What’s the Lightning Network? A Newbie’s Handbook

What’s the Lightning Network? Lightning Network: How it Works Wrapping Up: Why the Lightning Network Issues In case you’ve ever dealt in Bitcoin, you could possibly possibly also goal contain suffered by technique of hour-long (or at worst, day-long) transaction cases. It’s changing into celebrated for Bitcoin to contain backlogs of 150k+ unconfirmed transactions at

- What’s the Lightning Network?

- Lightning Network: How it Works

- Wrapping Up: Why the Lightning Network Issues

In case you’ve ever dealt in Bitcoin, you could possibly possibly also goal contain suffered by technique of hour-long (or at worst, day-long) transaction cases. It’s changing into celebrated for Bitcoin to contain backlogs of 150k+ unconfirmed transactions at cases of high transaction quantity, and when we couple this with its exorbitant charges, it’s a shock how you’re ever gonna spend it to pay for that 5 portion meal at KFC.

The lightning community is here to wait on with that. This notion is the brainchild of Thaddeus Dryja and Joseph Poon, and the duo offered it with a whitepaperattend in 2015. In case you’re no longer too aroused about studying the prolonged paper chock-rotund of tech jargon, we’re gonna lay it out for you in layman’s terms here.

On its most classic level, the lightning community is a potential for Bitcoin customers to switch currency rate off the Bitcoin blockchain. Right here is accomplished utilizing about a complex algorithms that work at the side of Bitcoin’s sinister script, and it permits for, that’s appropriate, lightning rapid payments at a allotment of the transaction charges. As such, it’s been offered as a crucial scalability machine, individual that Bitcoin will need if it desires to be a viable rate chance in the end. This be aware can lengthen to sinister-chain atomic swaps. These swaps are the an identical in be aware, excluding that they occur between two a quantity of currencies/blockchains. We race over atomic swaps in extra detail here.

Now that we’ve covered the extra special-too-easy explanation, it’s time for a lengthier one.

Lightning Network: How it Works

Opening a Bilateral Payment Channel

To get started utilizing the lightning community, you’d are seeking to living up a rate channel. Payment channels are the transaction avenues all the absolute top design by technique of which the lightning community transfers rate. To construct one, you’ve to delivery a transaction for this channel straight on the blockchain.

“But I believed you acknowledged all of this takes effect off-chain?” Don’t alarm–it gentle does, however you first must always let the Bitcoin community know that you just’re opening a transaction. If you’ve carried out this, you and the opposite party you’re transacting with will effect your bear balance sheet of the exchanges you accomplish on the channel. Transactions and as much as this point myth balances will be recorded on this ledger every time funds are moved, and after you’ve conducted your enterprise on the channel, you’ll broadcast the final consequence to the blockchain to close the myth.

Multi-signature Wallets

“So if rate channels occur off-chain, where/how are the funds managed till they’re recorded onto the blockchain?” What a correct-taking a look request. In stutter to spend a rate channel, both events must always ship their funds to a multi-signature wallet handle.

Let’s sigh Molly and Steve contain positioned bets on the final consequence of the Huge Bowl. They every wager 1 BTC and are seeking to make certain that the opposite holds his/her finish of the low cost, so they deposit both of their funds into a multi-signature wallet. This wallet capabilities admire a obtain for deposits, whereas a living of non-public keys for the transactions capabilities admire combinations that allow either party to get entry to the funds. The funds will remain locked within the wallet till:

- both Molly and Steve signal a finalizing transaction with these non-public keys,

- one party decides to finalize the transaction themselves, or

- a cut-off date is reached and the transaction is robotically submitted. Once this happens, the funds will be moved attend to either party’s individual wallets.

In stutter to efficiently living up the multi-signature wallet, both Molly and Steve accomplish a rate (truly, a secret key to free up transactions) which they then spend to carry out a hash and ship to every other. Help onto this files–it’s crucial to working out how commitment transactions work later.

Once Molly and Steve deposit their respective funds into the multi-signature wallet, they’ll then accomplish what’s known as an delivery transaction and broadcast it to the blockchain. Once that is broadcasted, a chain of commitment transactions are then former to effect a watch on funds.

