SOL Sign Pops 10%, Can Solana Bulls Receive Power?

Solana started a restoration wave from the $120 zone. SOL ticket is rising and can speed higher if there is a shut above the $142 resistance. SOL ticket recovered higher and examined the $140 resistance towards the US Greenback. The price is now trading beneath $142 and the 100 easy moving reasonable (4 hours). There

Solana started a restoration wave from the $120 zone. SOL ticket is rising and can speed higher if there is a shut above the $142 resistance.

- SOL ticket recovered higher and examined the $140 resistance towards the US Greenback.

- The price is now trading beneath $142 and the 100 easy moving reasonable (4 hours).

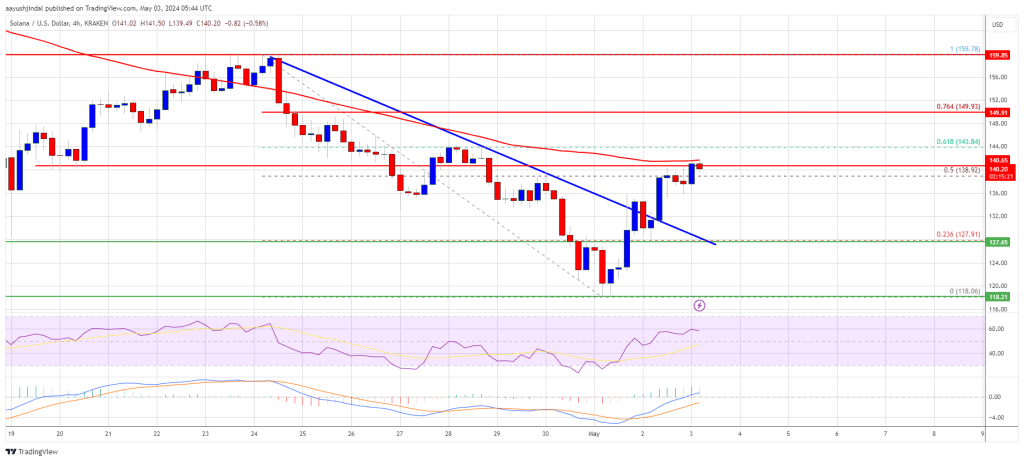

- There used to be a shatter above a key bearish model line with resistance at $132 on the 4-hour chart of the SOL/USD pair (data source from Kraken).

- The pair could presumably well initiate yet every other decline if it stays beneath $142 and $150.

Solana Sign Faces Resistance

Solana ticket extended losses beneath the $150 and $140 fortify stages. SOL examined the $120 zone and currently started an upside correction, cherish Bitcoin and Ethereum.

There used to be expand above the $125 and $130 stages. The price climbed above the 23.6% Fib retracement stage of the downward wave from the $160 swing high to the $118 low. There used to be a shatter above a key bearish model line with resistance at $132 on the 4-hour chart of the SOL/USD pair.

It even spiked above the $140 zone and the 100 easy moving reasonable (4 hours), however there is no hourly shut. The bears are for the time being active shut to the 50% Fib retracement stage of the downward wave from the $160 swing high to the $118 low.

Source: SOLUSD on TradingView.com

Solana is now trading beneath $142 and the 100 easy moving reasonable (4 hours). Rapid resistance is shut to the $142 stage. The following predominant resistance is shut to the $150 stage. A a hit shut above the $150 resistance could presumably well space the tempo for yet every other predominant expand. The following key resistance is shut to $160. Any longer features could presumably well also ship the price in the direction of the $175 stage.

Any other Decline in SOL?

If SOL fails to rally above the $142 resistance, it can presumably well initiate yet every other decline. Preliminary fortify on the downside is shut to the $132 stage.

The predominant predominant fortify is shut to the $128 stage, beneath which the price could presumably well test $120. If there is a shut beneath the $120 fortify, the price could presumably well decline in the direction of the $105 fortify within the shut to term.

Technical Indicators

4-Hours MACD – The MACD for SOL/USD is gaining tempo within the bullish zone.

4-Hours RSI (Relative Power Index) – The RSI for SOL/USD is above the 50 stage.

Indispensable Make stronger Ranges – $132, and $128.

Indispensable Resistance Ranges – $142, $150, and $175.

Disclaimer: The article is provided for academic purposes most though-provoking. It would now not portray the opinions of NewsBTC on whether or to now not uncover, sell or preserve any investments and naturally investing carries dangers. You could to perchance presumably be told to habits your possess study earlier than making any funding choices. Exercise data provided on this web situation completely at your possess probability.

Ayush Jindal

Aayush is a Senior International exchange, Cryptocurrencies, and Monetary Market Strategist. He focuses on market suggestions and technical diagnosis and has spent over 15 years as a monetary markets contributor and observer. He additionally primarily based an IT firm and works carefully in offering top quality draw services and products.Aayush possesses solid technical analytical abilities and is successfully diagnosed for his sharp and informative diagnosis of the currency, commodities, Bitcoin, and Ethereum markets. Practice him on Twitter @AayushJs.