, these indicators confirmed that market participants appreciated TRB accumulation over its distribution.

Nonetheless, it is pertinent to label that the values of those indicators steered that the altcoin will be overbought. At these levels, the market is deemed to be overheated, and value correction is continuously frequent.

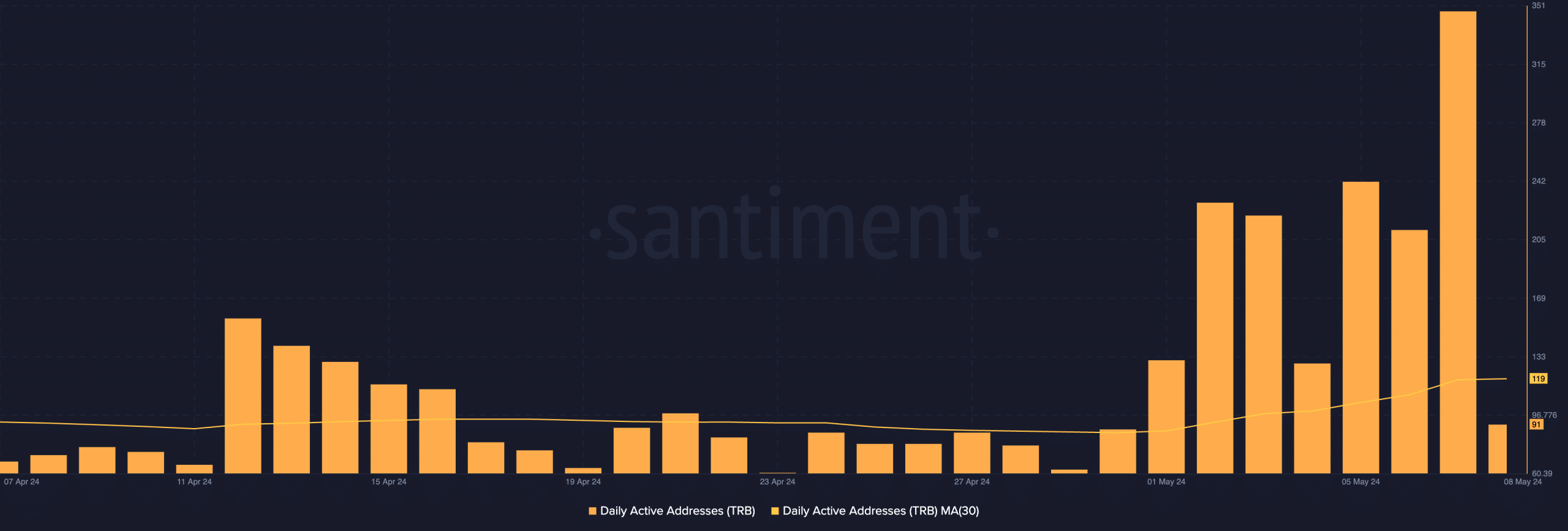

Confirming the hike in TRB interrogate, an on-chain evaluation of the token’s network process confirmed that the count of its on a typical foundation provocative addresses has elevated by 29% within the final month.

While other crypto sources languish below a bearish impression, readings from the TRB market confirmed major bullish presence at press time.

The token’s Weighted Sentiment used to be at a high of 6.98 as of this writing, confirming that the bulls own major abet watch over, per Santiment’s data.

On the cost charts, the dots that arise TRB’s Parabolic SAR relaxation below its label. This indicator identifies seemingly model direction and reversals.

When its dotted traces are positioned below an asset’s label, the market is supposed to be in an uptrend. It indicates that the asset’s label has been rising and must proceed.

Lifelike or no longer,right here’s TRB’s market cap in BTC’s phrases

Referring to how a success TRB investments had been, AMBCrypto found that within the final month, for each TRB transaction that led to a loss, 1.04 transactions returned a profit.

This steered that market participants own made more profit than losses buying and selling the altcoin within the final 30 days.