STR Commentary on U.S. Performance for November 2023

STR Commentary on U.S. Performance for November 2023 STR Commentary on U.S. Performance for November 2023 STR Commentary on U.S. Performance for November 2023 STR Commentary on U.S. Performance for November 2023 STR Commentary on U.S. Performance for November 2023 STR Commentary on U.S. Performance for November 2023 Prime-Line Metrics (share alternate from November 2022):

-

STR Commentary on U.S. Performance for November 2023

-

STR Commentary on U.S. Performance for November 2023

-

STR Commentary on U.S. Performance for November 2023

-

STR Commentary on U.S. Performance for November 2023

-

STR Commentary on U.S. Performance for November 2023

-

STR Commentary on U.S. Performance for November 2023

Prime-Line Metrics (share alternate from November 2022):

- Occupancy: 58.4% (-1.2%)

- Moderate on daily basis payment (ADR): US$151.23 (+3.6%)

- Income per accessible room (RevPAR): US$88.36 (+2.4%)

Key sides

- RevPAR grew as solid ADR reveal offset an occupancy decline.

- With an additional steal from Las Vegas, national ADR reveal surpassed CPI for the main month since May perchance additionally merely 2023

- Higher Upscale and Upscale chains lead in twelve months-to-date efficiency reveal.

- Team and transient assign a query to grew on the the same payment.

- Unique Year’s Eve bookings within the Prime 25 Markets are suitable panicked of 2022 stages. Q1 bookings are forward of hump.

Year-over-twelve months reveal in RevPAR doubled to 2.4% when compared to the 1.2% make considered for October. The calendar turned into dapper with equal numbers of weekdays and weekends, unlike the earlier month when the calendar negatively impacted efficiency.

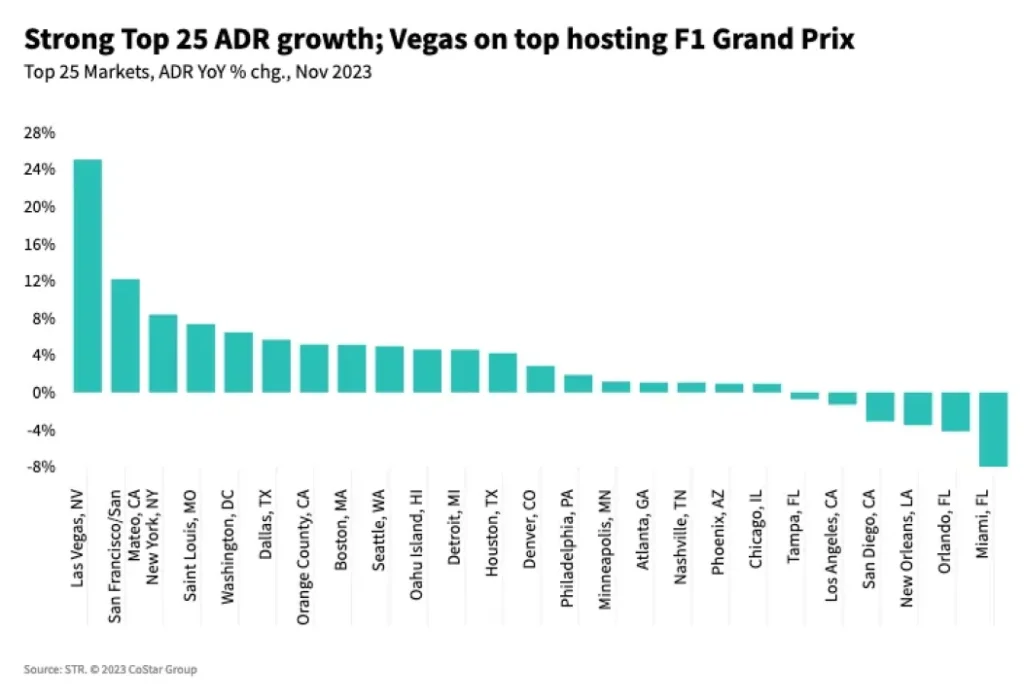

ADR reveal (+3.6%) continued to pressure the stop-line with the measure matching the extent considered in September. Additionally, ADR surpassed CPI for the main time since May perchance additionally merely. That solid reveal turned into lifted by Las Vegas, which hosted the F1 Enormous Prix. Excluding Las Vegas, U.S. ADR would luxuriate in increased 2.5%. The contribution from Las Vegas turned into its largest since the starting up of the twelve months.

As has been the case since April, occupancy continued to decline attributable to lower shoulder-day and weekend stages. Weekday occupancy turned into actually flat twelve months over twelve months, supporting our projections of strengthening industry and neighborhood shuffle. Whereas no longer up to the decrease considered in October (-1.2 share sides), the decline in November occupancy (-0.7ppts) remained worse than what turned into considered from May perchance additionally merely by September. The bulk of the decrease got right here from Economy class inns, the assign occupancy lowered 2.5ppts for the month.

