$47,600 Or $38,600? What Also can Be Next For Bitcoin

An analyst has pointed out two quiz zones that would perchance perchance be necessary for Bitcoin. Right here’s what would perchance perchance be next for BTC in holding with these present walls. Bitcoin On-Chain Reinforce And Resistance Phases Also can Provide Hints For What’s Next As defined by analyst Ali in a new put up

An analyst has pointed out two quiz zones that would perchance perchance be necessary for Bitcoin. Right here’s what would perchance perchance be next for BTC in holding with these present walls.

Bitcoin On-Chain Reinforce And Resistance Phases Also can Provide Hints For What’s Next

As defined by analyst Ali in a new put up on X, Bitcoin has only in the near past been floating between two predominant present walls of the asset. “Provide wall” refers to the amount of Bitcoin that addresses acquired in any given tag vary.

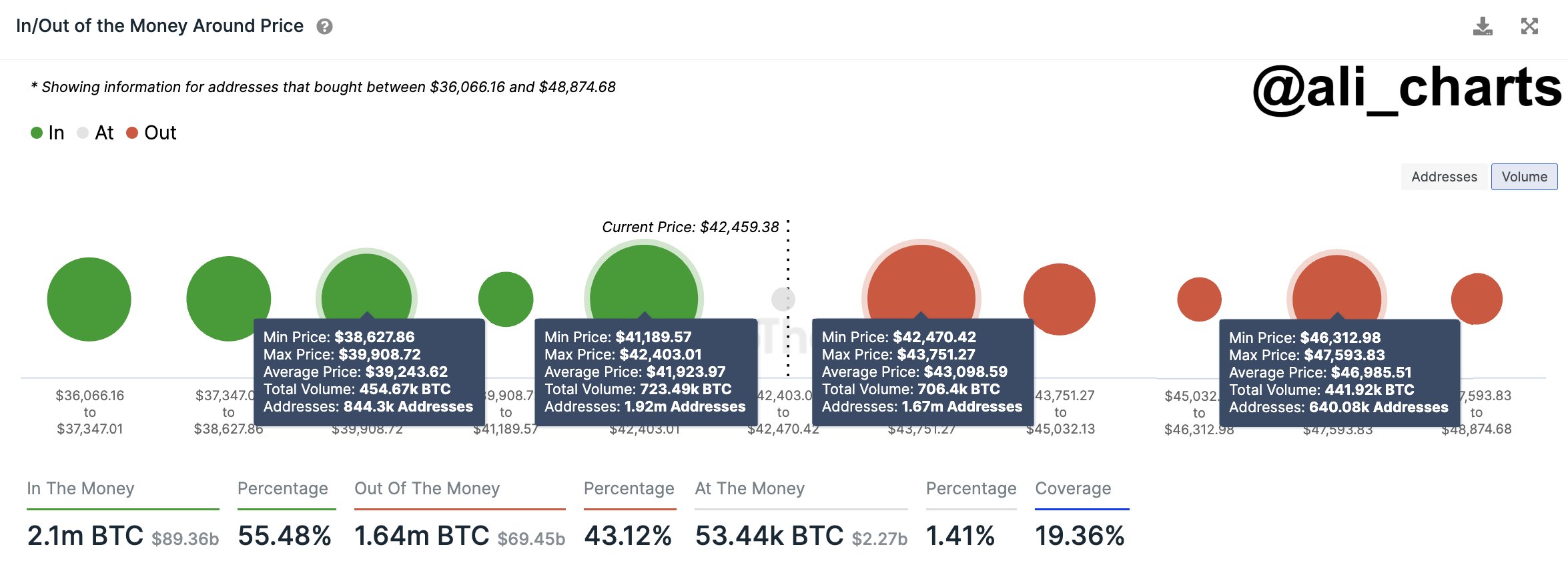

The chart below reveals what the change present walls peek adore for BTC for the ranges around the present dispute tag of the cryptocurrency.

The data for the on-chain support and resistance levels | Source: @ali_charts on X

In the above graph, the scale of the dot represents the desire of cash the merchants bought at some stage in the corresponding vary. It would seem that the $41,200 to $42,400 and $42,400 to $43,700 ranges are notably heavy with present.

To be more explicit, the worn vary noticed 1.92 million addresses buy a total of 723,490 BTC, while the latter witnessed an accumulation of 706,400 BTC from 1.67 million holders.

For any investor, their acquisition tag or tag foundation is a mandatory level, as when the asset’s tag retests, their profit-loss effort can doubtlessly trade. As such, the holders usually tend to illustrate some reaction when such a retest takes dispute.

Naturally, most challenging a few merchants exhibiting a reaction won’t have an effect on the market, nonetheless if many addresses fragment their tag foundation interior a slim vary, the reaction from a retest would perchance discontinue up being sizeable.

On legend of of this motive, predominant present walls (adore the two mentioned most challenging earlier) can discontinue up being necessary retests for Bitcoin. Most incessantly, the asset is more more likely to feel support when this retest occurs from above, while the coin would perchance feel some resistance when it’s from below.

These results appear to appear at on legend of of how investor psychology tends to work; an investor who became as soon as in profit earlier than the retest would perchance must snatch an extra gamble, believing the identical tag vary to be winning again. Such shopping for is the supply of the support.

Similarly, loss holders would perchance per chance be tempted to sell when the tag reaches their destroy-even point, as they’ll no longer must threat holding further because the coin would perchance bolt support down, pulling them underwater again.

Bitcoin has been trading between two predominant present walls for the interval of its recent consolidation. “A sustained shut past these bounds will abet gauge BTC’s pattern,” notes Ali.

The chart reveals that the next astronomical resistance forward is between $46,300 to $47,600, while $38,600 to $39,900 carries the next predominant support below. “A breakout above resistance would perchance propel BTC in direction of $47,600, while a dip below support would perchance lead to a correction the full components down to $38,600,” explains the analyst.

BTC Price

Bitcoin is trading around the $42,700 label because it continues its recent sideways motion.

Looks like the asset's price has been stuck in consolidation during the last few days | Source: BTCUSD on TradingView

Featured image from Shutterstock.com, charts from TradingView.com, IntoTheBlock.com

Disclaimer: The article is outfitted for educational functions most challenging. It does no longer signify the opinions of NewsBTC on whether or to no longer buy, sell or retain any investments and naturally investing carries risks. You are informed to behavior your absorb research earlier than making any investment selections. Exercise files provided on this web page totally at your absorb threat.