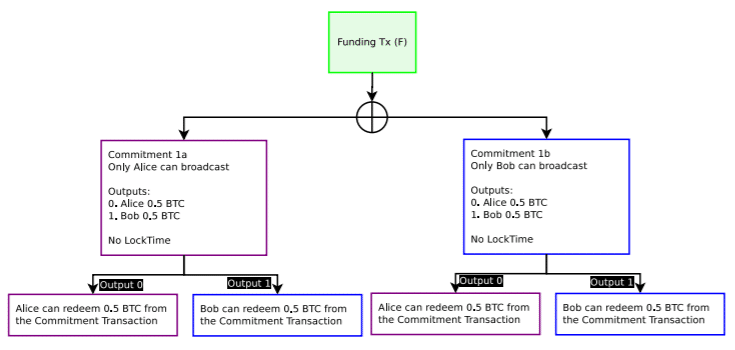

Transferring Imprint with Commitment Transactions

Appears, Molly won the bet, however she’s good, so she says Steve only owes her 0.5 BTC in desire to 1. To delivery a transfer of this wealth, both Molly and Steve would update their respective balances within the rate channel by signing a commitment transaction. Commitment transactions divide funds between both contributors per their mutual agreement–in essence, these transactions act admire IOUs that will be paid out as soon as the rate channel is closed.

As an instance, in stutter to switch values, Molly signs a transaction that sends 1.5 BTC to herself and .5 to a brand original multi-signature wallet handle. Then, she signs this transaction and sends its hash to Steve. In flip, Steve signs a commitment transaction to contain Molly’s, wherein he sends .5 BTC to himself and 1.5 to 1 other multi-signature wallet. He then signs this and sends this transaction’s hash over to Molly.

So, we’ve received a) the distinctive 2 BTC sitting within the rate channel’s multi-signature wallet, b) .5 BTC sitting in a multi-signature wallet that’s payable to Steve, and c) 1.5 BTC sitting in a multi-signature wallet that’s payable to Molly. Successfully, as soon as either party sends their respective transaction hashes, the balance sheet within the rate channel’s multi-signature would update as both events contain agreed to the transfer. Viola, the currencies had been exchanged with out utilizing Bitcoin’s blockchain.

The values from these wallets will also be unlocked only underneath three conditions:

- a obvious quantity of time expires,

- either party unlocks the funds from the multi-signature wallets they living up with the wallet’s rate (key), or

- both events resolve to signal off on the transaction collectively.

It’s crucial to display veil that, if one party decides to close the channel and signal off on a transaction by myself, s/he’ll must always wait on a pre-obvious interval of time (dictated by the contract) from the time that the transaction is signed to receive his/her funds. This could possibly also goal seem indecent, however it’s imperative to forestall dishonest by technique of rate channels–extra on this in a minute.

Habitual Payments/Updating the Channel

What if Molly and Steve are seeking to effect updating the channel or accomplish higher than one switch?

To illustrate this extra, sigh Steve used to be paying Molly for a recurring provider, admire a haircut. Steve deposits 0.2 BTC into their multi-signature wallet, and each time he gets his locks trimmed, he signs a commitment transaction to Molly for 0.001 BTC and sends it to the original multi-signature handle. To carry out this, he’d must always repeat the steps we appropriate went over, sans opening a transaction on the community as that’s accomplished by the time the first commitment transaction is signed.

So, to route of recurring payments, myth balances within the multi-sig must always be as much as this point every time. To carry out this, every time Steve gets his haircut, he’d commit a brand original quantity of money to the multi-signature wallet that he living as much as pay Molly. But in doing so, he creates a brand original rate and a brand original hash for this original transaction. Molly does the an identical, and when both events switch the original hashes, they furthermore consist of the earlier values (keys) for the old transaction.

In stop, this ensures that neither party can cheat the opposite. If upon closing the rate channel Steve tries to cheat Molly out of her payments by broadcasting an former transaction quantity, he’s in concern.

