The SEC Can’t Finish Suing Crypto Companies

Robinhood is the latest agency to procedure the ire of the U.S. Securities and Substitute Charge (SEC). This weekend, it reported receiving a Wells mediate – an announcement that the securities watchdog is building a case and intends to sue. In an 8-K filing, the fintech agency published it bought the letter from the SEC’s

Robinhood is the latest agency to procedure the ire of the U.S. Securities and Substitute Charge (SEC). This weekend, it reported receiving a Wells mediate – an announcement that the securities watchdog is building a case and intends to sue. In an 8-K filing, the fintech agency published it bought the letter from the SEC’s enforcement division for alleged securities violations.

That is an excerpt from The Node e-newsletter, a day-to-day roundup of the most pivotal crypto data on CoinDesk and beyond. You are going to be ready to subscribe to web the overall e-newsletter here.

At this point, it’s laborious to be surprised by the SEC’s anti-crypto actions – shameless despite the indisputable truth that they are going to be. It looks, the agency sent the awareness after Robinhood cooperated with the SEC’s investigative subpoenas about its crypto operations. A Wells mediate is definitely the final chance the accused has to convince regulators that it didn’t crash the regulation, which could be a impress of factual faith other than that the sizable majority of those letters cease up in a lawsuit.

As Robinhood factual, compliance, and company lead Dan Gallagher well-known in an announcementthe agency has been in advise communication with the SEC over its crypto offerings for years, which is precisely what you’d demand from a agency that in point of truth finest dabbles in crypto. It’s not sure from the letter which tokens are even handed securities by the SEC, despite the indisputable truth that it’s rate noting the brokerage proactively delisted a decision of tokens — alongside side Solana (SOL)Polygon (MATIC) and Cardano (ADA) — in accordance with previous SEC complaints in opposition to rival procuring and selling corporations.

“We firmly judge that the resources listed on our platform must always not securities and we learn about forward to participating with the SEC to create sure fair how passe any case in opposition to Robinhood Crypto may possibly be on both the info and the regulation,” Gallagher talked about. He well-known in tell the agency’s “years of factual faith attempts to work with the SEC for regulatory clarity” and, love various crypto corporations in factual limbo, “well-known try to ‘attain in and register.’”

Extra, in heeding “the SEC’s calls,” Robinhood tried to register as a sure motive dealer-vendor with the agency. Whereas there are many licensed crypto corporations, up to now Prometheum Ember Capitala procuring and selling company that doesn’t but offer any resources to alternate, is definitely by myself in receiving a sure motive dealer-vendor license, which had been launched in 2020 to permit corporations to custody and transact in “crypto asset securities.”

Whereas fair speculation, I’ve a sense the SEC started to create a case correct kind around the time Gallagher, himself a historical SEC commissioner and securities regulation expert, testified sooner than Congress that the SPBD process is irrevocably damaged and a profound break of sources. To wit:

“When Chair Gensler on the SEC in 2021 talked about, ‘Can be found in and register,’ we did,” Gallagher talked about in a June 2023 Dwelling Agriculture Committee crypto listening to. “We went through a 16-month process with the SEC workers looking out for to register [as] a sure motive dealer-vendor. And then we had been reasonably summarily prompt in March that that process was once over and we’d not see any fruits of that effort.”

So, to sum up, the SEC announced intentions to sue a agency for failing to register for a license after seemingly denying the agency that very license (despite the indisputable truth that to be appropriate, the SPBD licenses are given out by self-regulatory group FINRA).

