Morgan Stanley Chief Executive Leaves for Crypto

Jeremy Huff, the feeble Chief Working Officer (COO) of Morgan Stanley China, has transitioned into the crypto trade. He has joined No Restrict Holdings (NLH), a blockchain-focused endeavor capital agency. This pass reflects the growing entice of the crypto sector among frail finance professionals and necessary institutions. Morgan Stanley’s Susceptible COO Embarks on a Unique

Jeremy Huff, the feeble Chief Working Officer (COO) of Morgan Stanley China, has transitioned into the crypto trade. He has joined No Restrict Holdings (NLH), a blockchain-focused endeavor capital agency.

This pass reflects the growing entice of the crypto sector among frail finance professionals and necessary institutions.

Morgan Stanley’s Susceptible COO Embarks on a Unique Endeavor in Crypto

Huff brings a wealth of skills from his tenure at Morgan Stanley. He directed operations across the agency’s diversified platforms in mainland China since 2017.

His role encompassed strategy execution for Morgan Stanley’s onshore mutual fund trade. He additionally participated in the funding committee of Morgan Stanley’s RMB deepest equity fund.

Gin Chao, a accomplice and co-founding father of NLH, highlighted the strategic importance of Huff’s appointment. He emphasised that Huff’s skill to navigate advanced ideas and convert them into actionable suggestions may be priceless to NLH’s future endeavors.

“Jeremy brings deep skills across corporate law, intellectual property, and asset management that is highly complementary to NLH’s strengths as native crypto investors,” Chao defined.

Be taught extra:How To Fund Innovation: A Recordsdata to Web3 Grants

Furthermore, Huff expressed his enthusiasm about his recent role. He emphasizes the transformative possible of blockchain skills. He smartly-known NLH’s commitment to supporting visionary founders and growing merchandise that harness blockchain’s possible for decentralization and democratization.

“As a believer in the vitality of blockchain to trade our world for the higher, I couldn’t be extra angry,” Huff mentioned.

No Restrict Holdings’ most modern pass additionally solidifies the renewed passion from endeavor capitalists in the cryptoblockchain, and Web3 sectors.

Shall we embrace, Haun Ventures not too long previously led a $5 million seed funding round for Agora, an app designed to streamline voting and willpower-making for decentralized self sustaining organizations. This round additionally saw participation from necessary players love Coinbase Ventures.

Furthermore, Galaxy Digital has expanded its funding strategy by launching a $100 million fund to empower early-stage crypto startups. Identified as Galaxy Ventures Fund I, LP, the fund plans to again up to 30 startups over the subsequent three years. Investments will originate at $1 million, focusing on monetary applications, tool infrastructure, and crypto protocols.

Moreover to endeavor capitalists, frail monetary institutions additionally inform elevated passion in crypto. The most modern funding from BlackRock in the actual-world tokenization agency Securitize exemplifies this style.

On Might maybe per chance maybe 1, Securitize announced that they secured a $47 million funding round led by BlackRock. This funding round aspects participation from Hamilton Lane, ParaFi Capital, and Tradeweb Markets. Furthermore, Joseph Chalom, BlackRock’s Global Head of Strategic Ecosystem Partnerships, will seemingly be appointed to the Securitize Board of Directors.

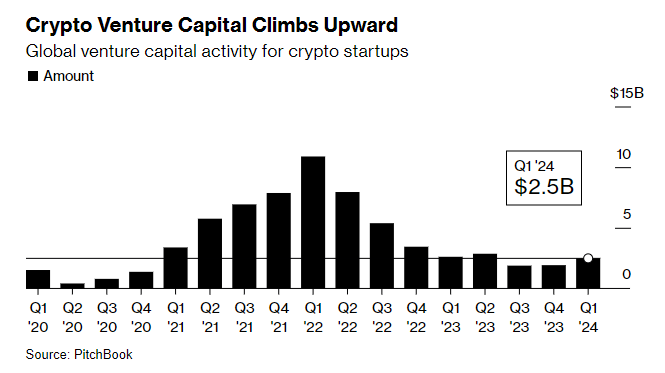

A recent document from PitchBook extra solidifies this style. The knowledge finds that endeavor capital funding in crypto startups reached $2.5 billion all by the first quarter of 2024. This represents a 32% magnify from the final quarter.

Be taught extra:Crypto Hedge Funds: What Are They and How Attain They Work?

At the an identical time, crypto startups are raising extra capital, and endeavor companies are launching recent digital asset funds. Robert Le, crypto analyst at PitchBook, attributes this renewed enthusiasm partly to the approval of Bitcoin alternate-traded funds (ETFs) in January. Furthermore, Le additionally mentioned growing passion in the intersection of crypto and man made intelligence as regarded as one of many drivers.

Trusted

Disclaimer

In adherence to the Have confidence Challenge pointers, BeInCrypto is dedicated to fair, clear reporting. This files article goals to maintain correct, timely files. On the other hand, readers are informed to verify facts independently and seek the advice of with a official earlier than making any choices per this boom material. Please demonstrate that ourTerms and Circumstances,Privateness ProtectionandDisclaimershad been up so a ways.