dYdX Tops Uniswap as Ideal DEX by Volume

Decentralized substitute dYdX, which only in the near previous migrated from Ethereum to Cosmos, has topped for sure one of Uniswap’s markets to was the supreme DEX by on daily basis procuring and selling volume, in accordance with knowledge from CoinMarketCap. The Cosmos-primarily based completely completely v4 version of dYdX honest saw $757 million of

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

Decentralized substitute dYdX, which only in the near previous migrated from Ethereum to Cosmos, has topped for sure one of Uniswap’s markets to was the supreme DEX by on daily basis procuring and selling volume, in accordance with knowledge from CoinMarketCap.

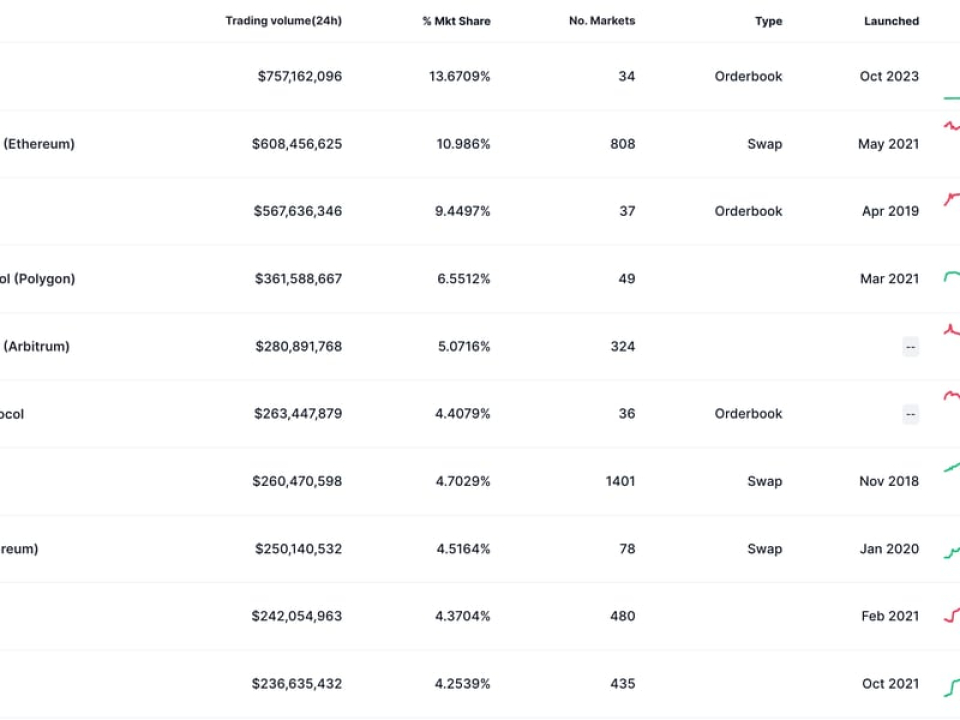

The Cosmos-primarily based completely completely v4 version of dYdX honest saw $757 million of volume over a 24-hour duration, topping Uniswap v3, which had $608 million, the suggestions reveals. dYdX’s v3 market, which soundless operates, had $567 million, sufficient for third location.

Based completely on dYdX, the total alternate volume to this level for its v4 market since launch is $17.8 billion. In 2023, dYdX’s v3 saw a total of over $1 trillion in procuring and selling volume with diverse days exceeding $2 billion of procuring and selling volume.

There have been considerations when dYdX departed Ethereum that it will also strive in opposition to to recoup the identical level of exercise that it skilled in previous iterations attributable to Ethereum, while a costlier chain, has critically larger usage than the Cosmos ecosystem. dYdX’s excessive procuring and selling volumes, which now surpass that of Uniswap and a sort of Ethereum-primarily based completely completely exchanges (along side dYdX’s indulge in v3 DEX), also can attend as a form of validation of the company’s decision to swap ecosystems.

dYdX specializes in facilitating the procuring and selling of perpetual futures, which would perchance perchance perchance be contracts with out a expiration date, thus allowing investors to speculate on the price of an underlying asset while bypassing the bodily settlement of products all in favour of regular futures procuring and selling.

The platform only in the near previous transitioned to v4, which it coined as a “absolutely decentralized” chain, in difference to its previous v3 chain, which the company said changed into no longer. dYdX said v3 on Ethereum will at final be closed, however no firm date is location for the closure.

Based completely on Pantera Capital’s Paul Veradittakit, decentralized finance (DeFi) customers see platforms that provide “excessive throughput for rapid, continuous procuring and selling.” Veradittakit added that “excessive gas bills further compound the verbalize of affairs, diminishing person earnings and platform allure.”

Veradittakit said that dYdX v4’s transition to a standalone blockchain the usage of the Cosmos SDK addresses challenges head-on by “promising critically improved procuring and selling throughput, lowered transaction charges and personalized on-chain good judgment tailored to subtle and excessive-frequency procuring and selling wants.”

dYdX is backed by the likes of Patnera, Paradigm and Delphi Digital.

Sam Kessler contributed to reporting.

Edited by Slash Baker and Stephen Alpher.