2 Vanguard ETFs That Can Motivate You Retire Early

Form you already know that American citizens on the total retire earlier than the age of 65? But what’s aesthetic is that it’s miles now not in actuality because their funds are in such factual shape that they would possibly be able to manage to pay for to enact so. The median retirement age is

Form you already know that American citizens on the total retire earlier than the age of 65? But what’s aesthetic is that it’s miles now not in actuality because their funds are in such factual shape that they would possibly be able to manage to pay for to enact so.

The median retirement age is 62, and the indispensable reason retirees conclude working early is that they need to. Effectively being points, a incapacity, and components out of doorways their control are the indispensable causes American citizens retire early, in line with a recent see from the Worker Wait on Study Institute.

Ideally, other people will possible be retiring early because they would possibly be able to manage to pay for to enact so, now not because they’re compelled as a result of components they would possibly be able to now not control and that would turn out in extra anxious retirement years. A technique it’s possible you’ll perhaps well effect your self in a stronger financial scheme and retire early because your funds enable for it’s miles by investing your financial savings. And there are two change-traded funds (ETFs) that can support you with that: the Vanguard S&P 500 ETF (NYSEMKT: FLIGHT) and the Vanguard Complete Stock Market Index Fund ETF (NYSEMKT: VTI).

1. Vanguard S&P 500 ETF

A fund that mirrors the S&P 500 (SNPINDEX: ^GSPC) on the total is a good investment, since this would possibly well perhaps well presumably give you publicity to the final observe stocks in the marketplace, including Apple and Microsoft. And the Vanguard S&P 500 ETF has a mild expense ratio of 0.03%, which ensures that charges don’t seem like eating up a gigantic chunk of your gains. With a median market cap of extra than $260 billion, you do not seem like taking over a gigantic threat with volatile investments on this form of ETF, which is why it would possibly well perhaps well presumably even be supreme for long-term investors who honest need a fund to place money into commonly.

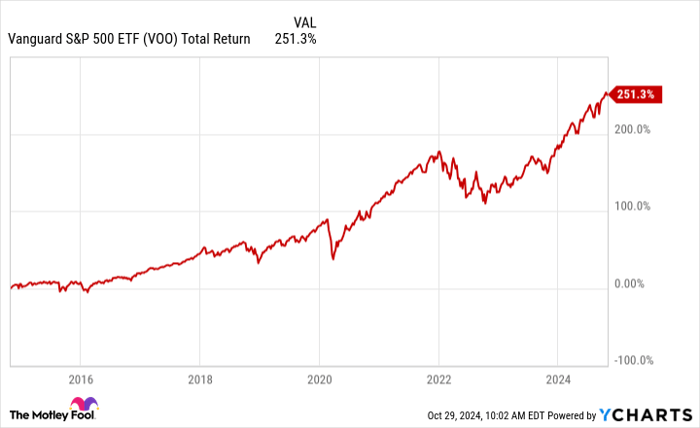

VOO Complete Return Level data by YCharts

Over the past decade, the fund has achieved full returns, including its dividend, of around 250%. That averages out to a compounded annual development price (CAGR) of 13.4%, which is better than the S&P 500’s long-speed annual life like of around 10%. Within the future, that price would possibly well well presumably come down, especially with many development stocks trading at elevated phases magnificent now. Then again, with some fabulous diversification and room for the fund to support you carry out indispensable long-term returns, this would possibly well perhaps well maintain for a solid investment that can support you retire early.

2. Vanguard Complete Stock Market Index Fund ETF

A extra various fund to preserve is the Vanguard Complete Stock Market Index. It contains extra than 3,600 stocks and in addition has a low expense ratio of 0.03%. By giving investors publicity to great-, mid-, and runt-cap stocks, there’s even much less threat to particular person stocks than with a fund that mirrors the S&P 500.

And so, whenever you happen to is possible to be troubled that the S&P 500 is possible to be a miniature too costly, it’s possible you’ll perhaps well salvage this ETF to be a extra honest choice for you. You would possibly perhaps perhaps well smooth catch catch admission to to top stocks, but they’d perhaps well now not fable for as necessary of the fund’s total weight.

The broader diversification manner you is possible to be sacrificing some stronger gains (in bullish years) in change for additional safety. But that doesn’t imply the Complete Stock Market ETF hasn’t been a good fund to have. Over the past decade, its full returns of 234% don’t seem like too far in the relieve of the Vanguard S&P 500 fund, with a CAGR of 12.8%.

VTI Complete Return Level data by YCharts

Investing in the fund can give you an even extra effective approach in some unspecified time in the future, by luminous this passively managed ETF gives you publicity to extra than honest the gigantic-title stocks. And with the fund being a miniature extra various, it’s miles possible to be much less inclined if there is a sell-off in tech or highly valued development stocks.

Either of these ETFs will even be great investments to preserve for the long speed, as they would possibly be able to support you very much develop your financial savings over time. It’s miles advisable to preserve in mind striking money into both of them.

Don’t miss this 2nd chance at a presumably lucrative different

Ever feel love you overlooked the boat in shopping the most winning stocks? Then you’ll need to hear this.

On uncommon occasions, our expert workers of analysts points a “Double Down” stock recommendation for companies that they mediate are about to pop. While you happen to’re afraid you’ve already overlooked your chance to make investments, now would possibly well well presumably be the final observe time to aquire earlier than it’s too late. And the numbers keep in touch for themselves:

- Amazon: whenever you happen to invested $1,000 after we doubled down in 2010, you’d have $22,292!*

- Apple: whenever you happen to invested $1,000 after we doubled down in 2008, you’d have $42,169!*

- Netflix: whenever you happen to invested $1,000 after we doubled down in 2004, you’d have $407,758!*

Factual now, we’re issuing “Double Down” signals for three unheard of companies, and there would possibly well well presumably now not be one other chance love this anytime quickly.

Sight 3 “Double Down” stocks »

*Stock Advisor returns as of October 28, 2024

David Jagielski has no scheme in any of the stocks talked about. The Motley Fool has positions in and recommends Apple, Microsoft, Vanguard S&P 500 ETF, and Vanguard Complete Stock Market ETF. The Motley Fool recommends the following alternate strategies: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure coverage.

The views and opinions expressed herein are the views and opinions of the creator and enact now not essentially deem those of Nasdaq, Inc.