What Will Happen If Bitcoin Set Reaches $1 Million

In a newest, tantalizing observation, Samson Mow, the CEO of JAN3, boldly predicted a meteoric upward thrust in Bitcoin’s value to $1 million, suggesting this might maybe happen “in days to weeks.” This forecast, while startling, is rarely any longer baseless. Mow elaborated that Bitcoin in most cases defies expectations and causes disruption, especially when

In a newest, tantalizing observation, Samson Mow, the CEO of JAN3, boldly predicted a meteoric upward thrust in Bitcoin’s value to $1 million, suggesting this might maybe happen “in days to weeks.”

This forecast, while startling, is rarely any longer baseless. Mow elaborated that Bitcoin in most cases defies expectations and causes disruption, especially when it’s least expected.

Bitcoin Set Prediction: $1 Million

On the core of Mow’s argument is the thought that of “max anxiousness” for the majority. Bitcoin’s unpredictable nature, as Mow famed, is its hallmark. This unpredictability might maybe well consequence in a mercurial magnify in Bitcoin’s impressdisrupting no longer factual individual plans however entire economic techniques.

As an instance, JAN3, below Mow’s management, has been planning to onboard nation-states into the Bitcoin ecosystem. Right here is a course of that will well be severely impacted by such an abrupt impress hike.

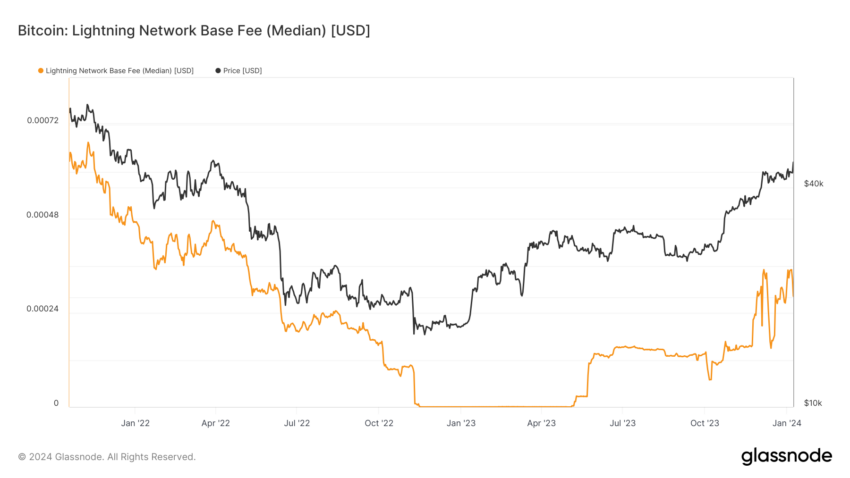

Mow additionally talked about the Belief B’s Stock-to-Circulate (S2F) mannequina typical technique for predicting Bitcoin’s impress, which can maybe smash below such cases. Additionally, the Lightning Communitydesigned to enable more affordable and faster Bitcoin transactions, might maybe well change into impractical if Bitcoin’s impress soared to $1 million.

The assumption of “low-impress” transaction charges would now no longer defend, rendering newest lightning channels doubtlessly ineffective.

“The basic effort with Lightning is that it became once designed to gain interaction with the first chain below the belief that charges might maybe well be ‘low-impress’ ish (doubtlessly with bigger blocks down the aspect road). But it breaks down when charges are no longer low-impress… And the effort is that charges are no longer going to salvage more affordable. Bitcoin transaction charges are easiest going to salvage more immense both in BTC and dollar terms,” Mow explained.

Some of the placing impacts of a unexpected impress magnify to $1 million might maybe well be on entities cherish MicroStrategy and countries cherish El Salvador.

MicroStrategy, led by Michael Saylor, would gain their plan of proudly owning 1% of the Bitcoin provide elusive. Right here is despite the company’s wide funding. Within the period in-between, El Salvador, which has taken main steps to undertake Bitcoin, would miss another option to effort Bitcoin bonds and originate their reserves at lower costs.

BTC Skeptics Would Be in Max Wretchedness

Mow humorously famed that this scenario might maybe well consequence in job losses for prominent economists and central bankers cherish Christine Lagarde and Jerome Powell, because the monetary world shifts without be conscious to accommodate Bitcoin. This hyperbitcoinization would approach with its section of challenges, forcing the legacy monetary arrangement to reorganize around Bitcoin without be conscious.

Curiously, Mow additionally talked about the psychological impact on gold advocates cherish Peter Schiff, who gain long adverse Bitcoin. A swift upward thrust to $1 million might maybe well be a powerful pill to swallow for them, especially with gold costs stagnating.

“Lagarde, Powell, and heaps very stylish economists lose their jobs… [And] Peter Schiff and goldbugs endure a collective psychological breakdown after Bitcoin goes to $1 million rapidly,” Mow added.

In a broader context, Mow’s prediction hinted at a uncared for alternative for the worldwide population. The mercurial ascent to $1 million would imply most folks uncared for their chance to make investments in Bitcoin. Instead, incomes Bitcoin thru work might maybe well be the most efficient viable option left for heaps of.

Read more: Who Owns the Most Bitcoin in 2024?

Mow concluded by emphasizing that the chance of Bitcoin making an unexpected transfer that ends in “max anxiousness” for the greatest sort of folks is excessive. Components cherish space Bitcoin ETF approvals, the upcoming Bitcoin halvingnation-negate adoption, renewed quantitative easing, and the Veblen make are no longer but mirrored in Bitcoin’s impress, in accordance to him.

Whereas Mow’s prediction might maybe well also appear a ways-fetched to just a few, it’s a ways a reminder of Bitcoin’s inherent unpredictability and likely for disruption.

Weak Coinbase CTO Balaji Srinivasan, additionally made headlines in March 2023 alongside with his forecast of an upcoming crisis. He suggested this crisis would role off a deflationary spiral for the US dollar, in the smash culminating in a hyperinflationary ambiance. Such a scenario, Srinivasan projected, would propel the value of Bitcoin to an unparalleled $1 million.

Disclaimer

In adherence to the Trust Mission pointers, BeInCrypto is devoted to fair, clear reporting. This news article goals to give factual, properly timed recordsdata. Then all another time, readers are told to verify information independently and discuss to a real sooner than making any choices in accordance to this issue material. Please show that ourPhrases and Stipulations,Privateness PolicyandDisclaimersgain been up so a ways.