High stakes for native weather finance in 2024

Environment finance dreams with out the revenues and systems to raise on them is a recipe for disappointment – this three hundred and sixty five days it is miles going to serene be diverse. Can any person take into accout a time after we didn’t initiate the three hundred and sixty five days pondering that

Environment finance dreams with out the revenues and systems to raise on them is a recipe for disappointment – this three hundred and sixty five days it is miles going to serene be diverse.

Can any person take into accout a time after we didn’t initiate the three hundred and sixty five days pondering that this time native weather finance turned into key? Yet there may perhaps be something historic and diverse this three hundred and sixty five days. What’s on the table is a ideal combination for things to budge truly ideal or truly infamous.

Closing three hundred and sixty five days ended with a historic final consequence. After extra than 30 years, the UN native weather negotiations in the waste identified the core driver of the disaster – fossil fuels – and home out a series of steps to portion them out, which would perhaps require important funding.

How important? The high-stage educated crew on native weather finance estimates that organising nations (except for China) want $2.4 trillion yearly in native weather funding by 2030. No longer an straightforward feat.

Renewables are the least dear accumulate of electrical energy era in the majority of nations. They’re projected to change into noteworthy extra sensible, as technology advancements and economies of scale power down costs.

Notion bribing minister’s household hold Congolese carbon credit firm

They additionally supply elevated price steadiness since they don’t rely on gasoline purchases. Nonetheless, the upfront capital funding wanted is commonly elevated than for fossil energy vegetation. For heaps of nations the place market curiosity charges exceed 10 percent, this puts stunning energy ambitions out of reach.

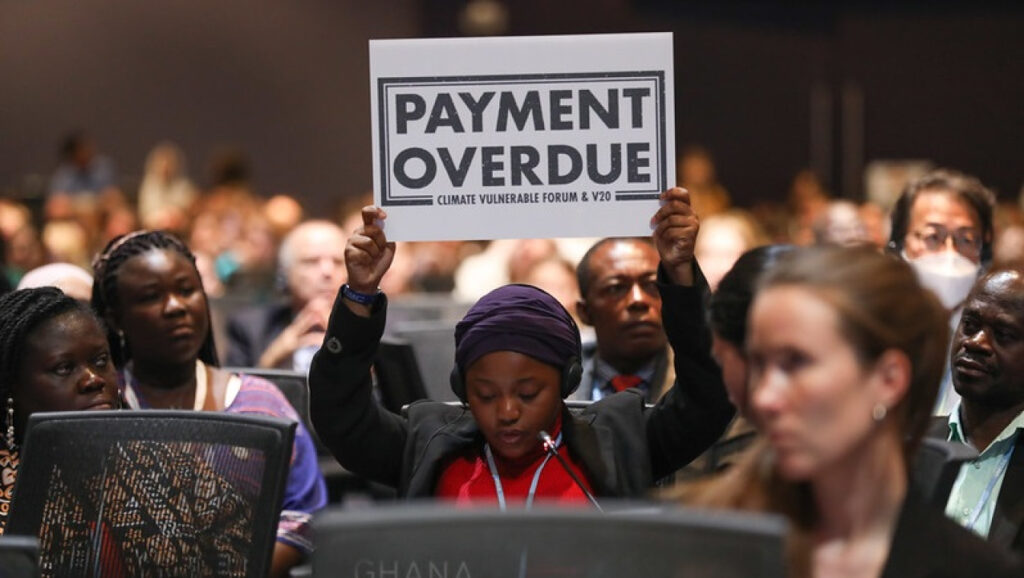

On prime of this, mounting native weather impacts are hitting the poorest and most prone communities world vast. The cruel injustice of the native weather disaster is that folk that did the least to trigger the sector are hit first and worst by its impacts, and accept as true with the least skill to make investments of their resilience.

Unusual finance foundations

We all know what wants to be delivered at Cop29 in Azerbaijan: your total diagram abet in 2015 governments agreed to home a brand recent native weather finance diagram, previous the unusual $100 billion per three hundred and sixty five days target, ahead of 2025.