November neighborhood assign a query to among Luxury and Higher Upscale inns slowed versus October’s solid showing. Recall, October neighborhood assign a query to turned into the last observe of the previous 60 months. Whereas lower than that level, November neighborhood assign a query to exceeded final twelve months’s similar with weekdays having the last observe affect, as has been the case since April. Team assign a query to turned into below 2019 nonetheless no longer by a lot.

Year-to-date RevPAR reveal got right here down from +5.5% in October to +5.3%. The downward pattern is according to STR’s November forecast update, which has stout-twelve months RevPAR reveal of +4.8%. Irrespective of the united statesand downs of the twelve months, hoteliers’ sentiment for 2024 continued to be sure with occupancy and ADR, to a better extent, anticipated to reinforce within the modern twelve months. STR’s forecast displays optimism as 2024 RevPAR is predicted to elevate 4.1%, driven once more by ADR.

Chain Scales

The head three chain scales (Luxury by Upscale) luxuriate in considered assign a query to reveal in every month of 2023. As when compared to 2019, Luxury assign a query to has been increased in every month this twelve months, other than August. Whereas for Upscale, assign a query to has exceeded 2019 in on the subject of every month since early-2022. The same is appropriate for Higher Midscale.

With barely low supply reveal, the stop three chain scales luxuriate in additionally reported occupancy reveal in most months of this twelve months, together with November. The lower-tier chain scales, Midscale and Economy, luxuriate in continued to post declining assign a query to and occupancy.

November RevPAR share adjustments ranged from +4.3% in Higher Upscale to -5.5% in Economy. For many chain scales, YTD RevPAR reveal is solid attributable to beneficial properties posted in Q1 against easy Omicron comparisons. From April to November, RevPAR alternate has ranged from +4.7% in Upscale to -4.3% in Economy. Higher Upscale has additionally considered RevPAR reveal (+4.5%) at some stage in that duration with Higher Midscale at +2.2%.

Segmentation

Reflecting seasonality, Luxury and Higher Upscale inns noticed neighborhood assign a query to reveal softened from the earlier month whereas transient assign a query to accelerated. In contrast with 2022, both segments increased at barely the the same payment with weekdays main occupancy beneficial properties. Alternatively, neighborhood assign a query to turned into suitable panicked of 2019 stages whereas transient assign a query to has slowed relative to 2019 stages since August. In November, neighborhood assign a query to turned into 2.2% no longer up to 2019, whereas transient assign a query to turned into 4.1% in arrears. ADR reveal turned into strongest within the neighborhood section with an elevate of 7.2%. Transient ADR reveal turned into 1.4%. Precise (inflation-adjusted) transient ADR has remained better than 2019 for all months of the twelve months, whereas real Team ADR has been above 2019 since September.

Markets

Room assign a query to within the Prime 25 Markets grew whereas falling in all others, devour it has since April. Weekday occupancy turned into up 0.4 ppts within the Prime 25 Markets. The shoulder duration turned into somewhat down (-0.2ppts) whereas November weekends had been flat. Given the assign a query to decline all over the remaining of the markets, its occupancy sample matched the Prime 25 with weekdays showing the smallest decrease (-0.3ppts) with shoulder days (-1.1ppts) and weekends (-1.4ppts) down perchance the most.

ADR reveal within the Prime 25 Markets has increased every month since July, resulting in RevPAR reveal of three% or increased with November posting the last observe elevate since May perchance additionally merely, boosted in piece by the solid finally ends up in Las Vegas. Across the remaining of the nation, ADR reveal has leveled out over the final two months nonetheless remained excessive sufficient to help the RevPAR comparability sure in November (+0.3%).

Pipeline

The assortment of rooms below constructing turned into flat as when compared to October, which noticed a huge month-to-month elevate. Like many of the twelve months, the assortment of rooms below constructing continued to traipse 2022 (-1.1%) with many projects in a conserving sample as witnessed by the twelve months-over-twelve months make in rooms in closing planning rooms (+19%).

Pipeline leaders, Upscale and Higher Midscale, confirmed below constructing rooms come month over month as did on the subject of all chain scales other than Higher Upscale and unaffiliated projects. Taking a see at inns versus rooms, the assortment of properties below constructing increased 3.2% versus final twelve months with the last observe make in Economy (+31%). Whereas the percentage is excessive, the assortment of economic system inns below constructing is barely low (81) versus 433 inns in Higher Midscale and 271 in Upscale.

Total, better than 713,000 rooms (6,000 inns) sit within the pipeline with rooms up 17.1% from final twelve months.

Most up-to-date Weekly Records U.S. RevPAR for the week ending 16 December rose by the last observe share of the earlier three weeks, propelled by the Prime 25 Markets. Team assign a query to particularly increased when compared to the the same duration final twelve months, even at some stage in what’s historically a slower season.

This text before every little thing looked on STR.