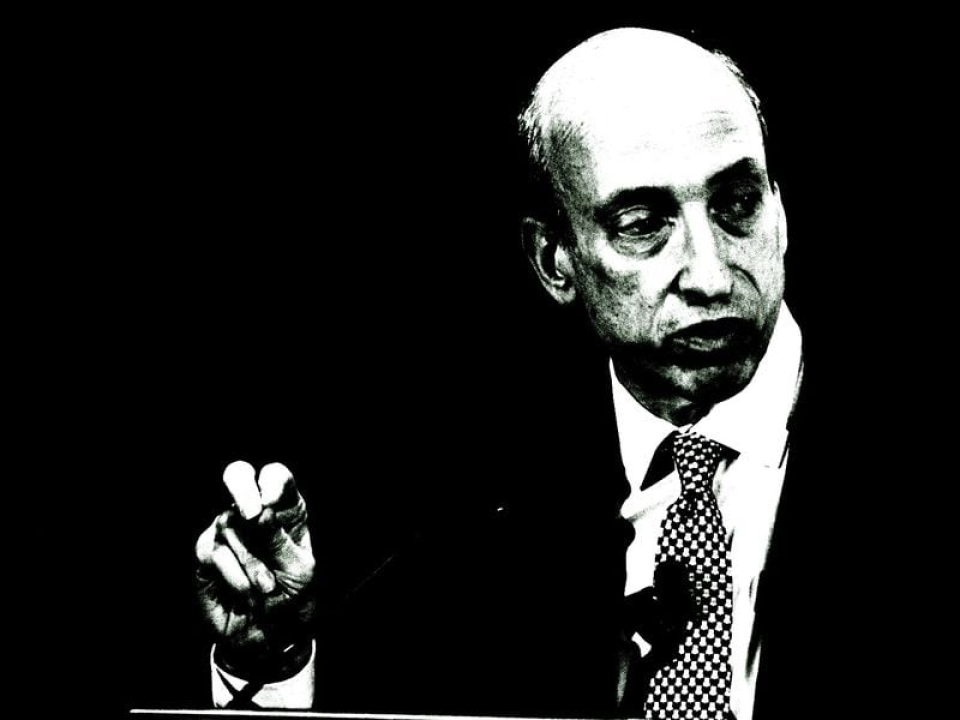

This fits with a protracted sample. Since coming into put of business in 2021, SEC Chair Gary Gensler has made it his industry to rein within the crypto industry, which he says is under his remit (an debatable contention). These efforts dramatically elevated within the wake of the give method of FTX, which was once significantly embarrassing for U.S. regulators given how cushty Sam Bankman-Fried was once with them.

The SEC now spends a disproportionate quantity of time and cash pursuing factual challenges in opposition to crypto corporations both massive and minute. The agency has filed not lower than one lawsuit per month since final November in opposition to a crypto company, nearly all of which waddle unnoticed and usually end result in a settlement.

“The SEC fair sent a Wells mediate to Robinhood. The quantity they’ve sent about crypto in latest months is fantastic. Or not it is laborious to imagine that they’d (or may possibly) affirm so many enforcement actions true away,” Variant Fund factual lead Jake Chervinsky talked about on X. “It looks love they’re abusing the Wells process as a alarm tactic now.”

In some sense, these complaints — significantly the ones brought in opposition to plentiful title corporations love Coinbase and Robinhood — are an try to impress that crypto is definitely lawless. That shouldn’t be squarely the fault of the SEC, but additionally that Congress slept on crypto regulation for over a decade and is now hampered by partisan gridlock.

“I don’t know why [the SEC] did what they did. But there’s no going attend on ideas now,” Beau J. Baumann, a PhD. candidate at Yale Regulations College, and co-creator of an influential crypto regulation paperprompt CoinDesk in an interview. “In that sense, the entire component is substandard faith. If the enforcement actions are unlawful, writing a rule is plan extra obviously so.”

“Congress must create new rules to manual clear of factual pitfalls, alternatively it’s unclear to me whether or not they in point of truth will,” Baumann added. Gensler, for his piece, has talked about straight that he doesn’t mediate crypto desires bespoke rules or steering, given his watch that all the pieces crypto, bar bitcoin, walks and talks love securities.

Whereas the SEC has had factual victories, it’s suffered many court losses as well. It stays to be seen whether Robinhood will in point of truth web sued, and if that is the case whether it goes the plan of Coinbase and Consensys and mounts its hold offensive factual marketing and marketing and marketing campaign.

If there may possibly be a silver lining here, it’s that, after years of looking out for to enjoy the entire crypto pie, Gensler’s SEC may possibly have bitten off bigger than it may possibly possibly bite. Robinhood’s inventory dipped in pre-market procuring and selling nowadays, but has since bounced attend, a impress up piece that the market doesn’t rob this action seriously, not lower than materially-speaking.