The Simplest Shares to Invest $50,000 in Accurate Now

To bake a pie, you would prefer determined ingredients, along with a filling, a crust, sugar, and spices. The usage of a recipe and some kitchen expertise, anybody can turn apple, flour, sugar, and cinnamon into something different: an apple pie. Investing works the the same come. Any gargantuan portfolio accommodates determined very crucial ingredients

To bake a pie, you would prefer determined ingredients, along with a filling, a crust, sugar, and spices. The usage of a recipe and some kitchen expertise, anybody can turn apple, flour, sugar, and cinnamon into something different: an apple pie.

Investing works the the same come. Any gargantuan portfolio accommodates determined very crucial ingredients, which, when blended, build the portfolio bigger than perfect the sum of its ingredients. They complement one one more, turning person shares into a different portfolio that can assemble wealth for a lifetime.

With that in mind, we might per chance maybe presumably notify how to gain a hypothetical $50,000 portfolio the employ of perfect three shares.

Picture supply: Getty Shots.

1. Visa

Let’s starting up with the “pie crust” — a gargantuan, staunch stock with a easy enterprise mannequin and a long observe myth of success: Visa (NYSE:V).

This payments-processing company is a broad with a market cap of $543 billion, making Visa The USA’s Tenth-biggest company. Truly, Visa is the world’s biggest fintech company — bigger even than the world’s biggest bank, JPMorgan Dash.

Visa’s gargantuan size is thanks to its monumental rate community. The corporate processes an unprecedented option of rate transactions on its sprawling community. Within the fourth quarter on my own (the three months ending on Sept. 30, 2023), Visa reported $3.2 trillion in rate transactions on its community. To construct that one more come, that’s a little bit of bigger than the annual injurious home manufactured from France — in perfect three months.

Obviously, Visa would not myth wherever approach that decide when it involves revenue or profit — these are perfect payments that it processes from one celebration to one more. The corporate does, nonetheless, apply a rate to those transactions, which is how it generated practically all of its $8.6 billion in revenue in its final quarter.

Furthermore, every transactions and revenue are rising year over year. Transactions jumped by 9%, while revenue elevated by 11%.

And due to Visa’s asset-light enterprise mannequin, important of its revenue is converted into profit. The corporate reported $4.7 billion in gain earnings, and its profit margin stands at a hefty fifty three%.

To sum up, a portfolio with Visa in it might per chance maybe per chance per chance salvage stable enhance and profit. That’s an attractive come to gain started.

2. Palantir Technologies

Subsequent, our hypothetical pie/portfolio desires some sugar and spice. And, on the moment, there’s nothing sweeter or spicier than man made intelligence (AI). That’s why I’m going with Palantir Technologies (NYSE: PLTR).

The corporate is a pacesetter in the discipline of gigantic recordsdata analytics. Which blueprint Palantir helps organizations gain a grip on their own recordsdata.

This might per chance maybe presumably well also seem easy — even silly — but it’s miles a exact danger for many gargantuan organizations that are awash in recordsdata. Many organizations kind more recordsdata — from workers, customers, and suppliers — than they are able to process or indubitably realize. Palantir helps these organizations by the employ of its AI-basically based recordsdata analytics instruments to explore patterns and supply ideas to its customers.

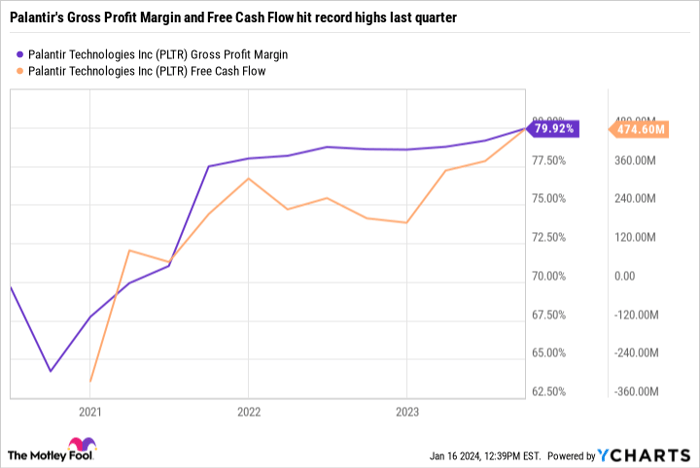

Financially, Palantir is thriving as the marketplace for big recordsdata analytics takes off. In its most most modern quarter (the three months ending on Sept. 30, 2023), the corporate reported $558 million in revenue — up 17% from a year earlier. Atrocious profit margin elevated to a myth excessive of 81%, and 12-month free money float additionally hit a myth excessive of $475 million.

PLTR Atrocious Revenue Margin recordsdata by YCharts

Granted, Palantir just isn’t any longer a stock for every portfolio. Its excessive valuation (shares trade at a forward designate-to-earnings more than one of 57x) will rule it out for designate-hunting for investors.

On the opposite hand, for these having a see to add a spirited dose of AI-pushed gigantic recordsdata analytics to their portfolio, Palantir is a stock rate occupied with.

3. Microsoft

At final, let’s talk about the “pie filling”: the merchandise that provides all the portfolio its personality. For me, this option is easy: It is Microsoft (NASDAQ: MSFT).

That’s for the rationale that company has four issues that build it a amazing funding:

- A gargantuan enterprise mannequin

- Unbelievable administration

- Financial tailwinds

- Incredible fundamentals

As for its enterprise mannequin, Microsoft is more bask in three or four companies in a single. It has a booming cloud products and providers segment, one of the important world’s biggest gaming companies, and an iconic system division.

It is led by Satya Nadella, who for my share is with out doubt one of the important world’s top five CEOs. At some stage in his nearly 10-year tenure on the helm, Microsoft stock has elevated by bigger than 1,200%.

MSFT Total Return Degree recordsdata by YCharts

The corporate is a pacesetter in system innovation, along with AI pattern. What’s more, it has an especially shut partnership with OpenAI, the corporate in the support of ChatGPT.

At final, its fundamentals are excellent. Over the final twelve months, the corporate generated $218 billion in revenue and $77 billion in gain earnings.

In summary, Microsoft makes a amazing cornerstone to perfect about any stock portfolio.

Where to invest $1,000 upright now

When our analyst personnel has a stock tip, it pays to listen. In any case, the publication they’ve bustle for twenty years, Motley Idiot Stock Marketing consultanthas bigger than tripled the market.*

They perfect revealed what they have are the ten biggest shares for investors to amass upright now… and Microsoft made the checklist — but there are 9 other shares you’re going to be overlooking.

*Stock Marketing consultant returns as of January 8, 2024

JPMorgan Dash is an advertising partner of The Ascent, a Motley Idiot company. Jake Lerch has positions in Visa. The Motley Idiot has positions in and recommends JPMorgan Dash, Microsoft, Palantir Technologies, and Visa. The Motley Idiot has a disclosure protection.

The views and opinions expressed herein are the views and opinions of the author and build no longer necessarily reflect these of Nasdaq, Inc.