To illustrate, if when he closes the channel Steve owes Molly 1 BTC out of the distinctive 2 BTC he deposited, however he signs the distinctive transaction to offer himself the distinctive quantity, Molly can name him on it because she has the values from all prior transactions. What’s extra, Steve has to wait on before his transaction clears in accordance to the timeframe both events agreed on before conducting enterprise, whereas Molly’s is on the spot. Thus, if she sees that she’s been paid 0 BTC for her products and services, she will be able to signal off on the two BTC within the multi-signature wallet because she has the important thing for this transaction, and thus, the flexibility to free up its funds.

Thus, if one party makes an try to defraud one other, the counterparty is awarded the total malicious party’s funds. This penalty is in effect to discourage terrible actors from abusing the rate channel’s shared fund allocation.

Additionally, node operators and miners who space this corrupt play can act on Molly’s behalf if she’s no longer online to behold the dishonest. In compensation, these guardian angels are awarded a bounty (rate) within the transacted currency for his or her products and services.

Closing a Payment Channel

When Molly and Steve are ready to close out their accounts, they simply signal a transaction with their non-public keys to broadcast their final myth balances to the blockchain. At this point, miners will examine it per celebrated and store it on the public ledger. As with an opening transaction, this closing transaction is the absolute top interplay that either party will contain with Bitcoin’s blockchain.

Alternatively, two events could possibly furthermore living an expiration date for the size of the contract. As an instance, utilizing the nLockTime algorithm, they’d possibly delivery a rate channel for 30 days, after which time, the channel will close and the final balances will be broadcasted to the blockchain. On every occasion the events are seeking to update their balances, on the other hand, the expiration date is diminished. So, if Molly and Steve had been placing bets on extra than one soccer video games all the absolute top design by technique of a season, every time a wager used to be paid, the nLockTime contract would contain a brand original, shortened expiration date (e.g., if the first commitment transaction could possibly be finalized in 30 days, the 2nd transaction would pay out in 29, then the third would pay out in 28, and so forth).

The cause of nLockTime contracts is modest: it keeps myth balances as much as this point and prevents one party from falsifying an myth assertion. Indulge in we went over earlier, every time a commitment transaction is agreed upon, the earlier myth balance is changed with a unusual one, and each eager party has files of this original balance apart from an former transactions rate (key). If any party makes an try to defraud the opposite, the fraudulent party will be penalized.

Multichannel Payments and Hash Time Locked Contracts

“What if Molly and Steve are seeking to ship Bitcoin to every other however they don’t contain a rate channel delivery?” Successfully, they’ll battle by technique of an middleman. We’ll name this guy Chuck–stutter Chuck hello.

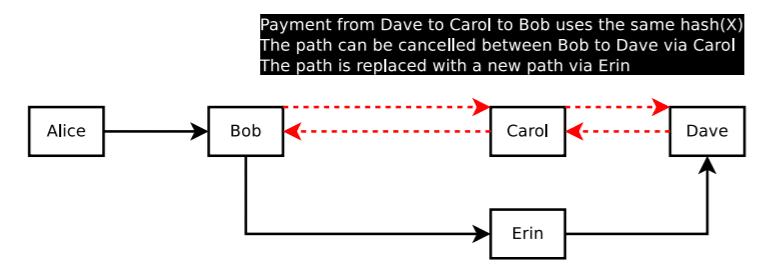

Appears, Molly and Steve both contain rate channels delivery with Chuck, so in desire to opening up a brand original channel, they resolve to us their respective bidirectional rate channels to trade by technique of Chuck.

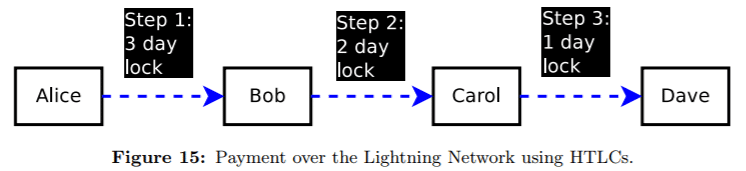

Now, that is theoretically a relied on trade, so the trick is facilitating the switch in a obtain design. To carry out this, the Lightning Network implements Hash Time Locked Contract s (HTLCs).

