DTCC Announces 100% Crypto Haircut Protection

The Depository Have confidence and Clearing Corporation (DTCC) has determined to put into effect a 100% haircut on all investment instruments backed by cryptocurrency sources. This decision is a part of a broader chance administration review for quite loads of asset classes, along side company notes and bonds rated B1 to B3, whose haircuts had

The Depository Have confidence and Clearing Corporation (DTCC) has determined to put into effect a 100% haircut on all investment instruments backed by cryptocurrency sources.

This decision is a part of a broader chance administration review for quite loads of asset classes, along side company notes and bonds rated B1 to B3, whose haircuts had been raised to 70%.

How Will DTCC’s Decision Affect Bitcoin ETFs?

DTCC is a financial products and companies agency that affords clearing and settlement products and companies in the financial markets. It plays a pivotal role in the procuring and selling operations of recently launched Bitcoin ETFs.

Notably, DTCC’s decision will take carry out on April 30 and can affect spot valuation in the collateral note. This capability that, DTCC products and companies will no longer enable entities to spend crypto alternate-traded merchandise as collateral for financial transactions done by draw of the DTC system.

“No collateral fee may per chance perchance be given for any ETF or varied investment automobile that involves Bitcoin or any varied

cryptocurrency as an underlying investment, hence may per chance perchance be self-discipline to a 100% haircut,” DTCC acknowledged.

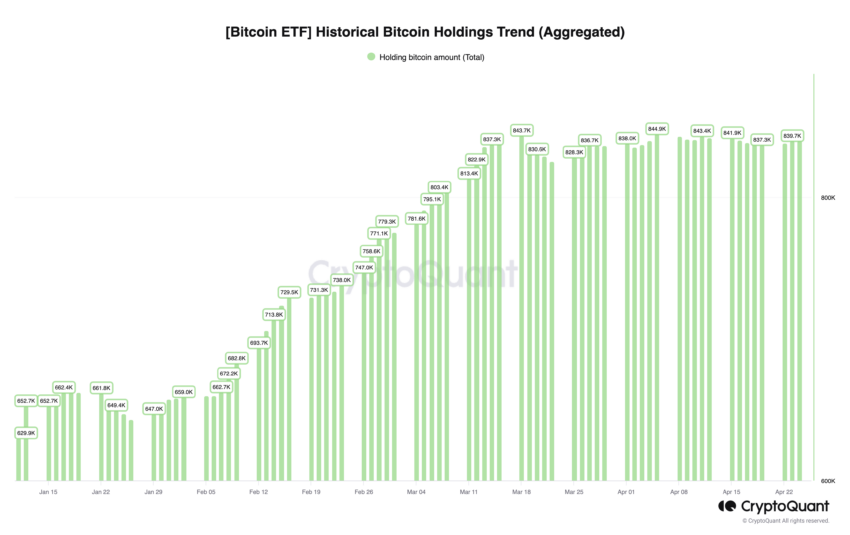

This announcement has precipitated speculation relating to its likely ramifications, with some suggesting it’ll also provoke a reversal in Bitcoin ETF inflows. Autism Capital expressed concerns over doubtlessly diminished liquidity and increased investor chance. Additionally, the agency effectively-known that the transfer can also mitigate Wall Toll road leverage maneuvers.

Read more: How To Alternate a Bitcoin ETF: A Step-by-Step Plan

Opposite to such concerns, certain consultants argued that the update can also honest no longer enormously affect crypto ETF efficiency. They pointed out that digital sources are no longer the only real self-discipline of the 100% haircut when utilizing a line of credit ranking to settle trades with DTCC, as shares below $5 face identical medication.

Moreover, they additionally emphasised that virtually all efficient specific huge banks and financial institutions resort to drawing down on traces of credit ranking for alternate settlements, with most trades settling by draw of Supply versus Cost (DvP), minimizing the need for credit ranking traces.

“Basically the most efficient entities that may per chance perchance plot down on the LoC are specific huge banks / FIs – i doubt any of them would have had the chance appetite to pledge crypto collateral anyway. The LoC is reviewed yearly – closing time across the crypto ETFs didn’t exist, so sounds like they’re correct keeping their bases for the latest annual review. Present – there’s LOTS of asset forms which have a 100% haircut,” 0XBoboShanti added.

Additionally, Bloomberg ETF knowledgeable James Seyffart pushed apart the doomsday notions, echoing the sentiment that the update holds runt tangible significance.

Trusted

Disclaimer

In adherence to the Have confidence Project pointers, BeInCrypto is committed to unbiased, clear reporting. This news article objectives to provide appropriate, timely data. Nevertheless, readers are suggested to verify info independently and talk about with a legit sooner than making any choices according to this order material. Please exhibit that ourTerms and Conditions,Privacy ProtectionandDisclaimershave been updated.