Dump Incoming? Miners Offload BTC To Exchanges

Bitcoin (BTC) miners enjoy begun offloading their BTC holdings to crypto exchanges, signaling a potential reversal of months of upward rate momentum. Per a Sunday put up from SignalQuant – an author for Bitcoin analytics company CryptoQuant – paying attention to non permanent miner behavior would be compulsory for “wise investment.” The Which formulation Of

Bitcoin (BTC) miners enjoy begun offloading their BTC holdings to crypto exchanges, signaling a potential reversal of months of upward rate momentum.

Per a Sunday put up from SignalQuant – an author for Bitcoin analytics company CryptoQuant – paying attention to non permanent miner behavior would be compulsory for “wise investment.”

The Which formulation Of Miner Deposits

Miners are the predominant recipients of all original BTC issued by the Bitcoin network, besides all transaction costs paid by customers. As such, they are the final dictators of whether original coins enter the market’s circulating supply, or dwell dormant.

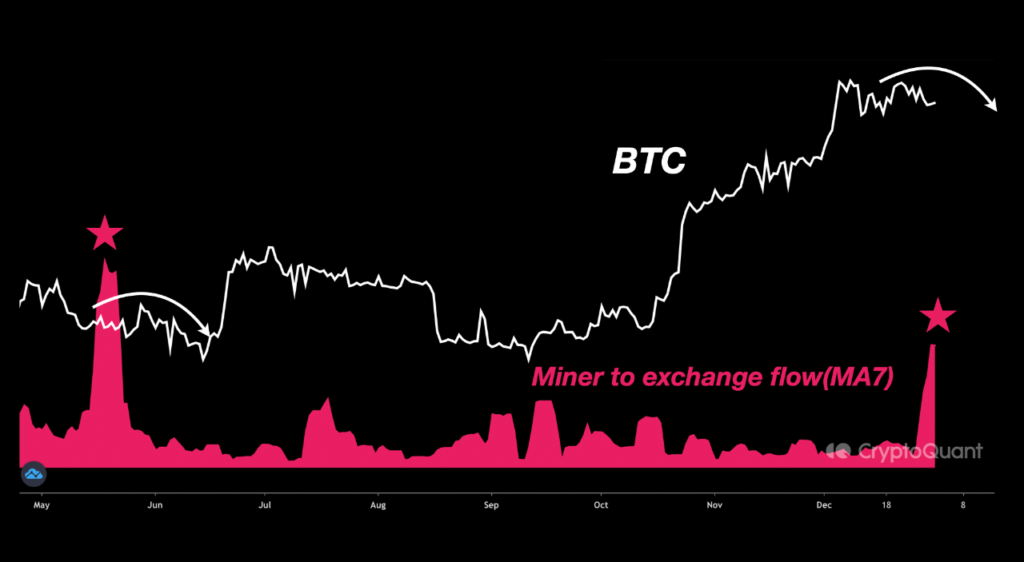

“Miners enjoy historically been one of the basic excellent whales, and when they deposit substantial amounts of BTC to exchanges, the cost experiences fundamental downward stress,” wrote SignalQuant in his analysis.

CryptoQuant voters unanimously voted for miners’ sale of coins as a bearish indicator.

The analyst referenced mid-Could perhaps moreover of 2023 when a surge in miner deposits became adopted by a slow trek in Bitcoin’s rate from tough $27,000 to $25,500 by mid-June. This took residing after a two-month-long Bitcoin rally above $30,000, inspired by a aggregate of U.S. monetary institution screw ups and excitement over Ordinals.

This day, BTC faces a identical subject: having now rallied previous $forty five,000 amid excitement for coming near near Bitcoin space ETF approvals, miners enjoy offloaded an entire bunch of millions of bucks in BTC one day of the final week.

The selloff is the excellent since Could perhaps moreover and displays a identical designate of revenue taking from miners all the intention through a duration of specifically profitable BTC costs.

Likewise, it moreover follows a duration of excessive Ordinals exercise, which has pushed up network transaction costs and given miners an all-original predominant source of revenue. As of January, the arena’s excellent miners are averaging 1.73 BTC per block in costs – a 27% bonus on their favorite 6.25 BTC block subsidy.

Gradual final month, Bitcoin crossed $100 million in cumulative costs.

Is Bitcoin About To Explode?

Opposite to SignalQuant, Matrixport no longer too long ago posited that Bitcoin may perchance well perchance perhaps surge previous $50,000 this month after ETF approvals invite a wave of capital searching out for BTC.

“Institutional traders can not rating the money for to fail to see out on any potential rally all yet again and, attributable to this truth, enjoy to aquire straight when the markets launch for purchasing and selling in 2024,” wrote the crypto platform on Monday. “We search data from an rapid rally that after all yet again catches traders off-guard.”

By the slay of the 365 days, Matrixport has suggested Bitcoin may perchance well perchance perhaps attain $125,000 – powerful fancy Typical Chartered’s $120,000 rate prediction final 365 days.

Binance Free $100 (Contemporary): Narrate this hyperlink to register and receive $100 free and 10% off costs on Binance Futures first month (terms).