Fed birth price lower discussions

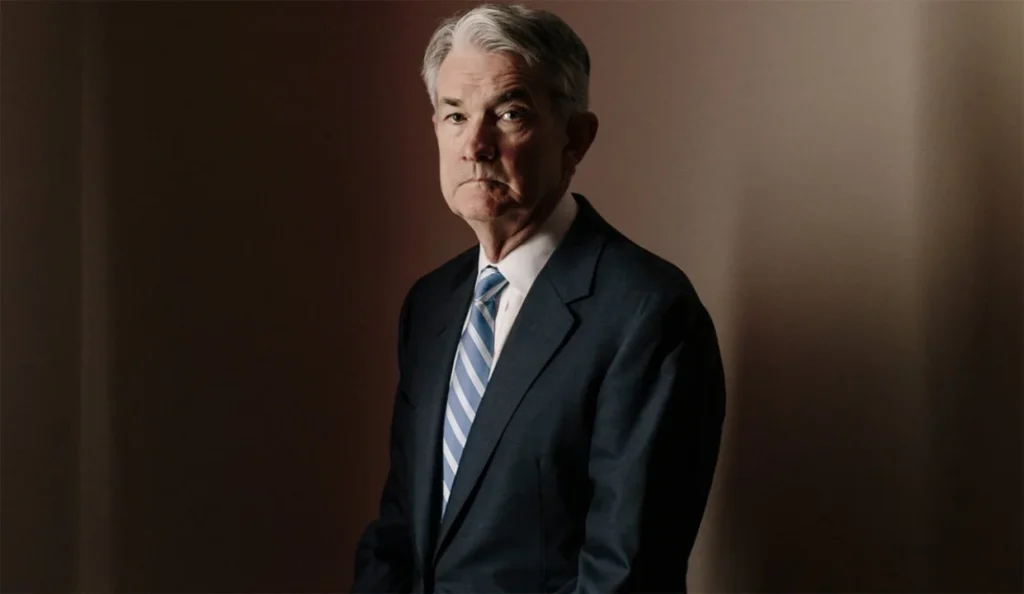

The Federal Reserve is starting discussions about potential curiosity price cuts, but it no doubt is no longer anticipated to appropriate away region the stage for a price low cost. Federal Reserve Chairman Jerome Powell and varied officials have faith no longer signaled any plans to make use of their upcoming meetings to arrange for

The Federal Reserve is starting discussions about potential curiosity price cuts, but it no doubt is no longer anticipated to appropriate away region the stage for a price low cost. Federal Reserve Chairman Jerome Powell and varied officials have faith no longer signaled any plans to make use of their upcoming meetings to arrange for a price lower. San Francisco Fed President Mary Daly has mentioned that it’s a long way ‘untimely’ to have faith in thoughts curiosity price cuts, emphasizing the necessity for extra proof that inflation is consistently tantalizing assist in opposition to the 2% aim.

- Morgan Stanley’s chief US economist, Ellen Zentner, expects the main price lower to occur in June, suggesting that the Fed can have faith sufficient money to be patient. This sentiment is supported by the reality that the Fed is no longer going to be cutting back rates to counteract a recession but rather to adjust protection based mostly fully on a critical fall in inflation.

- Fed Governor Christopher Waller has indicated that with economic activity and labor markets in accurate form and inflation declining progressively, there might possibly be no want to pass as swiftly or lower as impulsively as in the previous.

- This explore is reinforced by stronger-than-anticipated retail gross sales recordsdata from December, which has led merchants to appear a no longer up to even chance of a price lower going on soon.

- Atlanta Fed President Raphael Bostic has expressed a desire to connect a long way flung from hastily protection changes, suggesting that the central monetary institution might possibly possibly perchance perchance merely extend a price low cost except May possibly. Alternatively, once the Fed decides to lower rates, it might possibly possibly perchance perchance pass swiftly based mostly fully on economist Claudia Sahm, a former Fed staffer.

- Federal Reserve Bank of Chicago President Austan Goolsbee has acknowledged that officials will deserve to have faith in thoughts cutting back curiosity rates as inflation falls to connect a long way flung from overly restrictive monetary protection, but he moreover emphasized that decisions will be made on a gathering-by-meeting basis.

- Overall, while the Fed is originate to the muse of price cuts as inflation cools, the central monetary institution is continuing cautiously and is no longer always anticipated to begin price cuts straight away. The timing and straggle of any future price cuts will rely on the trajectory of inflation and economic recordsdata.

What’s the impact of fed price cuts on the economic system?

Fed price cuts can have faith a lot of impacts on the economic system:

- Stimulating economic boost: Decrease curiosity rates can support borrowing and investing, resulting in increased economic activity.

- Impact on stock and bond markets: Hobby rates and the stock market have faith a lovely oblique relationship, with the two tending to pass in reverse instructions. When the Fed cuts curiosity rates, stock prices might possibly possibly perchance perchance rise, but share prices might possibly possibly perchance perchance merely have faith already rallied in expectation of price cuts, potentially limiting any extra will enhance.

- Inflation: Decrease curiosity rates can abet attach inflation-adjusted borrowing prices from rising, as a widespread slowdown in imprint will enhance would elevate inflation-adjusted curiosity rates.

- Recessions: Decrease curiosity rates can make a contribution to the end of recessions by making borrowing money more cost effective, that might possibly possibly perchance perchance merely entice of us to begin spending over again.

- Particular person spending: Decrease curiosity rates can lead to increased particular person spending, as borrowing turns into more cost effective.

- Trade growth: Decrease curiosity rates can abet protect trade growth, as borrowing prices are diminished.

Alternatively, there are moreover potential dangers linked to lower curiosity rates, equivalent to a decline in US savings rates, which might possibly possibly perchance perchance be cease to their top doubtless ranges this century3. Furthermore, the Fed’s decision to lower curiosity rates might possibly possibly perchance perchance be considered as a signal that the economic system is headed for a recession, but this might possibly possibly perchance merely no longer continuously be the case