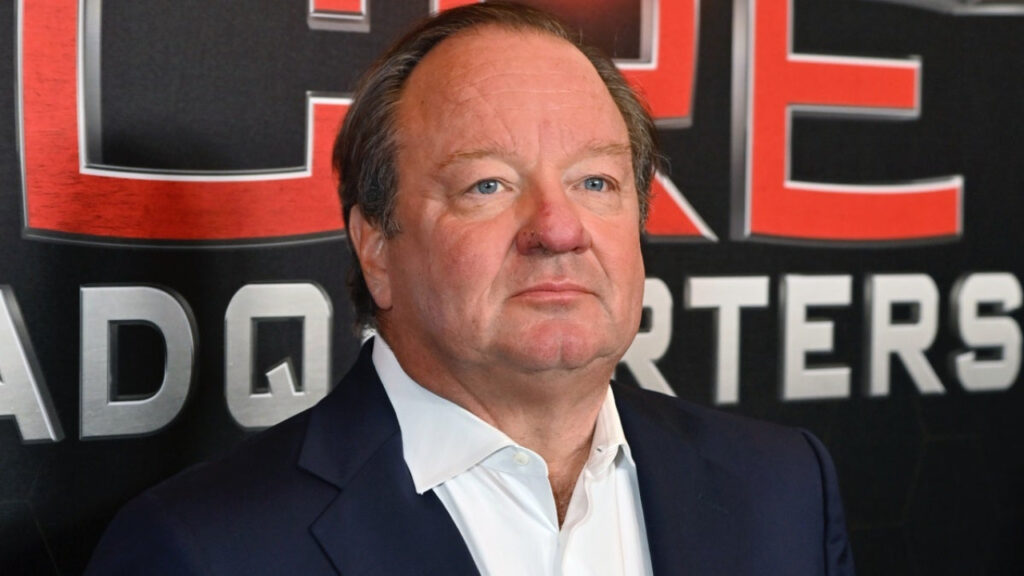

Paramount CEO Bob Bakish Steps Down

Paramount World CEO Bob Bakish has officially stepped down from his goal atop the company, the entertainment giant provided Monday.

Following Bakish’s departure from his goal as CEO and from the board of administrators, three senior executives will take management over Paramount World transferring forward: George Cheeks, CBS CEO and president; Chris McCarthy, Showtime/MTV Entertainment Studios and Paramount Media Networks CEO and president; and Brian Robbins, Paramount Photos and Nickelodeon CEO and president.

“Paramount World comprises distinctive sources and we imagine strongly in the future price creation capacity of the company,” Paramount non-government chair and controlling shareholder Shari Redstone stated in an announcement. “I in point of fact receive sizable self belief in George, Chris and Brian. They’ve every the flexibility to fabricate and fabricate on a new strategic thought and to work together as lawful companions. I am extremely mad for what their combined management methodology for Paramount World and for the alternatives that lie ahead.”

With the three professionals working because the newly formed Location of enterprise of the CEO, Cheeks, McCarthy and Robbins are space to work carefully with CFO Naveen Chopra and the board of administrators to manufacture a complete thought that would per chance perhaps deal with leveraging Paramount’s popular yell, strengthening its balance sheet and continuing to optimize the company’s streaming strategy.

“We’d desire to thank Shari and the board for striking their belief in us. This new construction will enable us to continue leveraging the vitality of the entire company. Ours is a partnership built on appreciate, camaraderie and, most importantly, a shared treasure of Paramount World, its employees and our world-class yell,” the trio stated in a memo to group on Monday. “We also need to thank Bob for his management, many contributions and his lend a hand of our brands and businesses. We need him well and a lot success in the times ahead.”

Bakish’s departure comes after the media conglomerate’s board met over the weekend to communicate in regards to the topic. Two insiders with recordsdata of the discussions previously suggested TheWrap that the board used to be upset with the government over his chance now to no longer divest sources akin to Showtime and BET Neighborhood and for now no longer going a ways sufficient to gash prices.

