Nvidia shares fallafter failing to provoke growth-hungry investors

Nvidia’s most up-to-date quarterly forecast fell short of investor expectations, causing a 6% drop in after-hours trading. Despite real earnings growth and a $50 billion portion buyback, the corporate’s inability to exceed Wall Boulevard’s excessive targets has raised concerns. Investors are now questioning the prolonged-term viability of the generative AI market, leading to broader market

Nvidia’s most up-to-date quarterly forecast fell short of investor expectations, causing a 6% drop in after-hours trading. Despite real earnings growth and a $50 billion portion buyback, the corporate’s inability to exceed Wall Boulevard’s excessive targets has raised concerns. Investors are now questioning the prolonged-term viability of the generative AI market, leading to broader market jitters.

Join your early morning brew of the BizNews Insider to defend you up to flee with the articulate that matters. The newsletter will land on your inbox at 5:30am weekdays. Registerright here.

By Arsheeya Bajwa

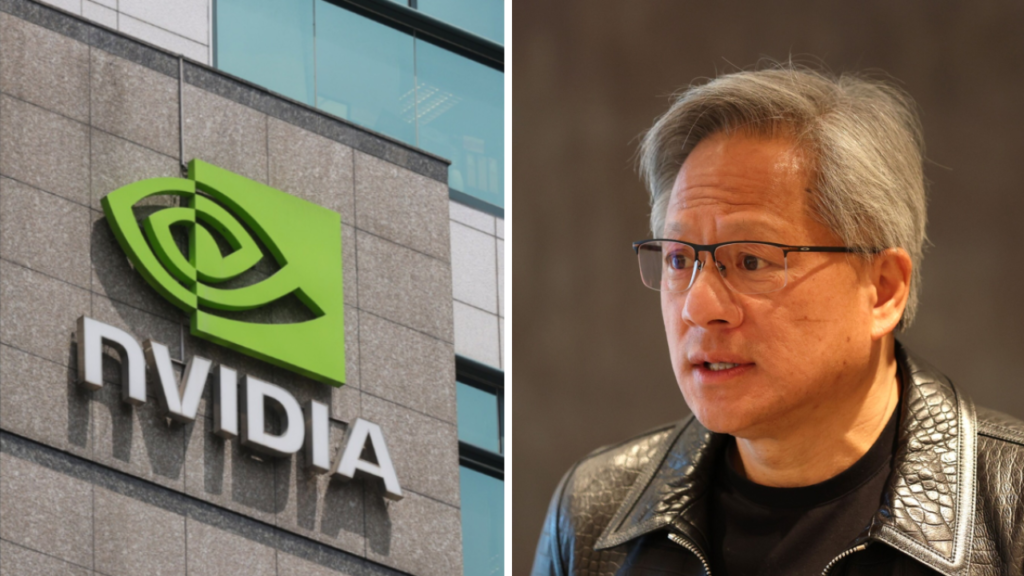

Nvidia’s NVDA.O quarterly forecast on Wednesday didn’t fulfill lofty expectations of investors who comprise driven a dizzying rally in its stock as they guess billions on the long plod of generative artificial intelligence.

Shares of the chipmaker fell 6% in after-hours trading, weighing on shares of other chipmakers. The document has been considered as a day of reckoning for the tech sector and the outcomes had been treated as blended, despite heady growth and earnings.

“Here’s the difficulty,” said Ryan Detrick, chief market strategist on the Carson Community. “The scale of the beat this time became grand smaller than we’ve been seeing.” He added, “Even future steering became raised, but again now not by the tune from earlier quarters. That is a fat company that’s still rising earnings at 122%, but it no doubt looks the bar became staunch build of dwelling a tad too excessive this earnings season.”

The earnings and sad margin forecast for the present quarter weren’t removed from analysts’ expectations and didn’t stay up to a most up-to-date ancient previous of trouncing Wall Boulevard’s targets, overshadowing a beat on second-quarter earnings and adjusted earnings as well to the unveiling of a $50 billion portion buyback.

In the final three consecutive quarters, Nvidia recorded earnings growth of extra than 200%, and the corporate’s ability to surpass estimates is at an increasing number of higher chance as every success prompts Wall Boulevard to steal its targets even greater.