But there are three foundations governments want to place this three hundred and sixty five days that can if truth be told assemble an ambitious diagram achievable: reforming multilateral pattern banks, addressing debt, and initiating innovative taxation.

Let’s initiate with the oldest of the multilateral pattern banks (MDBs). The World Monetary institution turns 80 this three hundred and sixty five days and is notorious for its overbearing and cumbersome paperwork.

Germany and US warn Brazil in opposition to the exhaust of Amazon Fund to pave rainforest toll road

MDBs were created to get financing to nations on extra favourable terms than the market to make investments in pattern, but accept as true with grown lengthy in the tooth.

The ideas for what wants to trade are all there: fully aligning with the Paris Settlement’s dreams by ending financing for fossil fuels; reforming their blunt eligibility ideas to permit middle-earnings nations to safe entry to more cost effective financing for native weather projects; and raising extra capital by both fashioned—authorities contributions and bond issuances—and unconventional diagram, corresponding to rechanneling IMF Particular Drawing Rights.

Debt debates

On debt, governments accept as true with in the waste recognised the hyperlink between nations’ fiscal set and their skill to undertake native weather motion, and emphasised the importance of low-price financing to take care of this. The pandemic has turbocharged a sovereign debt disaster that turned into already brewing ahead of 2020. The IMF has warned that 60 percent of low-earnings nations and 25 percent of rising markets are in or reach debt injure.

Underlying these nations’ fiscal situations are the fingerprints of native weather trade. Many organising nations face a native weather funding trap: unusual money owed and high curiosity charges assemble it dear to borrow to make investments in native weather mitigation and adaptation.

As a consequence, they are extra prone when disasters hit, meaning elevated recovery costs and a success to credit rankings, making future investments noteworthy dearer.

The United Countries Environment Programme estimates that native weather trade has raised moderate borrowing costs for prone nations by 117 basis facets, equating to an additional $40 billion in curiosity funds over the final decade. International locations want a technique to safe away of the native weather funding trap if the world is to fulfill its native weather dreams.

The hot multilateral course of for facing sovereign debt, the G20 Well-liked Framework, is no longer turning in; as a piecemeal diagram, it is miles neither customary nor a framework. Predominant economies in the G20 want to acknowledge this and invent a brand recent fit-for-reason approach for facing debt.

A promising recent initiative launched at Cop28 turned into the Expert Review on Debt, Nature and Climate. Led by Presidents Macron of France, Petro of Colombia and Ruto of Kenya, the evaluation will bring collectively main experts to independently rely on how sovereign debt can hinder native weather ambition and explore solutions.

Once debt crises are addressed, extra sustainable financing alternatives must serene be made on hand for nations, in every other case they have a tendency to tumble abet into disaster. Providers of native weather finance must serene guarantee that that their finance is structured to most bright address country and project wants.

Too usually it is miles the opposite course round: because of political constraints, contributors accept as true with preferences for debt-organising devices and strive to shape native weather projects to fit these in ways in which is no longer going to raise the greatest advantages for folk or the planet.

Unusual taxes

Lastly, essentially the most controversial phrases in a important election three hundred and sixty five days are going to be unavoidable: recent taxes. We all know that recent authorities contributions to native weather funds accept as true with been a plunge in the ocean till now.

Getting polluters to pay the costs of their actions—corresponding to taxing the fossil gasoline enterprise’s $4 trillion-a-three hundred and sixty five days earnings, a levy on the emissions of the shipping enterprise, and surcharges on enterprise and first-class flights—supply noteworthy extra equitable ways of raising revenues to finance the response to native weather trade.

Antigua and Barbuda, Barbados, France, Kenya and Spain accept as true with already near collectively to home up a Taskforce on International Taxation that will gaze into these and other measures and agree on declare proposals for raising extra native weather finance by Cop30.

Development on all of these fronts is foremost to place the groundwork for a a hit finance final consequence at Cop29. We accept as true with now to be taught from history: atmosphere native weather finance dreams with out the revenues and systems to raise on them is a recipe for disappointment. This time must serene be diverse.