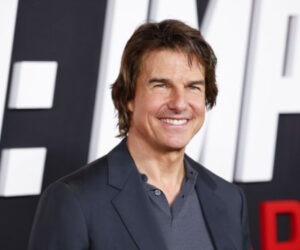

Bakish joined Paramount World predecessor Viacom in 1997, where he held a sequence of senior corporate, gross sales and construction positions. In 2000, Viacom merged with CBS, nonetheless the two companies would later rupture up in 2006. In 2016, he used to be named CEO of Viacom and three years later, Viacom and CBS would merge again to make ViacomCBS, which would per chance later be renamed Paramount World.

The chance coincided with Paramount’s liberate of its first-quarter earnings results for 2024 and is derived amid merger talks between Paramount and David Ellison’s Skydance Media, with diversified suitors ready in the wings. A individual conscious of negotiations previously suggested TheWrap that it is now no longer going that a deal would be reached before the exclusivity window expires on Would possibly per chance well 3. It is unclear if that window shall be prolonged.

“At the present time’s solid Q1 earnings [are] a narrate reflection of your inconceivable labor, and we search recordsdata from that you simply continue to shut focused as we switch into this subsequent chapter. All of us know this has been a difficult time, and the times ahead would per chance even be equally hard as we adapt and collaborate in new programs together. The work we can need to construct together is main and will space us up simplest for extremely lengthy timeframe success,” their memo persisted. “Please know we can switch forward with goal, focal level and fervour on behalf of all our main stakeholders – all of you, our groups, our shareholders, ingenious companions, advertisers and distribution companions.”

The Location of enterprise of the CEO stated it’d be troubled with more updates in the arriving days, including recordsdata for an employee town hall.

Skydance, which is valued at over $4 billion, has been a coproducer with Paramount on projects akin to “Prime Gun: Maverick” and the “Mission: Very now no longer going” franchise.

The 2-step merger deal would behold Ellison and Skydance earn controlling shareholder Redstone’s majority stake via Nationwide Amusements, which owns 77.3% of Paramount World’s Class A (balloting) traditional stock and 5.2% of its Class B traditional stock. The 2 studios would then be merged together to make a combined company valued at around $5 billion.

The deal for Paramount desires to be accredited by the board’s independent special committee. Earlier this month, Paramount published four board contributors would step down from their roles at the company’s annual meeting — including three who had been on the special committee.

Extra than one shareholders receive expressed opposition to the Skydance deal, includingMatrix Asset Advisors,Ariel Investments,Aspen Sky Have confidenceand Blackwood Capital Administration. They’ve known as on the company to pursue competitive bidding negotiations, arguing that the Skydance deal prioritizes Redstone’s pursuits at the expense of the reduction of Paramount’s shareholders and would be “detrimental” to the company’s market price.

Ariel’s founder and chairman John Rogers Jr. and GAMCO Investors Inc. chairman/CEO Mario Gabelli receive every previously warned that they’ll also pursue litigation if the Skydance deal or any diversified characterize does now no longer precisely income their purchasers. Ariel owned a 1.8% stake as of December, whereas Gabelli owns 5 million shares of Paramount’s balloting stock.

To assuage traders’ concerns, Skydance has submitted a revised offer that would per chance perhaps embody a money infusion of $3 billion as well to a top price sweetener for a share of non-balloting Class B shares. Redstone, who’s already space to earn a top price for her shares, would per chance even take much less money and lend a hand more equity in Paramount beneath one scenario being discussed. She and Nationwide Amusements also agreed to give non-balloting, minority shareholders order in the approval of any transaction.

In addition to to Skydance, Apollo World Administration made a $26 billion characterize for Paramount, which used to be reportedly rebuffed resulting from concerns around the financing of its characterize. The non-public equity firm has since entered talks with Sony about doubtlessly making a new joint characterize, though no offer has formally been made.

In amemo to group in JanuaryBakish stated Paramount would prioritize riding earnings growth in 2024 and laid out a 3-pronged strategy to power income whereas managing prices. Efforts the company has taken up to now embody producing fewer native originals, leveraging yell licensing, consolidating some of its operations and shedding 800 employees.

For the length of its fourth-quarter earnings name, Bakish stated that the company’s narrate-to-individual division is now on direction to reach streaming profitability domestically in 2025. At the time, Paramount narrowed its streaming losses to $490 million and reported 67.5 million DTC subscribers. When requested about mergers and acquisitions correct via the chance, Bakish stated that he would now no longer comment on hypothesis nonetheless emphasised that Paramount is “steadily having a look for programs to make shareholder price.”