Yell Molly desires to offer 0.5 BTC to Steve because she’s appropriate truly good admire that–severely, what a peach. In stutter to carry out so, Steve must always accomplish a string of cryptographic numbers known as a rate (truly a confirmation code or key). He then creates a hash of this rate to ship to Molly. To simplify this written illustration, we’ll characterize rate with V and hash with H.

When Molly receives H, she shares it with Chuck. At this point, Molly will only ship Chuck the 0.5 BTC if he finds V. To get V, Chuck sends 0.5 of his bear BTC to Steve in switch for V. Once he has this quantity, he sends V to Molly who then sends 0.5 BTC to Chuck. And there you’ve it–Molly effectively transferred 0.5 BTC to Steve.

In case you received misplaced, here’s how it went down:

Steve creates V and H→ Steve sends H to Molly→ Molly sends H to Chuck→ Chuck sends BTC to Steve→ Steve sends V to Chuck→ Chuck sends V to Molly→ Molly sends BTC to Chuck

Thus, the rate (V) serves as a confirmation code/key for the hash (H), which represents a receipt/lock for the transaction.

“That’s all aesthetic and dandy, however how does Molly know that the rate Chuck sends her is legit, and what’s preserving Steve from running away with the BTC Chuck will pay him?”

All as soon as more, correct questions. Real as nLockTime keeps all americans correct in a bidirectional rate channel, Hash Time Locked Contracts effect events responsible on this mannequin.

With HTLCs, the Bitcoin funds being transacted are locked up as soon as more in a multi-signature wallet and could possibly only be unlocked a) after the rate (V) and hash (H) are offered or b) the contract expires after a timeout interval.

In stop, this design that, when Molly and Chuck race into an agreement for Molly to pay Steve, she locks the Bitcoin she owes Chuck in a multi-signature wallet utilizing the HTLC. Once Chuck will pay Steve and receives V, he can then enter V and H into the HTLC to be reimbursed with the Bitcoin Molly committed to the contract. Alternatively, if Chuck fails to effect up his finish of the low cost and the contract expires after, sigh, per week, then Molly’s Bitcoin is freed up and goes attend into her non-public wallet.

The an identical interplay takes effect on Chuck and Steve’s bear rate channel. Chuck can no longer relinquish his Bitcoin to Steve till Steve finds V. Once Steve finds V into the multi-sig contract, Chuck now has V and Steve receives his BTC.

This route of could possibly, theoretically, be speed by technique of extra than one rate channels and extra than one contributors.

Wrapping Up: Why the Lightning Network Issues

It’s a worldly topic. Synthesizing this files into digestible chunks used to be laborious ample, so cheers to you for sticking with it this long.

For a TL;DR recap: The Lightning Network is an off-chain machine that enables contributors to swap currencies extra than one cases with out having to construct all of these transactions on-chain. In its build, only two transactions (and opening and closing) are recorded on the blockchain, whereas all other transactions, as many as there could possibly be, are processed by technique of a secondary layer of off-chain nodes.

There are about a key advantages to this mannequin:

Effective microtransactions: The Lightning Network is geared against microtransactions. In effect of attending to pay exorbitant charges which will outweigh the rate being transferred, the Lighting Network permits customers to ship microscopic sums of currency to every other with out having to battle by technique of the Bitcoin community straight. They gentle must always pay a rate to node operates, however it’s minuscule when put next to Bitcoin’s celebrated community rate.

Scalability and latency solutions: Going alongside with the prior point, the Lightning Network would lower attend on community bloat. Lowering the replacement of on-chain transactions design less work for miners which, in flip, design faster transaction cases and lower charges. If every transaction doesn’t must always be positioned on the blockchain’s public ledger, the community would speed extra special extra effortlessly. Additional, Lightning Network transactions could possibly be extra special faster than these on-chain.

You’re potentially wondering how any moderate client could possibly be in a location to navigate the multi-step route of we appropriate outlined properly. Successfully, Dryja, Poon, and others are working on purposes/interfaces that determine the total refined steps for you–all you’ve to carry out is press about a buttons.

By no design Omit One more Opportunity! Obtain hand selected news & data from our Crypto Consultants so you could be in a location to accomplish expert, on the spot choices that straight have an effect on your crypto earnings. Subscribe to CoinCentral free newsletter now.

Read More