Bitcoin ETF Makes Waves: Volumes Surge $10 Billion 3 Days

Bitcoin Space Alternate-Traded Funds (ETFs) own as soon as again garnered the honor of crypto followers and merchants because the products own witnessed a whopping $10 billion in total buying and selling quantity in the important thing three days of buying and selling. Bitcoin Space ETF Sees Most significant Uptick In Day 3 Procuring and

Bitcoin Space Alternate-Traded Funds (ETFs) own as soon as again garnered the honor of crypto followers and merchants because the products own witnessed a whopping $10 billion in total buying and selling quantity in the important thing three days of buying and selling.

Bitcoin Space ETF Sees Most significant Uptick In Day 3 Procuring and selling

The improvement became published by Bloomberg Intelligence analyst James Seyffart on the social media platform X (beforehand Twitter). The working out shared by the analyst demonstrates a firm need for publicity to digital sources by using regulated financial markets.

Seyffart’s X post delves in on the info from the “Bitcoin ETF Cointucky Derby.” In accordance to the analyst, “ETFs traded practically $10 billion in total over the final 3 days.”

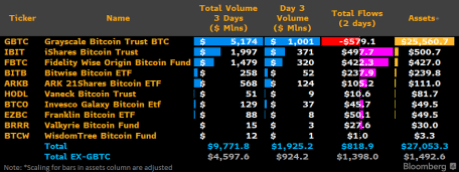

The analyst also equipped a digital file of the info to additional account for on the gargantuan buying and selling quantity. With a total quantity of over $5 billion, Grayscale Bitcoin Belief (GBTC) stands out because the pinnacle performer among the many valuable financial companies.

In the meantime, iShares Bitcoin Belief (IBIT) and Fidelity Intellectual Foundation Bitcoin Fund (FBTC) strategy next in line. The data displays that the financial companies witnessed an overall buying and selling quantity of $1.997 billion and $1.479 billion, respectively.

ARK’s 21Shares ETF (ARKB) and Bitwise Bitcoin ETF (BTTB) adopted on the lend a hand of with a in spite of every thing broad total buying and selling quantity of $568 million and $258 million, respectively. This spike in buying and selling quantity implies that every institutional and particular person merchants are increasing more at ease using ragged investment engines to commerce BTC.

Though Grayscale’s Bitcoin fund continues to safe the supreme overall buying and selling quantity, the fund has viewed indispensable withdrawals from merchants looking out for to lower their publicity.

There own been withdrawals totaling more than $579 million since Grayscale started buying and selling on January 11. For the time being, Grayscale is peaceable idea of the “Liquidity King” of the Bitcoin put ETFs.

Nonetheless, Bloomberg analyst Eric Balchunas anticipates that Blackrock might maybe maybe well oversee Grayscale to narrate the title. “IBIT protecting lead to be one amongst chance to overhaul GBTC as Liquidity King,” he said.

3-Day Procuring and selling Surpassed 500 ETFs In 2023

Following the file, Eric Balchunas has equipped a context for the broad surge of these products. The analyst did so by comparing the buying and selling quantity of BTC ETFs to the total ETFs that own been launched in 2023.

“Let me place into context how insane $10b in quantity is in the important thing 3 days. There own been 500 ETFs launched in 2023,” Balchunas said. In accordance to him, the five hundred ETFs carried out a $450 million blended quantity on the present time, and the finest one did $forty five million.

In addition, Balchunas highlighted that Blackrock‘s BTC ETF demonstrates a better efficiency than the five hundred ETFs. “IBIT by myself is seeing more job than your whole ’23 Freshman Class,” he said. It is great that half of of the ETFs launched in 2023 recorded an overall buying and selling quantity of “no longer up to $1 million” on the present time.

Balchunas also wired the scenario in buying quantity, noting that it’s more vital than flows and sources. Here is since the amount has to strategy in actuality in the market, which offers an “ETF lasting energy.”

Featured image from iStock, chart from Tradingview.com

Disclaimer: The article is equipped for academic purposes handiest. It doesn’t represent the opinions of NewsBTC on whether or no longer to aquire, promote or lend a hand any investments and naturally investing carries risks. That you just would be succesful to well be informed to conduct your dangle research forward of making any investment decisions. Employ recordsdata equipped on this web direct fully at your dangle risk.