CEO Jensen Huang conducted up insatiable query for the corporate’s extremely efficient graphics processors that comprise change into the workhorses for generative AI expertise comparable to OpenAI’s ChatGPT. “That you just can too comprise extra on extra on extra,” he suggested analysts on a convention call, describing query.

Huang confirmed media experiences that a ramp-up in manufacturing of Nvidia’s next-period Blackwell chips became delayed except the fourth quarter, but downplayed the influence, asserting possibilities had been snapping up present-period Hopper chips.

The corporate said it became birth Blackwell samples to its partners and possibilities after tweaking its make, and that it expected several billion greenbacks in earnings from these chips in the fourth quarter.

Shares in chipmakers including Stepped forward Micro Devices AMD.O and Broadcom AVGO.O every fell virtually 4%. Asian chipmaker SK Hynix 000660.KS fell 4.5% and Samsung 005930.KS became down 2.8% in Thursday morning trading in Asia.

INVESTOR JITTERS

Remarkable hinges on this outlook from Nvidia, whose stock has surged extra than 150% this Three hundred and sixty five days, including $1.82 trillion to its market payment and lifting the S&P 500 .SPX to recent highs. If Wednesday’s after-hours stock losses defend, Nvidia is decided to lose $175 billion in market payment.

The forecast might perhaps perhaps perhaps also stoke recent concerns about tiring payoffs from generative AI investments, which some investors difficulty might perhaps perhaps perhaps also lead tech giants to rethink the billions of bucks they are spending on data products and services. These concerns comprise despatched ripples via the AI rally in most up-to-date weeks.

Nvidia’s top doubtless possibilities – Microsoft MSFT.O, Alphabet GOOGL.O, Amazon AMZN.O and Meta Platforms META.O – are expected to incur extra than $200 billion in capital expenditures in 2024, most of which is supposed for building AI infrastructure.

Shares of these companies dipped now not up to 1% in after-hours trading on Wednesday.

“It’s a reflection of rising investor jitters about the prolonged-term viability of the generative AI market, alongside with your whole market reputedly hinging on Nvidia’s performance,” said eMarketer analyst Jacob Bourne.

Nvidia is additionally facing regulatory scrutiny about its practices.

Be taught additionally: 🔒 FT – Chip challengers strive to interrupt Nvidia’s grip on AI market

The corporate said in its quarterly submitting it has obtained requests for data from regulators in the U.S. and South Korea, relating to “gross sales of GPUs, our efforts to allocate provide, basis models and our investments, partnerships and other agreements with companies developing basis models.” Previously the corporate had neatly-known inquiries handiest from the EU, UK and China.

Reuters reported final month that France’s antitrust regulator became build of dwelling to payment Nvidia on alleged anticompetitive practices. A media document said earlier that U.S. regulators had been probing whether or now not Nvidia became making an strive to bundle its networking equipment with its sought-after AI chips.

Nvidia expects adjusted sad margin of 75%, plus or minus 50 basis facets, in the third quarter. Analysts on moderate forecast sad margin to be 75.5%, per LSEG data. It reported a 75.7% sad margin in the second quarter versus a median estimate of 75.8%.

Its sad margin still tops that of opponents, helped by the steep trace tags connected to its immediate chips. AMD recorded an adjusted margin of Fifty three% in its fiscal second quarter.

Nvidia forecast earnings of $32.5 billion, plus or minus 2%, for the third quarter, when compared with analysts’ moderate estimate of $31.77 billion, per LSEG data.

2nd-quarter earnings became $30.04 billion, beating estimates of $28.70 billion. Apart from for objects, Nvidia earned 68 cents per portion in the second quarter, beating estimates of 64 cents.

Gross sales in Nvidia’s data heart section grew 154% to $26.3 billion in the second quarter ended July 28, above estimates of $25.15 billion. From the considerable quarter, it elevated 16%.

It additionally derives earnings from promoting chips to gaming and auto companies.

Be taught additionally:

- 🔒 FT – Chip challengers strive to interrupt Nvidia’s grip on AI market

- 🔒As Nvidia’s shares wing, portfolio managers face the rising chance of overconcentration

- 🔒 Steve Eisman stays bullish on Nvidia amid market volatility

SOURCE: REUTERS